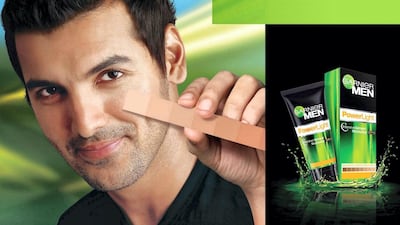

John Abraham

Indian actor John Abraham has purchased a two-storey home in Mumbai’s upmarket Khar suburb for more than 750 million Indian rupees ($9 million), India’s PTI news service has reported.

The transaction includes stamp duty of 4.2 million rupees.

The 5,416-square-foot property has about 7,722 square feet of open land, offering significant potential for redevelopment.

Abraham, 51, has a net worth of 2.5 billion rupees ($30 million), according to the Financial Express newspaper.

The Pathaan star lives in a 4,000-square-foot penthouse overlooking the sea in Bandra, about 2km away. He also owns properties in Bel Air, Los Angeles, and central London.

He is a keen investor, taking equity stakes in a wide range of companies, including Noto ice cream and Mumbai-based wellness retailer Guardian Healthcare.

In 2012, the actor launched his own film production house, J.A. Entertainment, and has produced several critically acclaimed films, including Vicky Donor and Madras Cafe.

He has also collaborated with denim label Wrangler in addition to co-owning the Indian franchise for US streetwear label Ecko Unltd, according to GQ India.

A former fitness model, Abraham co-owns Indian Super League football team NorthEast United FC and Indian Hockey League team Delhi Waveriders.

He has previously been involved with gyms under the name of JA Fitness in Mumbai and Pune.

Abraham has endorsed and teamed up with many brands over the years, including Reebok, Yamaha and tech accessories retailer U&i.

Cristiano Ronaldo

Al Nassr forward Cristiano Ronaldo is among a group of investors who have committed more than $40 million towards the creation of free-to-play association football video game UFL.

The new title is being developed by Cyprus-based Strikerz, the publishing brand of gaming company XTEN Limited.

“I’m thrilled to be a part of this project as UFL can become the new breed in football gaming,” Ronaldo said.

The size of his investment has not been made public.

An official release date for the game has yet to be announced, although a closed testing phase began last autumn.

Strikerz chief executive Eugene Nashilov said working with Ronaldo as a partner and investor would help create a game that fills a gap in the football gaming market “by unifying a rich gaming experience with continuous progress and a fair approach”.

Ronaldo, 38, has a net worth of $600 million, according to wealth tracking website Celebrity Net Worth.

The Portuguese citizen is the world’s highest-paid footballer and is projected to earn $260 million over the current season, according to an estimate by Forbes magazine.

The greater portion of that income – about $200 million – will be compensation from Al Nassr, including wages and financial incentives from commercial agreements arranged by the club, the publication said.

In 2020, he became the first active team-sport athlete to earn more than $1 billion over the course of his career, according to Forbes.

As of the start of this year, Ronaldo had more than 895 million followers on Instagram, Facebook and X (formerly Twitter) combined.

That popularity means the five-time Ballon d’Or winner is also a major brand magnet. He has partnerships and endorsements with the likes of luxury watch company Jacob & Co, cryptocurrency exchange Binance and a lifetime deal with Nike.

In addition, he has extended his CR7 clothing and accessories brand into hotels and gyms.

In November, Ronaldo became the subject of a class-action lawsuit over promoting Binance, with investors claiming his endorsement led them to make loss-making investments.

Binance announced a CR7 collection of non-fungible tokens (NFTs) in 2022.

Ronaldo has invested in at least five companies, according to investor database Pitchbook. They include watch market Chrono24 and fantasy sports platform and NFT cricket start-up FanCraze.

Last September, he also made a significant investment in Cidade do Padel, a 17-court padel complex in Oeiras, Portugal.

He owns or has owned homes in Lisbon and Madeira in his native Portugal, Turin in Italy, the Spanish capital of Madrid, Cheshire in England and New York City.

Kanye West

Rapper and fashion designer Kanye West, now called Ye, has put his 4,000-square-foot Malibu, California, property on the market for $53 million.

He purchased the Tadao Ando-designed beachfront home for $57.3 million in an off-market deal in 2021, according to The Hollywood Reporter.

The four-bedroom home, built about a decade ago, requires extensive interior work worth several million dollars, estate agent Jason Oppenheim told the publication.

West, 46, reportedly attempted to turn the home into a bomb shelter, removing all the windows and electricity. He reportedly owes at least $1 million in remodelling fees, according to Sky News.

He has a net worth of $400 million, according to Forbes.

In 2022, the publication revised his net worth down from $1.9 billion after sportswear retailer adidas ended a nine-year partnership over his anti-Semitic remarks.

The deal for West’s Yeezy line of trainers was worth $1.5 billion, calculated on a multiple of annual earnings.

His fortune is now derived from cash, property, the Yeezy brand, his music catalogue and a 5 per cent stake in former wife Kim Kardashian’s Skims shapewear brand.

His real estate portfolio alone is worth about $100 million. It includes property in Chicago and the state of Wyoming, as well as other homes in California.

West was due to release Vultures, his comeback album with fellow musician Ty Dolla Sign, on January 12, but it has since been postponed. It was scheduled for release on two separate dates in December.

His music catalogue generates upwards of $13.25 million in publishing royalties annually, according to estimates by Billboard magazine.

However, that total includes other songwriters’ shares, putting West’s annual share of royalties at an estimated $5 million.

In 2022, it was reported that the catalogue was for sale, with the highest estimates coming in at $175 million.

Last week, the UK’s Daily Mail newspaper reported that West owes more than $1 million in back taxes, including liens against Yeezy Apparel and levies on homes he owned with Kardashian.

Mouni Roy

Bollywood actor Mouni Roy is among a clutch of investors in VRO Hospitality, a food and beverage retailer based in Bengaluru, India.

The $10 million bridge round is a mixture of equity and debt. It was led by India’s Axis Bank and venture fund Gruhas and drew participation from UC Inclusive Ventures, UAE-based NB Ventures and investor Kunal Shah, according to investor database Crunchbase.

The funds will go towards product development and portfolio expansion, the company said.

Roy, 38, has a net worth of 410 million rupees ($4.9 million), according to calculations by the News 18 website.

She made her acting debut in 2006 with a role in the popular soap Kyunki Saas Bhi Kabhi Bahu Thi.

Roy and VRO are also partners in Mumbai restaurant Badmaash.

In 2022, the Brahmastra-Part 1 actor joined hands with cloud kitchen start-up Bigspoon during a 1 billion rupee funding round, taking a development and endorsement role.

Last year, she launched delivery-only brand The Pizza People with Bigspoon.

In June, Roy joined a $2 million seed round in trainer resale website The Mainstreet Marketplace.

Other investors included Gruhas, Zomato founder Deepinder Goyal, comedian Tanmay Bhatt and musician Nikhil Chinappa, the Outlook Indiamagazine reported.