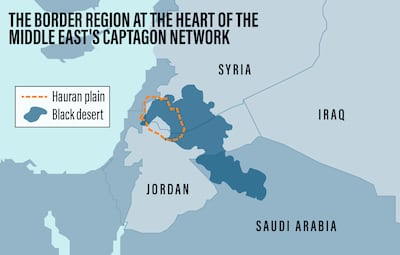

Only drug smugglers and shepherds rove across the Black Desert, a forbidding plateau covered with volcanic rock that stretches between Syria, Jordan and Saudi Arabia.

They navigate steep slopes and pre-historic paths, ferrying drugs from Assad regime territory in Syria into the Arabian Peninsula.

The rugged, 50,000 square-kilometre desert has emerged as the centre of the booming trade in Captagon, which threatens to destabilise the region, Arab security officials told The National.

Captagon in the Middle East

Drug trafficking from Syria through the area increased sharply this year, they said, helping to turn smuggling into a major component of the geo-political struggle between Saudi Arabia and Iran.

One official said that the Syrian regime and its allies – including Hezbollah and Iran-backed militias – have profited from the trade via businessmen close to the government, several of whom have been implicated in high-profile interceptions in recent years.

The promise to bring the rampant drug smuggling back under control could also become a vital bargaining chip for Damascus as it seeks reintegration in the region, they said.

“The problem is that there is no security partner on the other side of the Jordanian border,” a senior Jordanian official said on condition of anonymity.

“In such rugged terrain it is virtually impossible to stop the Captagon flows from Syria,” he said.

Attracted by the cash on offer, the tribes who live in the border region know the territory better than anyone and can co-operate with smugglers on both sides, he said.

While Saudi Arabia is the region’s main drugs market, the official said, “don’t underestimate Captagon demand in Jordan and Israel”.

He pointed out that some of the Syrian Captagon makes its way to Israel through the Wadi Araba region in southern Jordan.

State media has increasingly reported on drug busts on Jordan's border with Syrian government-held areas in recent months, while high ranking Jordanian and Syrian officials have met several times to discuss the smuggling.

Ali Ayyoub, Syrian Defence Minister and Chief of Staff, visited Jordan last week and met Jordanian Chief of Staff Yousef Hunaiti. The two officials discussed “joint efforts to combat cross-border smuggling operations, especially drugs,” the Jordanian military said.

A few days later in New York, the Jordanian and Syrian foreign ministers discussed “the security of the border in ways to serve the interests of the two countries”, the Jordanian foreign ministry said.

Smuggling hotspots

Captagon, a synthetic stimulant that is synonymous with Syria’s conflict, has become one of the most widely-consumed drugs in the region.

More efficient production techniques in Syria, as well as rising regional demand boosted by coronavirus lockdowns contributed to the increased smuggling this year, the official said, echoing the findings of the United Nations Office on Drugs and Crime (UNODC) and its World Drugs Report for 2021.

Producers of Captagon have become more closely linked to the Syrian regime, which has been hit by a breakdown in the economy, he said.

Captagon also comes by land from Syria to Saudi Arabia through the Hauran plain to the south-west of the Black Desert. The plain is situated near Israel and extends to the outskirts of Damascus.

For hundreds of years under the Ottoman empire the Hauran plain of southern Syria was the breadbasket of the Arabian Peninsula.

Traders in Damascus developed ties with the Arabian interior to market wheat from Hauran, the birthplace of the 2011 revolt against five decades of Assad family rule.

Hauran became a major smuggling region, mainly for fruits and vegetables, as well as sheep, after import and export controls were imposed in Syria in the 1960s.

Smuggling hits regional ties

In a decision that raised speculation about the state of ties between Amman and Ryiadh, Saudi authorities banned 400 Jordanian trucks that typically carry produce from entering the country in April.

Saudi officials cited technical reasons related to the roadworthiness of the trucks. But the ban indicated the sensitivity of the situation on the border between the two countries.

In an announcement that highlighted Jordan's anti-drug efforts, the Jordanian military said on August 7 that it foiled a smuggling attempt from Syria. The military said it killed a smuggler in the encounter and seized a large amount of narcotics.

Days earlier, Jordan's General Security Directorate said its anti-drugs unit seized half a million Captagon pills.

The pills had been hidden in industrial machinery on board a truck that arrived at Jaber, the main land crossing point between Jordan and Syria.

A Saudi official involved in combating the Captagon trade said: “Saudi Arabia is being targeted as a society”.

“It is a major threat to the national security of the kingdom,” the official said.

The smuggling is affecting legitimate inter-Arab trade and undermining relations between Saudi Arabia and states in the Levant.

Saudi Arabia banned imports of fruit and vegetables from Lebanon in April, after customs authorities seized 5 million pills hidden in a shipment of pomegranates.

Despite the ban on Lebanese imports, interceptions of large quantities of pills have continued as smugglers tried other ways of getting the drug into the kingdom.

“Saudi Arabia’s borders are too long to seal off,” the Saudi official said, pointing to its 2,640 kilometre coastline and 4,400km land borders.

He said the most effective way to stop the smuggling “is to have intelligence on where the next shipment is going to come from".

Hezbollah and Captagon trafficking

The Hauran plain extends into Jordan and the same clans live on both sides of its border. Social dynamics helped the underground trade prosper.

The Syrian city of Deraa, the capital of Hauran, is a few kilometres away from the Jordanian city of Ramtha, where smugglers are known as Bahhara, or sailors.

The Syrian regime captured Hauran in 2018 from rebel brigades after a tacit agreement between Moscow, Washington.

The deal resulted in the US and Arab Gulf countries abandoning support for the rebels.

Hezbollah moved in and Syrian opposition sources estimate that the group oversees with the support of Iran 4,000 militiamen in Hauran.

Hezbollah has established itself as a main partner in Syria on the production and trafficking side, with much of the raw material for producing Captagon coming from Lebanon, said two Levantine security officials.

They did not want to be further identified, citing sensitivity of the issue.

Hezbollah publicly denies being involved in any drug trade.

Despite more drug busts by governments in the region over the last few months, the officials said seizures typically represent no more than one-tenth of the actual smuggling.

Syrian opposition sources specialising in gathering intelligence from regime areas said that there were at least a dozen drug smuggling points on the border between Hauran and Jordan.

They say they counted more than 120 drug trafficking groups, comprising 1,600 men, who operate in Hauran.

At least 74 out of the 128 groups have warehouses to store Captagon – including its highly-prized, purer form known as Lexus – as well as marijuana and other drugs like Tramadol.

One of the sources, an officer who defected from the Syrian regime's military, said 65 per cent of the trafficking rings were linked to Hezbollah, with the remainder linked to the regime’s intelligence army divisions.

Cars and tunnels are used for smuggling, as well as drug mules travelling on foot.

Shepherds typically smuggle 25 to 35 kilograms and receive between $5,000 and $11,000 for each smuggling shipment they carry, the Syrian opposition sources said.

Syria remains the primary source of the Captagon making its way to the Gulf, they said, but certificates of origin for goods containing the pills are often forged or issued illegally in Lebanon.

Beirut has long played an intermediary role in Syrian affairs. Lebanon’s access to international markets and the sophistication of its business class have helped develop the war economy in Syria over the last decade, said one Arab security official.

Faced with farmers’ wrath, the Lebanese government have been showcasing what it describes as increased efforts to counter drug smuggling.

The authorities in Beirut in June intercepted 250,000 pills hidden in water pumps bound for Saudi Arabia.

One of the Levantine officials said the pills had been painstakingly hidden between compressor blades, in a sign of how far smugglers are willing to go to get a potentially huge profit.