At the 71st Miss Universe pageant in January, not only will a winner be announced, but she will get to wear a new crown, crafted by Lebanese jewellery brand Mouawad.

The crown, called Force for Good, was unveiled at a glitzy event in Bangkok on Monday by Fred Mouawad, the "co-guardian" of the Beirut-founded brand, as well as the Miss Universe Organisation's new Thai owner Anne Jakkaphong Jakrajutatip.

Former Miss Universe title holders Natalie Glebova (2005) from Canada and Thailand's Apasra Hongsakula (1965), also attended the event.

"The Force for Good crown is a work of extraordinary craftsmanship. It's a crown filled with symbolism. And we hope it will inspire not only the winners, but all of you to be a force for good," Mouawad said at the presentation, adding that the crown represents "a future forged by women who push the limits of what's possible".

Embedded with 110 carats of blue sapphires and 48 carats of white diamonds, the Force for Good crown features wave-like curls at the base, that emulates a serpent's head, "symbolising the challenges involved in swaying opponents," a description by Mouawad reads.

The colour gradiant of the predominantly white diamond base then changes to the blue of sapphires towards the top where a blue pear-shaped sapphire sits at the pinnacle, representing hope for a brighter future.

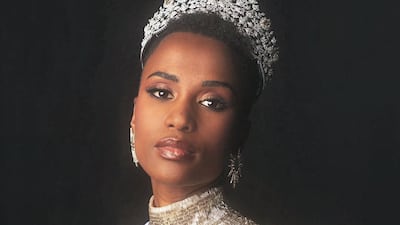

Founded in 1908 in Beirut and now with its headquarters in Geneva, Mouawad has been crafting one-of-a-kind pieces for royal families as well as the wealthy for four generations. It became the official jeweller for Miss Universe in 2019 when it crafted the crown for the winner of the title, South Africa's Zozibini Tunzi.

Called The Power of Unity, the crown, estimated to be between $4 million and $5 million, has been passed on to successive winners. Miss Universe 2021, India's Harnaaz Sandhu will be the last one to wear it.

"We thought, 'What can we do that's in line with our heritage, something majestic that would have a very wide exposure?'," Mouawad told The National in a previous interview, referring to how his company's relationship with the Miss Universe Organisation began.

"And we thought of Miss Universe, because we are, after all, jewellers to royalty. So why don't we use our know-how to also create a crown for the most beautiful women in the world?"

Estimated to be worth $5.5 million, the Force for Good crown comes amid a host of changes at the 70-year-old Miss Universe competition.

The organisation made history in August when it announced it was making one of the biggest changes to its selection process. Starting next year, the annual competition will accept married women and mothers. Previously, only single women, aged between 18 and 28, who have never been married or had children were allowed to apply.

In October, Jakrajutatip acquired the Miss Universe Organisation from IMG through her company JKN Global Group where she serves as chief executive.

JKN, which owns a portfolio of broadcast and media titles, said the deal will build on the pageant's legacy and further its commitment to inclusivity. There are also plans to expand the Miss Universe brand, including the launch of MU Lifestyle, a new licensing and merchandising arm.

Miss Universe has changed ownership a number of times since the first pageant was held in 1952. Former US president Donald Trump bought it in 1996 and sold it to global events and talent company IMG in 2015.

The global event is one of the longest-running and most-watched beauty competitions in the world; it is broadcast in 165 countries and seen by more than half a billion people annually.

Scroll through the gallery below for Miss Universe 2022 beauty queens who have been crowned so far, everywhere from Turkey to Italy