Investments by sovereign investors globally into funds and companies following environmental, social and governance standards surged by more than three times last year as government investment arms continued to add sustainability-linked assets to their portfolios.

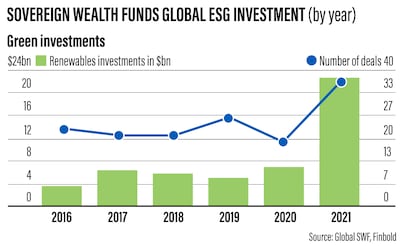

Investments by sovereign wealth funds in the ESG space surged to $22.7 billion at the end of last year from $7.2bn reported in 2020, according to Finbold.com and data from industry tracker Global SWF.

The number of sustainability-linked investment deals at the end of 2021 also rose to 37 from 19 a year earlier.

Investment in companies and funds tracking sustainable stocks and bonds stood at $5.2bn in 2019. It remained relatively low in the past six years before the jump in 2021, with 2016 recording the lowest value over the period at $3.7bn.

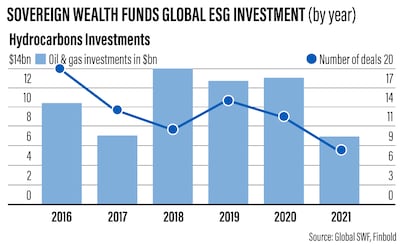

While investments in the ESG space rose, sovereign wealth funds’ capital deployment into oil and gas-related assets declined by 46.92 per cent to $6.9bn, down from $13bn in 2020. Eight oil and gas sector deals were recorded last year, the lowest number of transactions, according to the report.

Sustainable investments and build back better and greener economies have come into sharp focus as the world emerges from the pandemic-driven showdown. It is becoming a central theme for investors who are reshaping their portfolios, cutting down on hydrocarbons investment and seeking yields in greener assets and funds that follow ESG standards.

Sustainability-linked investments are at the heart of the UAE’s sovereign wealth funds’ capital deployments strategies, which are investing tens of billions of dollars domestically across the broader Middle East and North Africa region and elsewhere in the world.

“Like all investors, we are convinced that sustainability is extremely important, which is becoming even more important in the future,” Jean-Paul Villain, director of Abu Dhabi Investment Authority’s strategy and planning department, told the Abu Dhabi Sustainable Finance Forum last year.

Mubadala Investment Company, which bagged the global sovereign wealth fund industry’s top honour and was nominated by Global SWF as the “2021 Fund of the Year”, also lays emphasis on ESG. It is “increasingly material to the performance of our investment both in terms of downside risk and opportunities”, David Crofts, executive director of enterprise risk management and responsible investment at Mubadala Investment Company, said last year.

Saudi Arabia's Public Investment Fund’s governor Yasir Al Rumayyan has also urged the global investment community to capitalise on the "unprecedented opportunity" offered by the Covid-19 pandemic to transform the global economic landscape.

Assets managed by the world’s sovereign wealth funds and public pension funds reached a record high of $31.9 trillion in 2021. Assets held by sovereign wealth funds rose 6 per cent to $10.5tn during the year, while those managed by public pension funds climbed 8.7 per cent to $21.4tn, according to Global SWF's annual report.

Growth of sustainable investing in 2021 indicates that the ESG space has a financial appeal for sovereign wealth funds and can play a crucial role in its growth.

“Last year’s growth indicates that the ESG space has a financial appeal for investors, and SWFs play a crucial role,” Finbold.com cited the latest Global SWF report as saying.

“In general, the SWFs are uniquely positioned to promote the global environmental, ESG agenda and investing in certain products is the first step.”

Like sovereign investors, sustainable investing is also an overriding theme for private and institutional investors and global fund managers. BlackRock, the world’s biggest asset manager, expects sustainability to play an increasing role in how investor portfolios will shape up as ESG becomes an important consideration in investment decisions.

“Sustainable transition has become very central to the way investors are thinking in most regions, whether it is asset managers or the clients we manage money for,” Stephen Cohen, BlackRock’s head of Europe, Middle East and Africa business, told The National in November.

In October, the International Monetary Fund urged the $50tn global investment funds industry to step up efforts to finance the transition to a greener economy and help mitigate the effects of climate change.