Israel claimed it had killed Hezbollah's chief of staff in strike on an apartment building in a busy area of Beirut on Sunday, in which at least four other people died.

The Hezbollah official was named by the Israeli army as Haitham Ali Tabatabai, deputy to Secretary General Naim Qassem. As chief of staff, he would have been the most senior military official in Hezbollah.

There was no immediate confirmation from Lebanon that Mr Tabatabai had been killed, but the Lebanese Ministry of Health said at least five people were dead and 28 injured in the incident.

Israel's Prime Minister Benjamin Netanyahu said his military attacked "the chief of staff of Hezbollah" in the strike on Lebanon's capital, which took out at least three floors of the building.

Speaking from the attack site, Mahmoud Qamati, the deputy head of Hezbollah's political council, confirmed a senior leader of the group had been hit, without revealing their identity. He said the attack was a violation of "a new red line" and said Hezbollah leaders were studying how to respond.

It is the fourth strike on the Beirut suburb of Dahieh since the ceasefire between Israel and Lebanon's Hezbollah was announced last year. The last Israeli attack on Dahieh was in June, ahead of the Eid holiday.

Videos of Sunday's incident showed significant damage to cars and surrounding buildings as ambulance teams worked to evacuate the wounded from Haret Hreik neighbourhood. The Lebanese Army was quickly on the scene to set up a security cordon.

Residents of Haret Hreik said they heard the whistle of war planes before the missile struck the building.

The attack was condemned by Lebanese President Joseph Aoun, who has repeatedly called for negotiations with Israel. He said the bombing showed Israel "does not care about the repeated calls to stop its attacks on Lebanon".

Mr Netanyahu's office said he ordered the attack on the recommendation of Defence Minister Israel Katz and army chief Lt Gen Eyal Zamir. "Israel is determined to act to achieve its objectives everywhere and at all times," it said.

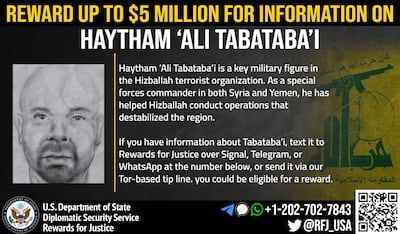

The US had sanctioned Mr Tabatabai, designating him a “specially designated global terrorist” and offering a reward of up to $5 million for information on him.

The US State Department described him as commanding Hezbollah’s special forces, operating in Syria – where at the time the group was heavily involved in propping up the regime of Bashar Al Assad. Mr Tabatabai was also reported to have been in Yemen.

“Tabatabai’s actions in Syria and Yemen are part of a larger Hezbollah effort to provide training, materiel and personnel in support of its destabilising regional activities,” the US State Department said.

Mr Tabatabai was reported to have been targeted several times during Israel’s war on Lebanon last year but, unlike most other top Hezbollah officials, he was able to escape. Israel notably killed Hassan Nasrallah, Hezbollah's leader since 1992, and some of his senior allies.

Israel has repeatedly threatened to escalate attacks on Lebanon amid its criticism at the pace that the Lebanese government has shown in disarming Hezbollah. The US has also increased pressure on Lebanon to show concrete progress on the matter. Hezbollah itself has rejected any conversation over its weapons under the current circumstances.

Last year, Lebanon and Israel agreed to a US and French-brokered ceasefire. Under the terms, Hezbollah and Israeli forces were required to withdraw from southern Lebanon, where UN peacekeepers were deployed alongside the Lebanese army to help dismantle Hezbollah infrastructure.

But despite the truce almost a year ago, Israel has continued to attack southern Lebanon relentlessly and occupy five points of Lebanese territory.