Four young Emiratis will help lead the charge towards a more sustainable future as the UAE prepares to host the crucial Cop28 climate summit in November.

The eco-conscious quartet — including a girl aged 12 — will serve as Emirati Youth Sustainability Ambassadors at the international gathering in Dubai as the Emirates seeks to shine a light on the significant role to be played by the next generation in protecting the planet.

Dr Sultan Al Jaber, President-designate of Cop28 and Minister of Industry and Advanced Technology, on Wednesday announced that the country will sponsor 100 international youth delegates to attend the conference, to be held at Expo City Dubai.

It will prioritise those from the least developed countries, small island developing states, indigenous peoples and other minority groups from around the world.

Here, The National speaks to the young climate champions hoping to effect change on the road to Cop28 and beyond.

The schoolgirl inspired by Sheikh Zayed's legacy

Ghaya Saad Alahbabi may be only 12, but she is aware the world is facing a pivotal moment in its climate change fight.

When she turned 11, she wasn't concerned about how many gifts she received or how many friends would attend her party, as her mind was focused on something bigger.

She marked her birthday by launching an art competition, with paintings made up of recycled materials to show what can be achieved with a sustainable vision.

The Grade 7 pupil at Liwa International School has organised more than 20 cleaning campaigns that have brought people together to spruce up the country's coastline and beaches.

“But it can't just be me,” she said. “It has to be all of us together to make a difference.”

She is inspired by UAE Founding Father, the late Sheikh Zayed bin Sultan Al Nahyan.

“It was a quote I read,” she said.

The powerful words from Sheikh Zayed were: “We cherish our environment because it is an integral part of our country, our history and our heritage.

“On land and in the sea, our forefathers lived and survived in this environment. They were able to do so only because they recognised the need to conserve it, to take from it only what they needed to live, and to preserve it for succeeding generation.”

Ghaya looks to how Sheikh Zayed and the UAE have successfully put words into action, and it fuels her desire to do the same.

“They didn’t believe him when he said he would plant the desert with trees and look at us today,” she said.

She wants children to dream big and never lose sight of the need to preserve the Earth for generations to come.

“I would tell children to dream big — continue on your path but whatever you do please care for your environment because it can’t just be me, it has to be all of us.”

A teenager ready to lead

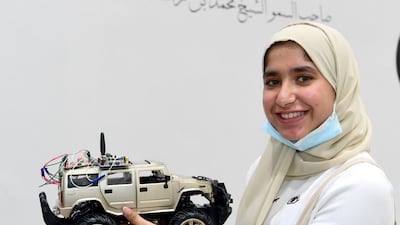

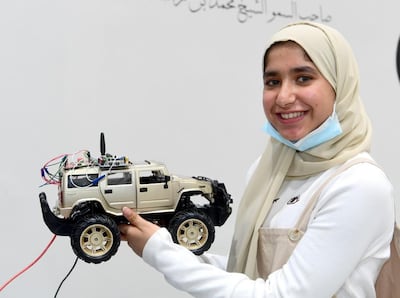

Mariam Al Ghafri epitomises the faith of the UAE leadership in the potential of the nation's youth.

At only 15, she has already come up with more than two dozens inventions with the aim of making everyday life better.

One includes a device which aims to detect if a child was locked inside car by measuring CO2 levels.

A rise would indicate someone was inside the car and trigger an alarm to be raised.

Another idea is to translate images into Braille.

Many of her inventions are prompted by her own life experiences.

“My cousin was once stuck in a car for 30 minutes and that is how I got the idea of the car sensor,” she said.

Mariam wants to pursue a career in engineering and takes her ambassador duties seriously.

“My role as an ambassador is to elevate the thinking of the Emirati child and put him in a position of responsibility that he must bear by preparing programmes and activities that enable him to do so.

She credits Sheikha Fatima, Mother of the Nation, for giving children a voice.

“She offered us the chance to speak up and influence decisions that supports children's rights. Children are the least responsible for climate change, but they will suffer its effects, so we must stop it.”

A youngster dedicated to the cause

Sofia Faghihy has an impressive track record in the climate change fight, at the age of only 16.

She is passionate about Cop 28 and believes decision-makers can make a difference if united.

She has previously met former UN Secretary General Ban Ki-moon, taken on eco ambassadorial roles for her school and volunteered for wildlife conservation work in Sri Lanka.

Her notable achievements include winning the International Mathematics Olympiad 2021 and the International Cyber Olympiad in the following year.

She secured the Sheikha Fatima Bint Mubarak Award for Excellence in 2022 and acted as Secretary General for the Gems World Academy Model United Nations 2023, where pupils serve as UN delegates to address the pressing issues facing the world.

Even with such a busy schedule, she also found time to author a non-fiction book, entitled Space Exploration: The New Rennaisance.

“I am driven by an innate desire to succeed. I see myself as a very privileged person by having access to a great education and constant support from my family, and I really want to give that back to the community as much as possible,” Ms Faghihy said.

“I feel like I should use the skills I was given not only to benefit myself but rather society as a whole through my existing and future platforms.”

The farmer showing the way

Saeed Al Remithi, 23, has his own organic farm, selling everything from tomatoes to milk, eggs and poultry.

He is sowing the seeds of sustainability in his every day work, using pesticide-free fertilisers, setting up solar panels and embracing hydroponic farming methods which greatly reduces water usage.

The farm located in Sweihan in Al Ain covers the needs of his family.

When he was 20 he wanted to build an eco-friendly farm.

“My uncle was having trouble with his greenhouses and complaining about the high cost of electricity and water consumption so I came up with a prototype of a hydroponic farm that worked using solar panels and the rest was history,” he said.

“Today we sell our products and we hope to compete with many of the local products you see in the market today. Our products are all organic.”

Mr Al Remithi is looking forward to advancing the green agenda at Cop28, where his business will be a highlighting as a model of good sustainable practice.