Repairing damaged underwater cables is a complex process that can take weeks or even months, as previous incidents have demonstrated, the International Cable Protection Committee says. Internet users across the UAE reported slower connections this weekend after cables were cut in the Red Sea.

Two major underwater cables, SMW4 (SEA-ME-WE 4) and IMEWE, were damaged near Jeddah, Saudi Arabia, global internet observatory NetBlocks says.

The cuts disrupted connectivity across India, Pakistan, the Gulf and parts of Africa, forcing operators to reroute traffic through alternative paths.

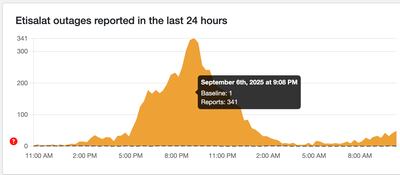

Customers of Etisalat by e& and du were among those affected in the UAE, with both operators receiving a surge of complaints on Saturday.

Users reported problems loading websites, streaming video and using messaging apps.

Du issued no official comment but responded to customers on its social media help desks, while Etisalat posted similar replies without stating the cause.

The Red Sea corridor carries about 17 per cent of global internet traffic between Asia, Europe and Africa, telecom research company TeleGeography says, making it one of the world’s most critical digital chokepoints.

Even localised faults in the area can ripple out across continents.

The cause of the latest disruption remains unclear, with authorities and cable operators yet to confirm whether the damage was accidental or deliberate.

Saudi Arabia and Egypt

Traffic was rerouted across alternate pathways, leading to widespread slowdowns, NetBlocks reported.

In Saudi Arabia, while authorities have not formally commented, the proximity of the damage to Jeddah suggests domestic users were also affected.

Egypt was not explicitly mentioned in this incident, but TeleGeography notes the country is historically central to regional cable disruptions. Past power cuts, including those affecting AAE-1, significantly disrupted connectivity through Egypt.

UAE

Downdetector data showed hundreds of disruption complaints in the UAE on Saturday evening, peaking at about 9pm, while Cloudflare Radar indicated shifts in routing that slowed international traffic.

Analysts say disruptions of this kind often affect businesses that rely on real-time connectivity, such as financial institutions and airlines.

On Saturday, Microsoft issued a service status update warning that some of its Azure users may experience higher-than-normal latency for traffic passing through the Middle East, particularly on routes linking Asia and Europe.

“Undersea fibre cuts can take time to repair; as such, we will continuously monitor, rebalance, and optimise routing to reduce customer impact in the meantime,” Microsoft said.

The company added that traffic not traversing the region remained unaffected and confirmed it had rerouted network traffic through alternative paths to maintain service continuity.

In Pakistan, telecom operator PTCL confirmed reduced capacity on the affected cables and said it had arranged alternative bandwidth channels to help mitigate service degradation.

Although rerouting kept services online, industry experts note that detouring traffic through longer and more congested paths inevitably slows performance.

Cloud applications, real-time messaging and streaming are especially sensitive to the added latency and congestion.

Why it matters

Past incidents have underscored the risks. Early last year, three cables were cut after a vessel attacked by Yemen's Houthi rebels drifted and dropped anchor in the Red Sea, disrupting services for weeks.

Analysts say the area’s shallow waters, busy shipping lanes and geopolitical tension make it especially prone to accidental and deliberate damage.

They also note the latest incident highlights the need for diversified cable routes and satellite backup to reduce reliance on the Red Sea corridor.

Repairs could take time

Repairing subsea cable damage is a highly complex and resource-intensive operation, the ICPC says.

It requires the posting of specialised repair vessels with trained crews and involves meticulous processes including detection, retrieval, splicing, testing and reposting, each step susceptible to weather, logistics and legal delays. The ICPC notes that such repairs often cost between $1 million and $3 million.

In the Red Sea, the task is further complicated by regional instability.

Last year, Reuters reported that three major cables could not be repaired quickly because Yemen’s government denied access to repair teams, while consortium investigations compounded delays.

The recent cuts take place as the Houthis exchange attacks with Israeli strikes over its war on Gaza.

Repair timelines in such scenarios have historically ranged from a few weeks to several months, industry data shows.

With repairs of such damages often stretching over weeks or months, customers and businesses across the UAE and wider region could be required to brace for continued disruptions as traffic is rerouted and cables are restored.