The outbreak of a new virus in China has sent shivers through world financial markets, with investors drawing comparisons to the 2003 SARS (Severe Acute Respiratory Syndrome) outbreak in order to assess its potential economic impact.

This factbox collates the estimates of the economic impacts of past such episodes as well as individual company winners and losers from the current outbreak.

Global economic and financial market impact

A 2017 paper published by the World Health Organisation titled Pandemic risk: how large are the expected losses? by economists Victoria Fan, Dean Jamison and Lawrence Summers estimated that the expected annual losses from pandemic risk to be about $500 billion (Dh1.84 trillion) — or 0.6 per cent of global income — per year, accounting for both lost income and the intrinsic cost of elevated mortality.

Another 2016 study by the Commission on a Global Health Risk Framework for the Future estimated that pandemic disease events would cost the global economy over $6tn in the 21st century — over $60bn per year.

Isolating the impact of a single factor on global stock indexes and the global economy is a formidable task: they reflect a multiplicity of simultaneously competing factors ranging from economic data, company performance, and geopolitical shifts. In the middle of the SARS outbreak for instance, the US invasion of Iraq would have exerted an equivalent if not greater impact on price action.

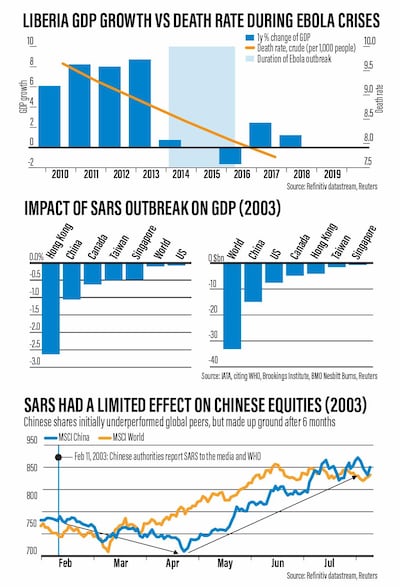

However, price action in markets indicates that the impacts of such outbreaks are limited. After Chinese authorities reported the outbreak of SARS to the WHO in 2003, the MSCI China index of shares decoupled from its global peers — but made up the lost ground in only six months.

The economic cost of SARS in 2003

Another paper titled Learning from SARS: Preparing for the Next Disease Outbreak by Jong-Wha Lee and Warwick McKibbin, estimates the global economic loss due at SARS at $40bn in 2003.

A May 2006 economic briefing by the International Air Transport Association estimated that world gross domestic product suffered a 0.1 per cent hit due to the outbreak.

Market winners and losers

Despite the disruption to the wider economy, virus outbreaks have tended to benefit pharmaceutical stocks, while tourism and travel-related stocks, such as hotels, airlines and luxury and consumer goods, tend to get punished. During the SARS outbreak, retail sales figures in China showed a marked drop-off as consumer spending took a hit.

On Tuesday, Chinese drugmakers Jiangsu Bioperfectus Technologies, Shandong Lukang Pharmaceutical and Jiangsu Hengrui Medicine were among those outperforming the wider market. Face mask manufacturers Tianjin Teda and Shanghai Dragon also outperformed.

Shares of long-haul flight operators Air France, Lufthansa and British Airways-owner IAG retreated, as news of the contagion raised concerns over disruptions to travel during a coming Chinese holiday.

China-exposed luxury goods makers including LVMH, Kering, Hermes and Burberry also fell.

Mortality rate and economic impact

An 2018 IMF paper titled New and resurgent infectious diseases can have far-reaching economic repercussions by David Bloom, Daniel Cadarette, and JP Sevilla notes that even when the health impact of an outbreak is relatively limited, economic consequences can be quickly magnified. The authors cite the case of Liberia during the 2014 Ebola outbreak, which saw gross domestic product growth decline even as the country's overall death rate fell over the same period.

"What scared people about SARS is the mortality rate," ING Asia Pacific's chief economist Robert Carnell said in a note to clients.

"People didn't take public transport, stayed away from work, stayed away from shops, restaurants, cinemas, conferences etc. The impact from the disease was massive on the economy, but almost all of it indirect, due to the precautionary behaviour of the population."