New land tax rules that came into effect in Saudi Arabia this month are expected to spur the development of property projects and boost housing supply.

The kingdom increased the annual levy on undeveloped land to as much as 10 per cent of the value of a plot. It introduced fees of between 5 per cent to 10 per cent on long-term vacant buildings, as part of regulations introduced by the government last week.

The changes apply to plots measuring 5,000 square metres or more, within the approved urban boundaries, Saudi Arabia’s Ministry of Municipalities and Housing said.

The plan comes as the kingdom opens up foreign ownership of property from January 2026, particularly in the cities of Riyadh and Jeddah.

“By raising the annual levy on undeveloped land and introducing a fee of up to 10 per cent on long-term vacant buildings, the reforms make it significantly more costly for owners to hold assets without putting them to productive use. This is expected to push many landowners to develop, sell, or lease their properties, bringing more projects to market,” Nils Vanhassel, legal director and tax adviser at DLA Piper Middle East, told The National.

“Over time, these measures should help balance supply and demand, moderate land price inflation, and improve housing affordability in line with Saudi Arabia’s Vision 2030 goals.”

Saudi Arabia, the Arab world’s largest economy, is undertaking reforms as it aims to attract more foreign direct investment and diversify its economy away from oil.

The reforms span sectors including stock markets, property, investment and governance of companies, among others.

Last month, the country updated its rules to allow foreigners to buy property in specific zones in Riyadh and Jeddah, with “special requirements” for home ownership in Makkah and Madinah.

It is also permitting foreign citizens to invest in publicly listed local companies that own real estate in Makkah and Madinah, as the kingdom seeks to attract international investments and boost its capital markets.

Saudi Arabia also opened its stock exchange to residents of Gulf countries, who are now allowed to invest directly in the kingdom’s main Tadawul market as the kingdom continues to introduce new amendments to its laws.

The country aims to boost home ownership among Saudi citizens to 70 per cent by 2030 through new government initiatives such as Sakani and simplifying access to affordable long-term financing.

The Saudi home ownership rate reached 63.7 per cent at the end of 2023, a 16.7 percentage point increase since the National Transformation Plan’s introduction in 2016 and surpassing the government’s 2023 target of 63 per cent, according to a recent Knight Frank report.

As of mid-2025, more than 5,500 undeveloped plots spanning approximately 411 million square metres have been identified under the white land tax regime in Riyadh, Jeddah, Makkah and Dammam, according to DLA Piper.

This marks a substantial increase compared to the initial 2017 roll-out, which covered 1,320 plots totalling about 387 million square metres, the law firm said.

More developers entering market

“While [the land tax's] full impact will be felt over the medium to long term, given that most projects take three to nine months for planning and design, and a further two to three years for construction, it could prompt developers who had previously delayed their plans to re-enter the market,” said Rahul Bansal, head of strategic consultancy for the GCC region at Savills Middle East.

“Many may look to collaborate with external partners or investors to bring new opportunities to life.”

New developers are entering the Saudi property market amid new opportunities. Last year, the Trump Organisation teamed up with London-listed Dar Global to launch a residential project worth 2 billion Saudi riyals ($533 million) in Jeddah. It is looking to start two more projects in Riyadh.

Home prices have continued to rise in key cities in Saudi Arabia amid higher demand.

Apartment prices in Riyadh are up by 82 per cent since 2019, while villa prices have risen by close to 50 per cent over the same time period, Faisal Durrani, head of research Mena at Knight Frank, said.

The new regulations are expected to solve the problem to some extent, with new developments increasing supply in the market.

“Raising the tax rate on vacant land to 10 per cent should help to unlock more development sites and therefore potentially ease the burden on developers,” Mr Durrani said.

“In turn, the move may slow the rate of price growth for vacant land, which, in the long run, should translate into homes that are within the affordability limits of most Saudi nationals. We have found that two thirds of Saudis are prepared to spend a maximum of 1.5 million Saudi riyals on a new home.”

Surge in real estate deals

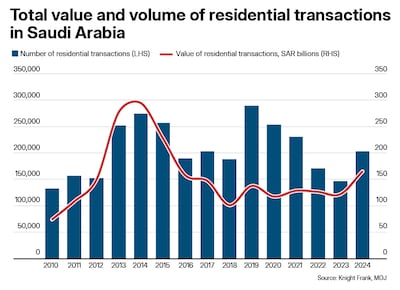

During 2024, the total number of real estate transactions across all asset classes in Saudi Arabia surged by 37 per cent to more than 236,690 deals, while the total value of all deals grew by 27 per cent to 267.8 billion riyals.

Residential transactions, which accounted for 61.5 per cent of all real estate deals by total value, registered a 38 per cent increase in the number of deals to just under 202,661 sales. While the value of residential transactions increased by 35 per cent to 164.8 billion over the same period, according to Knight Frank.