RELATED: UAE salary guide 2022: how much should you be earning?

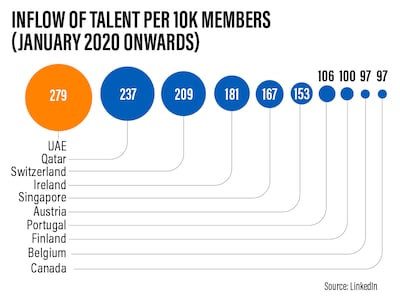

The UAE continues to be a global talent magnet, ranking fifth in the world for total talent inflow after the US, the UK, Canada and France, a new report by LinkedIn in partnership with the Ministry of Economy has said.

Relative to its population, the inflow of talent to the Emirates is the highest in the world, the professional network service said.

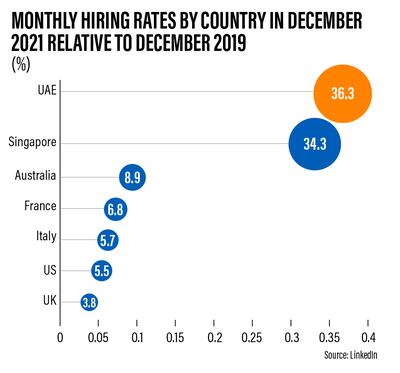

“The UAE has recorded one of the strongest hiring booms globally, with hiring rates 36 per cent higher in December 2021 compared with December 2019,” said Rajai El Khadem, head of LinkedIn Mena for government and academia.

“This represented one of the highest hiring recoveries in the world, trending above other developed economies.”

The jobs market in the UAE, the second-largest Arab economy, has recovered strongly from the pandemic-induced slowdown on the back of the government’s fiscal and monetary measures.

About 76 per cent of UAE employers plan to expand their workforce in 2022, a February survey by jobs portal Bayt.com and market research company YouGov said.

About two thirds of professionals in the UAE will actively look for new jobs in the first half of this year as business confidence and hiring activity return to pre-pandemic levels, recruitment company Robert Walters said.

Booming industries

Sectors in the UAE with the highest recovery in hiring levels include healthcare, software and information technology, all of which saw recruitment pick up after the immediate onset of the pandemic, the LinkedIn report said.

The retail and recreation and travel industries have also recovered and are above pre-pandemic levels, while other sectors such as construction, energy and mining are yet to catch up, the report said.

The UAE also witnessed the “Great Reshuffle”, a talent shift in which an increasingly skilled, flexible and mobile workforce was drawn to opportunities and companies that match their ambitions, LinkedIn said.

“Career switching has become more common in the UAE since the start of the Covid-19 pandemic. Professionals with transferable skills made career transitions out of struggling industries and into sectors that were booming,” Mr El Khadem said.

About 75 per cent of career transitions took place in 10 key industries. Software and IT services attracted 12.2 per cent of talent from other sectors, followed by corporate services (11.6 per cent), consumer goods (8.8 per cent), manufacturing (8.1 per cent) and finance (7.4 per cent), LinkedIn said.

Career change

Many employees switched their careers in 2021 to become “professional and personal coaches”, leading to a 208 per cent growth in these roles compared with the previous year.

“Digital content management and self-employment are two examples of job domains that witnessed a three-fold growth in the number of roles in 2021,” Mr El Khadem said.

Entrepreneurship, business development, research, media and communications and marketing job functions also grew by more than 10 per cent in 2021 compared with 2020, LinkedIn said.

However, there was a decline in traditional jobs such as accounting, engineering, operations and purchasing, which shrank by more than 10 per cent, the report said.

Women in the UAE workforce

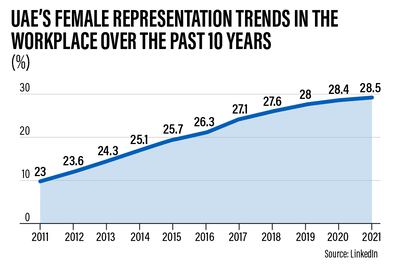

Women now make up a greater share of the UAE workforce, climbing to 29 per cent in 2021 from 23 per cent in 2011. This makes the Emirates one of the top-five most-improved countries in the world in terms of female representation in the workforce, the World Economic Forum’s Global Gender Gap Report 2021 said.

Sectors including public administration, healthcare, education, media and communications, and design improved female representation the most, LinkedIn said.

“Adjusting to hybrid working models in the post-pandemic labour market and offering more flexibility will possibly be a helping factor in attracting and retaining female talent,” the report said.

“More opportunities can be created for women by tapping into an extensive and diverse talent pool using a skills-first approach.”

The UAE ranks first regionally in all digital skills categories, including disruptive digital skills, digital software and hardware skills, and applied digital skills, the report said.

The top digital disruptive skills in demand among employers in the UAE are FinTech, artificial intelligence, robotics and data science, LinkedIn said.

“Moving forward, governments as well as companies will be well-served investing in talent and skills development, particularly in the disruptive areas of AI, machine learning, the Internet of Things, robotics and coding,” Mr El Khadem said.

“Incubating the industries of the future won’t be possible without such extensive investment.”

Increase in sustainability-linked jobs

Meanwhile, Covid-19 has been a catalyst for the green economy. The pandemic has accelerated efforts by both the public and private sectors to support a national green recovery and facilitate the transition to a sustainable economy.

The share of green jobs and those that are shifting to become greener have been increasing in recent years, the report said.

Roles such as sustainability managers and environmental co-ordinators have recorded a steady increase in the UAE over the past five years, LinkedIn said.

The share of remote jobs also tripled in the UAE from April 2020 to December 2021.

“Going forward, companies should rethink pre-conceived notions of how work gets done and use technology and processes to create more resilient work environments,” Mr El Khadem said.

“Employers must replace traditional hiring practices with a skills-first approach. Adopting a skills-first approach will allow organisations to tap into diverse talent pools and fill talent gaps faster.”

Reward and recognition, for example, are now influenced by skills and not only by tenure or the fulfilment of standard benchmarks, the report said.