France's fourth prime minister in two years, Francois Bayrou, was ousted on Monday after losing a no-confidence vote, plunging the country further into political turmoil days ahead of major national strikes.

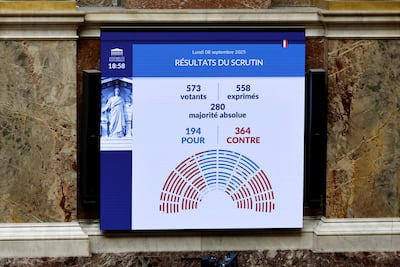

Mr Bayrou, who was appointed eight months ago, had hoped to unite politicians behind €44 billion in spending cuts aimed at reigning in national debt. Instead, opposition parties took the opportunity to topple the government, eight months after its nomination. Just 164 deputies backed the government while 364 were against.

President Emmanuel Macron is expected to move quickly to pick a replacement – probably someone from his circle of loyalists. Potential candidates include Defence Minister Sebastien Lecornu, Justice Minister Gerald Darmanin, and former Socialist prime minister Bernard Cazeneuve.

The collapse of Mr Bayrou's government comes at a critical moment as France braces for a tense September. A grassroots protest movement named “Let's block everything”, initially launched on social media during the summer, is scheduled for Wednesday. It has raised fears of a resurrection of the “gilets jaunes” movement that paralysed the country in late 2018.

Leftist movements such as France Unbowed have attempted to harness public anger fuelled by years of sluggish economic growth. Politicians such as the firebrand Jean-Luc Melenchon hope that social unrest will force Mr Macron to step down two years before the end of his mandate, paving the way for a new presidential election.

While Mr Macron resigning remains an unlikely prospect, and one that the President has repeatedly dismissed, it may become more pressing if the next government collapses shortly after it is nominated.

Reinvention?

Mr Bayrou's fate mirrors that of his predecessor, the conservative Michel Barnier, who lasted just three months in the job before becoming the shortest-serving prime minister in France's modern republic when he was toppled by a no-confidence vote – also over planned budget cuts.

In interviews, Mr Bayrou has argued that people will, in time, acknowledge with hindsight that he was right to push for massive debt cuts so as to not overly burden France's future generations.

“Our social system, which is no longer stable because of our ageing population, faces huge questions,” Mr Bayrou said in his final speech on Monday. “It's a model that needs to be reinvented.”

On Friday, Fitch is set to review France’s credit rating, which was downgraded by Moody's after the previous government collapsed last year. A repeat could force France to a lower rating category and raising the risk of forced selling of its already pressured bonds.

A number of trade unions have also announced nationwide strikes for September 18. Strikes are expected to affect the national railway service, as well as public transport in Paris and air traffic controllers.

Many fear that France has entered a period of chronic instability similar to that of 1958, which triggered the establishment of the Fifth Republic under the president and war hero Charles de Gaulle.

Political polarisation

“We are living at the same time a crisis of regime and a crisis of society,” the veteran political journalist and writer Alain Duhamel told the daily newspaper Le Monde in an interview. “What strikes me is the irresponsibility of politicians. The opposition does not seem to appreciate the seriousness of the economic, financial and budgetary situation.”

A number of political heavyweights, including the far-right figure Marine Le Pen, have also called for snap elections. Such a move would shift the balance of power in France's National Assembly, as Ms Le Pen's National Rally would be expected to win 33 per cent of votes in the first round, according to a recent poll by the broadcaster Public Senat.

This would probably pave the way for the far-right's 29-year old leader, Jordan Bardella, to become Prime Minister. He is the most popular choice among French voters, a recent poll ordered by the daily Le Figaro newspaper showed, ahead of the Interior Minister, Bruno Retailleau.

Adding to the political polarisation in the country, Ms Le Pen has declared that she will run in parliamentary elections – should they take place – despite being banned from office for five years following a corruption conviction in March.

Ms Le Pen's appeal trial has been scheduled for January 13 and is set to last until February 12, boosting her chances of being elected president in 2027. The three-time presidential candidate has vowed to pursue her presidential ambitions, saying she is the target of a “witch hunt”.