Bahrain, the Arabian Gulf’s smallest oil producer, said on Wednesday it has found up to 20 trillion cubic feet of gas offshore and 80 billion barrels of shale oil, which it hopes to produce in five years with potential help of international oil companies.

Agreement has been reached with Halliburton to commence drilling on two further appraisal wells in 2018, to further evaluate reservoir potential, optimise completions, and initiate long-term production," Sheikh Mohammed bin Khalifa Al Khalifa, Bahrain's Oil Minister, said.

The discovery dwarfs Bahrain’s current proven gas reserves, which stand at around three trillion cubic feet, with production averaging 547 billion cubic feet per day, according to the CIA Factbook. Bahrain’s 80 billion barrels of oil locked in tight reservoirs offshore outsize current proven reserves of 124.6 million barrels, according to figures from the data bank.

"We know oil is there and it is an unconventional resource, you need to do horizontal drilling. It has some advantages, it will produce in quantities that we can make commercial,” the minister said.

He added that it was a challenge to ensure the flow of oil and keep costs down to make the resource attractive to international oil companies.

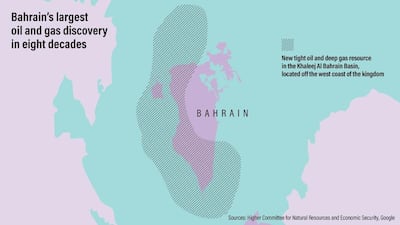

On Sunday, the island kingdom announced the discovery off its west coast, its first find since oil was first struck in 1932. Significant amounts of tight gas onshore beneath the Bahrain Field under pre-Khuff reservoirs has also been discovered.

Much of the island’s oil output comes from the offshore Abu Safah oil field - where production averages 300,000 bpd - which it shares with its larger neighbour Saudi Arabia

Bahrain, which was the first among its GCC peers to discover oil in the 30s, prompting exploration work across the Arabian Peninsula, was also ironically the earliest to suffer from output declines.

__________________

Read more:

Bahrain's largest oil discovery since 1932 'can be game changer'

New oilfield has large amounts of tight gas and oil

__________________

Bahrain’s discovery is one of the largest new finds of hydrocarbons reserves in the Gulf region. The discovery comes as a relief to the kingdom’s debt-saddled economy, where heavy borrowings by the government in recent years is expected to push the public debt to reach 100 per cent of GDP by 2019, according to forecasts by Moody’s Investors Service.

Tendering for work offshore in the 2,000 square kilometre Khaleej Al Bahrain basin off the country's west coast is expected to take time, with the government set to make initial investments to make the acreage attractive to international oil and gas companies, Yahya Al Ansari, exploration director at state-owned Bahrain Petroleum Company told The National.

Bahrain is currently evaluating two bids for the onshore gas find from US oil service companies Halliburton and Schlumberger, with the first drilling set to commence in two months’ time, said Mr Al Ansari.

“We’re targeting service companies to come and joint venture with us, so they invest in developing and producing the gas,” he said.

“The bids are in the evaluation process right now - technically and commercially - and once we select the winning bid, the operation will start immediately.”

Bapco is inviting international oil companies to participate in onshore gas development, after results of the winning bid come through “in a couple of weeks’ time,” he added.

Bahrain’s oil minister said the country was in discussions to bring on more partners to develop the historic Bahrain Field, where the GCC’s first well was first spudded and production currently averages 50,000 bpd.

“We’re always in discussions. We can expect something this year,” he said. Abu Dhabi’s Mubadala Investment Company and Occidental Petroleum exited in 2016 the field, which is currently operated by Bahraini firm Tatweer Petroleum. The potential recovery of high volumes of shale oil could add more refining capacities for Bahrain, which is currently undertaking an $4.2bn expansion of its sole Sitra refinery, said the minister.

Financial closure for the refinery, which will look to boost production capacity from 267,000 bpd to 360,000 bpd is in “process” said Sheikh Mohammed with construction work already underway.

The potential for high volumes of gas output could make discussions for gas linkages with Saudi Arabia more viable, he added.

The country’s upcoming liquefied natural gas import terminal built at a cost of just under $1 billion could function as a backup, to be used during peak summer consumption and leased to support gas requirements in neighbouring states.

“If Bahrain grows its gas consumption, we will need it, and if we could link it up to the GCC, the [LNG] vessel could be chartered. If we don’t need it, the vessel could be leased into the market,” said Sheikh Mohammed.

Bapco would “wait for the right time” to initiate the planned aromatics facility to be build adjacent to the expanded refinery at Sitra in a joint venture with Kuwait’s Petrochemicals Industries Company. He added that design on the scheme had been completed.