Live updates: Follow the latest on Israel-Gaza

The US had no knowledge of the deadly pagers blasts in Lebanon that killed 12 people, including Hezbollah members, and injured thousands, Secretary of State Antony Blinken said on Wednesday.

Addressing a news conference in Cairo with Egyptian Foreign Minister Badr Abdelatty, the top American official called on the parties in the region to refrain from taking any action that would escalate the situation, a thinly veiled reference to Hezbollah, which has blamed Israel for the attack and vowed to avenge it.

“With regard to Lebanon, the United States did not know about, nor was it involved in these incidents, and we're still gathering information and gathering the facts,” said Mr Blinken, whose country is a staunch supporter of Israel.

“Broadly speaking, we've been very clear and we remain very clear about the importance of all parties avoiding any steps that could further escalate the conflict.” Mr Abdelatty also warned against actions that will worsen the situation following the attack in Lebanon, one of the biggest security breaches and attacks by Israel on its enemy.

At least 2,750 were wounded – mostly in Beirut and its southern suburb of Dahieh, but with hundreds also injured in southern Lebanon and the Bekaa Valley.

An escalation “will lead to an all-out war that will destroy everything in the region”, said Mr Abdelatty. Cairo and Washington were working together to prevent that, he added.

“We in Egypt are convinced that the root cause in this conflict is Israel's aggression in Gaza,” said Mr Abdelatty.

Mr Blinken, who arrived in Cairo on Tuesday, is in the Middle East for his 10th visit to the region since the Gaza war began 11 months ago. He has no plans to travel elsewhere in the region during this trip.

The US and Arab allies Egypt and Qatar have for months been trying unsuccessfully to broker a Gaza ceasefire and secure the release of Israeli and other hostages held by Hamas in exchange for Palestinians jailed in Israel after being convicted of security-related offences. On Wednesday, Mr Blinken said 15 out of 18 paragraphs that comprise the latest proposals have been agreed on by all parties involved in the negotiations, but did not elaborate on what these were.

“We discussed the importance of getting this deal across the finish line, something we'll continue to pursue with our Qatari counterparts,” he said during the press conference. “We all know that a ceasefire is the best chance to tackle the humanitarian crisis in Gaza, to address risks to regional stability.”

Progress was slowed down by long gaps while waiting for messages to be passed between the sides involved, with “events” during those periods derailing the talks, Mr Blinken said. He citied the Israeli forces' recovery of six dead hostages as a recent example.

“We've seen that in the intervening time, you might have an event, an incident – something that makes the process more difficult, that threatens to slow it, stop it, derail it – and anything of that nature, by definition, is probably not good in terms of achieving the result that we want, which is the ceasefire,” he said.

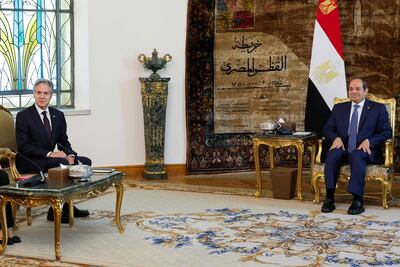

Mr Blinken met Egyptian President Abdel Fattah El Sisi earlier on Wednesday and discussed “ways to intensify joint efforts between Egypt, the US and Qatar to make progress on ceasefire negotiations and the exchange of hostages and detainees”, the Egyptian presidency said.

Mr Abdelatty, for his part, said Egypt would not accept any changes to the security arrangements that were in place on its border with Gaza before war broke out last October. Security on the border, and whether Israel will keep troops along a 14km buffer zone known as the Salah Al Din Corridor, have become a focal point of the negotiations.

Israeli troops captured the area in May, including the Palestinian side of the Rafah border crossing between Egypt and Gaza, a move that angered Cairo, which has since closed the facility. Bound by a 1979 peace treaty with Israel, Egypt insists that Israel must withdraw from the border area and that a Palestinian presence, not necessarily by Hamas, needs to be restored at the Rafah crossing.

“Egypt reiterates its position, it rejects any military presence along the opposite side of the border crossing and the aforementioned corridor,” said Mr Abdelatty.