Banking start-up Zeta this month became India’s latest company to cross the $1 billion valuation mark, raising $250 million from the SoftBank Vision Fund amid signs that investment flows into the country’s FinTech sector are beginning to recover.

Zeta, which is now valued at $1.45bn, is a platform for banks to operate credit and debit cards, daily transactions, loans and mobile banking through a cloud-based system.

The platform acts as “a bank in a box” for an industry that still uses outdated software, says Bhavin Turakhia, a seasoned entrepreneur and the chief executive of Zeta.

“The simple problem we are addressing is that banking software is still kind of stuck in the stone ages,” says Mr Turakhia, who co-founded Zeta in 2015.

“Banks spend close to probably $300bn a year on information technology infrastructure and IT spending and our role is to try to capture as much of that market for Zeta.”

The start-up is part of India’s fast-growing FinTech sector, which has experienced green shoots of a recovery after the Covid-19 pandemic tightened funding last year, analysts say.

The sector received $2.7bn in funding last year, down from $3.5bn in 2019, according to data from KPMG.

“FinTech has made a strong comeback in 2021,” says Devendra Agrawal, founder and chief executive of Dexter Capital Advisers. “We have seen big funding rounds already.”

Bengaluru-based online payment company Razorpay raised $160m in April from venture capital company Sequoia Capital India and GIC Private, Singapore’s sovereign wealth fund, taking its valuation to $3bn. Credit card rewards company CRED also raised $215m in April from investors including Falcon Edge Capital and Tiger Global.

Meanwhile, one of the biggest names in India’s FinTech sector, Paytm – backed by Alibaba and SoftBank – is working on plans to raise $3bn in what could be the country’s biggest initial public offering if it materialises, according to Bloomberg.

The Covid-19 pandemic has helped to boost the potential and acceptance of many FinTech platforms in India by hastening the shift towards digitalisation, analysts say.

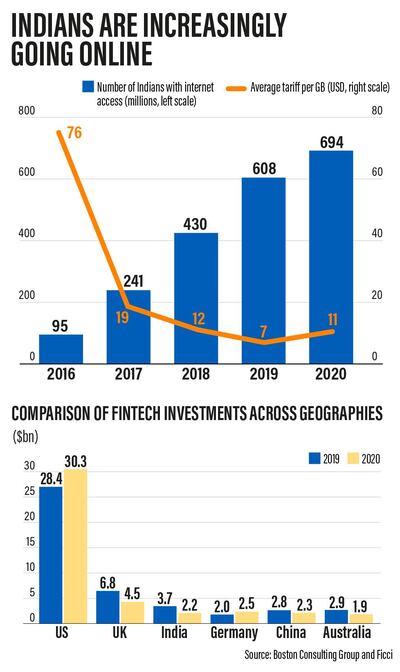

Other favourable trends for the sector include the country’s rapidly growing use of the internet amid expanding smartphone ownership and lower data costs in recent years.

Movement restrictions imposed to curb the spread of the virus have also led to an increase in contactless payments.

“While certain FinTech segments such as lending were negatively affected due to Covid, the pandemic has led to a digital shift in consumer behaviour when it comes to availing financial services,” says Mr Agrawal.

Zeta started meetings to raise funds in January last year but the process was halted because of the pandemic, says Mr Turakhia. The company resumed work on raising funds in November and went to market in January.

“There was already some level of pandemic fatigue and we had a greater reception, spoke to a bunch of funds, narrowed down the top three and signed with SoftBank,” he says.

The value of India's FinTech sector is projected to grow to between $150bn and $160bn by 2025, up from $50bn to $60bn last year, according to a report by the Boston Consulting Group and Ficci. However, the sector will require investment worth $20bn to $25bn over the next five years, the report says.

“There is no doubt that an increasing number of foreign investors are betting on the Indian FinTech industry,” says Raj N, founder and chairman of Indian FinTech company Zaggle. “Moreover, India has evolved into one of the biggest FinTech hubs in Asia.”

Covid-19 has been a “blessing in disguise, with the FinTech industry witnessing unprecedented growth,” and this has also pushed many banks and financial institutions to link up with start-ups, he says.

The FinTech sector’s growth is helped by the fact that India’s financial services remain “underpenetrated, compared to developed countries”, according to Mr Agrawal.

“FinTechs have come up with several innovative products and services – including pay later, online-only insurance, app-based loans within minutes – to cater to this vast untapped market, hitherto ignored by traditional players.”

Investor interest in the FinTech sector started to rebound at the end of last year “when people realised that the pandemic is here to stay and it has triggered tremendous momentum on many digital businesses”, says Shishir Mankad, managing partner and head of financial services at Praxis Global Alliance.

Another factor driving investment into the sector is that companies such as CRED and Zeta are coming up with new and more sophisticated offerings, says Mr Mankad.

“There has been a clear sign of maturity in the FinTech sector. Clearly, the first rush of companies has been discovered and the new stories that are coming out are much more nuanced in their business models.”

Experts expect to see more innovative FinTech companies emerge in India in the coming years.

“While this FinTech revolution is unfolding in India, many of the incumbents [such as] banks and insurance companies have also started to figure out and think through how they should engage with these players,” says Mr Mankad.

However, there are still issues that must be fixed, according to industry insiders, including a pressing need to improve cyber security in the FinTech sector.

“The development of strong and supportive regulatory policies for the FinTech industry is essential to promote the country’s business environment,” says Mr Raj.

Another major challenge for the sector is profit generation.

“The FinTech space in India is certainly at a point – especially for some of the mature businesses such as the payment business – where nobody is questioning whether you can build a large franchise,” says Mr Mankad.

“The question now to be solved is what is the monetisation for this vast customer base and franchise you have built?”

Customer acquisition costs will only reduce as volumes grow, paving the way for profitability and increased scope for businesses to expand in India, according to Utkarsh Sinha, managing director at Mumbai-based Bexley Advisers.

“The Indian FinTech ecosystem continues to be under-tapped, leaving significant room for growth,” he says. “We are still to monetise the largely untapped smaller towns and the advent of 5G will rapidly accelerate their ability to transact online.”

These opportunities “indicate that foreign investor interest in this space should continue”, he says. SoftBank’s recent investment in Zeta should only support this trend.

“We entered 2020 shaky on the news of the poor year SoftBank had in 2019, which chilled both late and early-stage investor sentiments,” says Mr Sinha.

“Now that they are back with a renewed focus on unit economics and that gives confidence to earlier-stage investments.”

Zeta plans to plough the money from its latest funding round into an aggressive expansion.

Its customers include 10 banks, among them HDFC, one of India’s biggest lenders, and 25 FinTechs, including Sodexo, an employee benefits company with about 30 million global users.

About 25 per cent to 30 per cent of capital will go towards adding more products to its platform, says Mr Turakhia.

The rest is earmarked for sales and marketing and a five-fold expansion of its teams in those departments as it aims to ramp up its presence in the Americas, Europe and the Middle East.

There is no better time for expansion as Covid-19 has “definitely has accelerated the receptiveness and the pace at which financial institutions are looking to transform to launch new modern products on a platform such as Zeta”, says Mr Turakhia.