Years before the fall of his regime in December, Syria's dictator Bashar Al Assad and his wife Asma embarked on victory tours of former rebel areas that had been captured by his forces.

None was as brazen as the visit in 2018 to the ruins of Jobar, a town on the edge of Damascus that was the scene of some of the worst destruction. During four years of siege by Assad's forces, almost every building in the now-abandoned town was struck by artillery, barrel bombs from helicopters, and Russian warplanes.

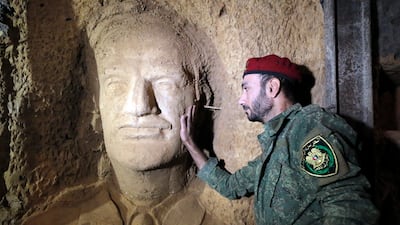

Weeks after Jobar surrendered, the regime brought in art students to carve sculptures into the walls of a tunnel that was dug by rebel defenders. The art was aimed at glorifying the same troops who levelled a city once home to 300,000 people.

In footage broadcast on state television, the couple beamed with smiles inside the tunnel. They praised the students for their creations, which they said symbolised “martyrdom and peace”.

“Assad not only erased Jobar, he celebrated it,” says Haitham Al Bakheet, a former construction worker who was made to wash the bodies of the dead during the siege. He was later taken, along with the last rebel fighters and civilians, to the northern governorate of Idlib under a surrender agreement.

The devastation in Jobar is emblematic of the magnitude of reconstruction needed in Syria and the obstacles to rebuilding, which go beyond the sheer scale of the task, including the need for international consensus on major investments.

Syria’s new Hayat Tahrir Al Sham (HTS) rulers lack funds, and the country is short of raw materials and energy. The exchange rate is volatile, and there is a shortage of Syrian pound liquidity, which hinders business activity.

Many of the country’s engineers and other skilled workers have left. The education system, long riddled with corruption and patronage, is in tatters, in kind with other public services. One in three houses was destroyed or damaged during the civil war, a UN report said.

For five decades under Assad family rule, arbitrariness was a hallmark of the legal system, contributing to an opaque real estate market with ill-defined property rights. This makes deciding who owned what difficult, especially in areas where dwellings and shops no longer exist, either because they were bombed or bulldozed to make way for new projects linked to the former ruling elite.

Last month, Mr Al Bakheet returned from Idlib, and is now living with relatives near Damascus. Like other people originally from Jobar, who are known as Al Jawabras, he visits the town regularly to look at the ruins. Shepherds tend to their sheep in the area, with the animals grazing on the undergrowth between abandoned buildings. Jobar is administratively separate from Damascus but for all practical purposes part of the capital, sitting on its eastern edge.

Mr Al Bakheet used to wash the bodies in a hospital, but the building was destroyed and the process was moved into an ancient synagogue, abandoned since Hafez Al Assad, father of Bashar and his predecessor as the country's dictator, allowed Syria’s Jews to leave the country in the 1990s. “The synagogue took a direct hit so we stopped the washing altogether,” he said.

In the Jobar tunnel, one sculpture depicts a soldier wearing a helmet and feeding a child, while another carries balloons, and a third splits stone. In reality, the security apparatus under the Assad family was often used to repress Syrians, and underpinned a system of cronyism and corruption. It was dissolved after HTS led the overthrow of Mr Al Assad on December 8.

New president Ahmad Al Shara has promised to build a new state and put Syria on the road to recovery. He was formerly a member of Al Qaeda, before breaking with the extremists and forming HTS. His group remains under UN, US and European sanctions.

Some sanctions imposed in the Assad era have been eased since Mr Al Shara took power. New aid pledges have been made, but nowhere close to the hundreds of billions of dollars needed to finance reconstruction and rebuild power generation, telecoms, health care and education.

A senior Western diplomat said Europe, in contrast to the US, appears more willing to extend funding to post-Assad Syria. But Mr Al Shara would still need to prove he can stay away from any confrontation with Israel and sideline the more extreme elements among his supporters to qualify for aid.

"If he does these things, the US might not be averse to arrangements that would also benefit it commercially," the diplomat said. Many Syrians are hoping the country will not relive its errors, and that Mr Al Shara will expand his current government, which is staffed by his proteges, and bring in more technically qualified personnel who would be more acceptable to donor countries.

His existing subordinates helped Mr Al Shara run Idlib while HTS was based there before it led an 11-day offensive that toppled the Assad regime. Now he is running a country in which the "economic wheels have stopped", and needs to move fast, said Samer Hamwi, a prominent Syrian financial technology executive who works in the Gulf.

“The government does not have money to even pay for the modest salaries," said Mr Hamwi, pointing to shortages of liquidity and deficiencies in the electronic payment system, which are also dragging on the private sector. "There are difficult structural issues that are affecting the psychological state of the people."

Mr Hamwi took part in a conference in Damascus last month that brought Syrians working in Silicon Valley together with IT specialists who remained in the country through the war.

"If things do not get moving soon there will be a popular backlash," he said. In Jobar and other parts of Damascus, signs of improvements are scant.

One day last month, a car with Lebanese licence plates stopped at a damaged flyover in Jobar. Its two occupants, who are brothers, surveyed the damaged houses. One of them identified himself as belonging to Mr Al Shara's HTS. His brother said he was a businessman who lived in Beirut interested in buying property.

He asked Mr Al Bakheet if he knew of any properties for sale and enquired about the owners of certain buildings. Mr Al Bakheet replied with a blank stare and they drove off. “If the profiteers take over, it means that we will never go back to Jobar,” Mr Al Bakheet said. The ownership of most properties was clear, unlike the rest of the capital, he added.

In 2010, the year before a revolt against Mr Al Assad that sparked Syria's civil war, an estimated 50 per cent of urban dwellings in the country were "ashwaiyat", the Syrian term for illegal built. Cases of property expropriation without compensation have scared off investors.

Over the last several weeks, The National twice saw HTS fighters evict occupants in Damascus after people who said they were the rightful owners complained that former regime operatives had unjustly taken their homes.

One incident was in the central Muhafaza area and the other in the nearby Shaalan. In both cases there was no legal procedure or recourse. HTS personnel told the evicted people that an emir would call if there was an error.

An Arab banker who was recently in Damascus said a parallel HTS control system that appears to have been installed in every major government department was bad for business. He described a meeting with Syrian central bank officials about resuming his bank's operations in Damascus that was attended by a mysterious HTS operative called Abu Abdul Rahman.

“He didn't give his real name, but it was clear that he was running the show,” the banker said in Amman. He added that he later met another shadowy man at the bank who appeared to oversee financial settlements. "From his accent, he didn't even sound Syrian,” the banker said.

A senior manager at an energy and water multinational said that although the scope for projects in Syria was substantial, there is little interest at his company. He cited security risks, and the time needed to build reliable state institutions.

"Rebuilding in Syria will be taking the Lebanese route for now," he said, referring to the diffculties Beirut has had in attracting foreign investment. “Whoever can afford it will build their own house, install their own power-generation, and find a way to dispose of sewage. I cannot see large-scale projects in Syria soon.”