SoftBank Group’s stock slid as much as 10 per cent on Wednesday after the tech investor’s exit from AI sector leader Nvidia spooked investors already nervous about climbing tech sector valuations.

The Japanese company’s shares touched a one-month low during early morning trading in Tokyo. That was after SoftBank on Tuesday disclosed it had sold its entire stake in Nvidia for $5.83 billion to help bankroll AI investments. The fall came despite better-than-projected quarterly results from SoftBank, which also disclosed a four-for-one stock split.

SoftBank’s Nvidia exit coincides with a growing debate about whether spending by big tech firms like Meta and Alphabet – expected to pass $1 trillion in coming years – will produce commensurate returns.

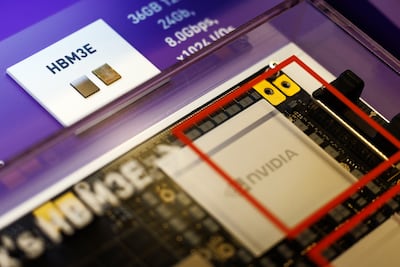

Investors have begun to question the amount of capital pouring into the technology and outsized gains in most of the companies considered front-runners in the AI race. Nvidia’s shares slid as much as 3.9 per cent in US trading, after climbing 48 per cent this year through to Monday’s close.

SoftBank founder Masayoshi Son has been unwinding positions to pay for a plethora of AI projects, including Stargate data centres with OpenAI and Oracle.

“The value of the company fluctuates on the market’s assessment of the value of its investments, so we think the shares are likely to prove to be highly volatile up ahead,” Citigroup analyst Keiichi Yoneshima said in a note. “But with NAV [net asset value] on an expansionary trajectory, we think investors will warm to the shares.”

On Tuesday, SoftBank executives sidestepped questions about whether the industry is fomenting an AI investment bubble, and said the sale had nothing to do with Nvidia itself but was a necessary financing measure.

“I can’t say if we’re in an AI bubble or not,” chief financial officer Yoshimitsu Goto said during an earnings conference. SoftBank sold Nvidia “so that the capital can be utilised for our financing”, he added, without elaborating.

SoftBank has sold its Nvidia stake once before, in 2019. The company resumed buying small stakes in Nvidia in 2020 – two years before the advent of ChatGPT ignited a historic rally. It disclosed that it increased its stake in the US chipmaker to about $3 billion at the end of March. It has done well just on that measure: Nvidia has gained more than $2 trillion of market value since.

That rally, along with its investment in OpenAI, helped prop up SoftBank’s bottom line. The Japanese company reported a surprise net income of 2.5 trillion yen ($16.2 billion) in its fiscal second quarter, far outrunning the average of analyst estimates of 418.2 billion yen.

OpenAI’s value has risen $14.6 billion since SoftBank invested, Mr Goto said.