The UAE and Egypt have entered into an agreement to build one of the world's largest wind farms in Egypt.

President Sheikh Mohamed and Egyptian leader Abdel Fattah El Sisi witnessed the signing of an agreement between Masdar, Egypt's Infinity Power and Hassan Allam Utilities to develop a 10-gigawatt onshore wind project.

The memorandum of understanding was signed in Sharm El Sheikh by Dr Sultan Al Jaber, Minister of Industry and Advanced Technology, Special Envoy for Climate, and chairman of Masdar.

Sheikh Mohamed said the deal was "consistent with our commitment to advance renewable energy solutions that support sustainable development".

Dr Al Jaber said the scale of the project — "one of the largest winds farms in the world" — was a "testament to the renewable energy ambitions of the United Arab Emirates and the Republic of Egypt, and demonstrates Masdar’s status as a global leader in clean energy".

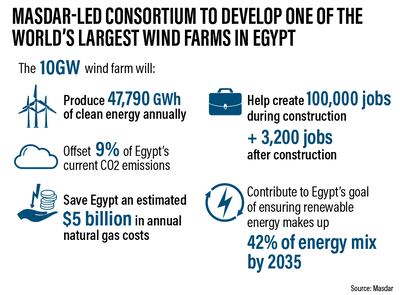

When completed, the 10-gigawatt wind farm will produce 47,790 gigawatt hours of clean energy annually and offset 23.8 million tonnes of carbon dioxide emissions — equivalent to about 9 per cent of Egypt’s current carbon dioxide output.

The project will be part of Egypt’s Green Corridor initiative — a grid dedicated to renewable energy projects — and will contribute to Cairo's goal of ensuring renewable energy makes up 42 per cent of the country's energy mix by 2035.

The wind farm will also save Egypt an estimated $5 billion in annual natural gas costs, and help create as many as 100,000 jobs, state news agency Wam said.

Direct employment in the construction phase is estimated at about 30,000 jobs, with as many as 70,000 people being employed indirectly. After construction, about 3,200 jobs will be added for operation and maintenance.

The world's largest wind farm is in Gansu, China. It can generate 20 gigawatts.

In April, Masdar and Hassan Allam Utilities signed two deals with Egyptian state-backed organisations to co-operate on the development of 4-gigawatt green hydrogen production plants in the Suez Canal Economic Zone and on the Mediterranean coast.

In the first phase of the project, a green hydrogen manufacturing facility will be developed and operational by 2026, able to produce 100,000 tonnes of e-methanol annually for bunkering in the Suez Canal.