Three prominent officials linked to Syria's security apparatus were sentenced to life imprisonment in a Paris courtroom on Friday, in what was described by victims' families as a victory for the hundreds of thousands who have been tortured and disappeared.

Ali Mamlouk, former head of the National Security Bureau; Jamil Hassan, ex-director of the air force intelligence service; and Abdel Salam Mahmoud, former head of investigations for the service in Damascus, were found guilty of complicity in crimes against humanity, including imprisonment, torture, forced disappearance and murder.

The four-day trial took place in their absence despite attempts by the court to contact them in Syria.

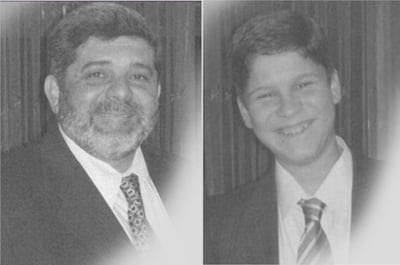

“It's a great victory. I couldn't ask for more,” said Obeida Dabbagh, who filed a complaint in France after the detention in 2013 and subsequent death in prison of his brother Mazzen, a senior education adviser at the French school in Damascus, and his 20-year-old son, Patrick, an arts and humanities student.

The three men were also found guilty of involvement in acts of extortion due to their role in overseeing the expulsion of Mazzen's wife and daughter from their family home in 2016 to the benefit of security officials, including Mahmoud himself.

Hope for further trials

Mazzen and Patrick were arrested as part of the Syrian government's crackdown on protests which then turned into a civil war.

They died in a detention centre known for its pervasive use of torture and high death rate.

Their bodies were never returned to their relatives, who said they had not engaged in protests and were arrested for reasons unknown.

lawyer

“I hope this will not be the first such trial and that others will follow,” Mr Dabbagh told reporters outside the courtroom.

Addressing his dead relatives, he added: “Fate has chosen you as standard bearers for all Syrians who were unable to find justice with a court that sentenced their executioners.”

Mr Dabbagh and his wife Hanane, who was also a civil party in the case, received a lengthy round of applause from supporters, including many Syrians who had relatives that died in detention in Syria or had themselves survived imprisonment.

“This life sentence targets some of the highest ranking officials of the Syrian security services and therefore President [Bashar] Al Assad himself ,” said lawyer Patrick Baudouin, honorary president of the International Federation of Human Rights in France.

Fellow lawyer Clemence Bectarte said: “It's a wonderful first step in the legal recognition that the regime of Bashar Al Assad is a regime of criminals.”

'You want to bring me to The Hague?'

The court upheld the international arrest warrants issued by judges against the three men in 2018. They are all believe to currently reside in Syria, and Mamlouk is now a special adviser to Mr Al Assad.

Syrian lawyer Mazen Darwish, who told the court about the torture he endured during his 2012-2013 detention in Damascus, said that he felt “complicated emotions”.

“To be honest, I'm sorry that this did not take place in Syria,” he told The National. “I feel sorry that this is mostly symbolic. At the same time, we deserve this.

“We need to keep fighting for justice to avoid a new circle of violence in Syria.”

During his hearing, he said that he was interrogated by Hassan, who asked him whether he wanted “to bring him to The Hague”, in a reference to the International Criminal Court.

“It was said in a mocking but serious tone,” said Mr Darwish.

Ahead of the trial, the investigating judges said it was “sufficiently established” that Patrick and Mazzen Dabbagh “like thousands of detainees of the air force intelligence suffered torture of such intensity that they died”.

The conflict in Syria has killed more than half a million people, displaced millions, and ravaged Syria's economy and infrastructure.

Trials over abuses in Syria have taken place elsewhere in Europe, notably in Germany. In those cases, the people prosecuted held lower ranks and were present at the hearings.

The trial in Paris followed seven years of investigation carried out by a French judicial war crimes unit.