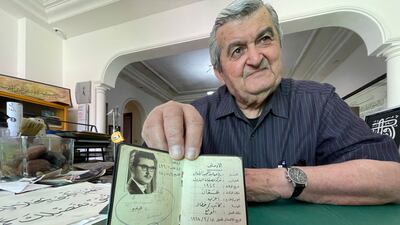

Few people in Jordan have heard of Ryad Tabbal, but they have almost certainly seen the master calligrapher's work over the decades – from the logo of the national carrier to the titles and credits for shows on state television.

The self-taught 81-year old calligrapher is from the generation of Arab emigres who helped to transform Jordan from a desert backwater into a middle-income economy.

Mr Tabbal's talent for penmanship appears to be hereditary. It was his Syrian father's neat handwriting that inspired his interest in calligraphy as a child growing up in Zarqa, a desert city adjacent to Amman. And all seven of his own children have “beautiful handwriting”, he says.

He started learning the rules of calligraphy on his own, practising the different pressures that need to be applied to the ink and paper. By the time he graduated from high school in the early 1960s, his skills were well known.

Through a family friend, he learnt of an opening for a calligrapher at the King Hussein Airbase near the dusty town of Mafraq, in north-east Jordan.

“I took a test and was immediately hired. I started the job the next day,” Mr Tabbal recalls.

He began by painting aircraft numbers and squadron logos on Royal Jordanian Air Force Hawker Hunter fighter jets, as well as signs at the base, before eventually being allowed into the operations room.

There, he copied out drafts of documents that needed to look good before being passed up the chain of command. He says he was sworn not to reveal their contents. “It was top secret work,” says Mr Tabbal.

He also worked for the government-owned oil refining company and state television, which for decades was the only channel in the kingdom, before opening his own business in the late 1970s. By then, Mr Tabbal had become recognised as a master calligrapher.

At the television station, he created titles and credits for series and other productions – and even lists of late-night pharmacies and taxis on duty that were broadcast as a public service.

The computer-generated titles of today are “blind imitation” of real calligraphy, without its nuance and spirit, he says.

Journey to Jordan

Many of the state channel's production staff in the 1970s had fled the iron rule of Hafez Al Assad in Syria, one of several countries in the region whose transformation into socialist dictatorships, starting in the late 1950s, prompted an exodus of talent to Jordan.

Mr Tabbal, who obtained Jordanian citizenship in the 1960s, made the journey earlier in life.

His father Abdulmajeed, who came from a large, landowning Arab Sunni tribe in the eastern Deir Ezzor region, had been facing pressure from the tribal elders to divorce his wife, Mariam, because she was Assyrian and a divorcee.

Two years after Mariam had given birth to Mr Tabbal in 1943, Abdulmajeed decided to move with his family to Mafraq, a desert outpost in what was then the British Protectorate of Transjordan. He joined the Jordanian army, then known as the Arab Legion, as member of its desert infantry unit. He died in 2010, aged 105.

High-flying commission

In the early 1980s, a familiar face from Mr Tabbal's air force days walked into his shop to commission what is probably his most widely seen work.

Kamal Balqaz had become head of the national carrier – Alia Royal Jordanian Airlines, named after the eldest daughter of King Hussein – and wanted Mr Tabbal to design the new logo for the airline as it changed its name to Royal Jordanian.

Mr Tabbal chose a decorative script known as Diwani, which was popular in the courts of the old Arab Muslim empires, for the airline's name. For the name Alia – which is still found next to the front door of Royal Jordanian planes, as a tribute to the late king – he chose a variation of the looping Tughra script.

Another well-known trademark he designed, in freestyle, was for Zakey, a popular juice drink founded by businessman Khaldoun Kabatilo, a Palestinian refugee who started as a spice dealer in Amman.

He was also hired by the Asfour business family, also of Palestinian origin, to design a billboard for their company, AsfourCo. This became a landmark in central Amman, until it was removed in the 2000s.

The AsfourCo sign was also written in Diwani, which is “very beautiful”, says Mr Tabbal.

“Not everyone can master it, by the way,” he adds.

Overtaken and underappreciated

Mr Tabbal's used to use ink from an Afghan ink maker in Damascus, but the supply dried up amid the upheaval of Hafez Al Assad's rule. He now uses ink from Japan, which he describes as “excellent”.

He still makes his own pens, using bamboo from Java and from India, with tips from five to 25 millimetres wide. Sometimes, when supplies are low, he uses qusseib, a type of bamboo that grows in Jordan. But the Indonesian and Indian materials are harder and, therefore, better, he says.

Mr Tabbal used to also make pens for the late Iraqi master calligrapher Abbas Al Baghdadi, who recognised him as a peer in their craft.

Mr Al Baghdadi presented one of his works to Mr Tabbal in 1993, which now hangs on a wall behind his desk at his home in Amman. It reads “Leave creation to the creator”, written in the angular Thuluth style, with a dedication below testifying to Mr Tabbal's standing as a calligrapher.

Mr Tabbal laments the rise of computer-generated fonts that contributed to the decline of calligraphy as a profession.

“It is mechanical. It has no spirit,” he says, comparing a wedding invitation created on a computer alongside the template for one that he created.

The lack of business forced Mr Tabbal to close his shop two years ago and start working from home. The wedding invitation he showed is one of the few commissions he now receives and took him three hours to finish. He is also working on a sign for a mosque in Dubai.

He says he would have been financially better off if had he been working in the West, where he says calligraphy is still appreciated.

In Jordan and in most other Arab countries, there is no longer an understanding of “why calligraphy exists”, which prompted him to steer his children away from the profession.

“I didn’t want them to go through what I went through,” he says.