Villas and apartments in Dubai recorded strong annual capital gains in the first quarter of 2023 as the emirate’s property sector continues to rebound from the coronavirus pandemic.

Villas, which represent 13 per cent of residential homes in Dubai, grew by 17.1 per cent annually while apartment values rose by 6.6 per cent, according to a report from property consultancy ValuStrat.

Jumeirah Islands, with a growth of 5 per cent, The Palm Jumeirah (4.6 per cent), Dubai Hills Estate (4.5 per cent) and Jumeirah Park (3.8 per cent) were the best-performing areas during the quarter.

The ValuStrat Price Index (VPI) covering Dubai’s residential market grew by 11.4 per cent annually to 88 points.

The VPI for villas rose 2.4 per cent on a quarterly basis, 3 per cent shy of 2014 price peaks, the report said.

The apartment VPI grew by only 1.5 per cent quarterly, 34.2 per cent below the peaks of 2014.

The top districts with the highest quarterly capital gains for apartments were The Palm, Jumeirah Beach Residence, The Greens and Discovery Gardens.

“The month of March observed capital gains of typical villas stabilise, whilst apartments witnessed marginal acceleration for the first time since the pandemic,” ValuStrat said.

The latest report comes after Dubai and Abu Dhabi property sales surged in the first quarter amid a broader recovery in UAE’s economy on the back of higher oil prices and new initiatives by the government.

Abu Dhabi’s total sales transaction value for the three months to the end of March jumped more than three times to Dh11.6 billion ($3.15 billion), from Dh3.6 billion during the same period last year, according to real estate listings website Property Finder.

Meanwhile, Dubai’s total transaction value in the first quarter stood at Dh157 billion, marking an 80 per cent annual increase, the emirate's media office said last month.

Prime villa prices surpassed the price peaks of 2014 by 1.2 per cent in the first quarter, according to ValuStrat.

The valuation-based price index for luxury villas grew 16.8 per cent annually and 3.2 per cent on a quarterly basis.

Prime apartments recorded capital gains of 10.2 per cent annually and 1.7 per cent on a quarterly basis.

An estimated 55,863 new-build units have been put on the market so far this year while the number of total estimated completions by the end of the first quarter was 6,564 for apartments and 1,178 for villas, the ValuStrat report said.

Notable apartment completions included the Summer at Creek Beach development with 298 units, the Sunset at Creek Beach project (536), Waves Tower in Sobha Hartland (414), Binghatti Creek at Al Jaddaf development (400) and Azizi Berton in Al Furjan (245).

Based on developer schedules for 2023 handovers, preliminary estimates suggest 48,209 apartments remain under construction, with 54 per cent located in Mohammed bin Rashid (MBR) City, Dubailand, Jumeirah Village Circle and Business Bay.

An 81 per cent share of the city’s coming 7,654 villas will be concentrated in MBR City, Dubailand and Dubai South, the report said.

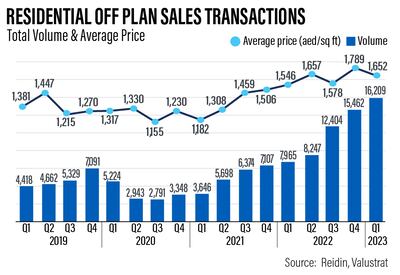

With higher borrowing costs, a shortage of good quality homes in some areas and attractive payment plans offered by developers, Dubai's off-plan sales volume jumped 103.5 per cent annually to 16,209 transactions worth more than Dh37 billion, representing 57.9 per cent of all residential homes sales, ValueStrat said.

The average ticket size of off-plan homes rose 22.2 per cent annually to Dh2.33 million. The citywide average transacted price for off-plan property was Dh17,783 a square metre (Dh1,652 a square foot).

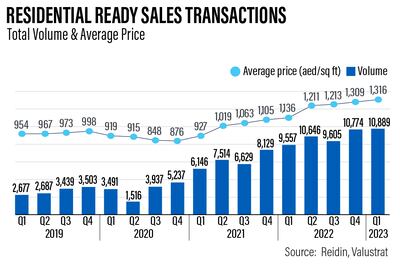

The average ticket size of ready-to-move-in homes fell 5 per cent annually to Dh2.52 million during the quarter.

The sales volume of ready homes rose 13.9 per cent to 10,889 deals, equal to a total investment of Dh27 billion.

The citywide average transacted price for ready units during the first quarter was Dh14,170 a square metre (Dh1,316 a square foot).

Residential market strength also expanded to the affordable segment, according to ValuStrat.

"This quarter, Dubai Silicon Oasis, Jumeirah Village and Dubailand Residence Complex broke their individual records, with the highest number of homes traded during March, highlighting a possible shift in buyer demand towards the mid to affordable segment of Dubai’s real estate market, particularly homes priced under Dh1 million,” the report said.

Meanwhile, asking rents for new residential contracts in the first quarter jumped 33 per cent from the same period last year and 4.1 per cent from the previous quarter.

Villas led the rental increase, up 51.5 per cent annually and 4.2 per cent quarterly, to record an average asking rent of Dh380,500 a annum, the highest in 10 years, the report said.

Apartment asking rents grew by 20.7 per cent annually and 4 per cent quarterly.