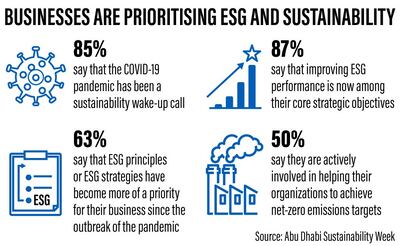

Around 87 per cent of executives polled around the world said that environment, social and governance norms are part of their core objectives following the Covid-19 pandemic, according to a global survey commissioned by Abu Dhabi's Masdar.

Around 525 executives leading businesses with over $250 million revenues were interviewed for the report ESG: Beyond Tipping Point, by Masdar and Abu Dhabi Sustainability Week.

Around 85 per cent of those polled also viewed Covid-19 as a "wake-up call" for sustainability.

"Once the preserve of niche or specialist companies operating in recognisably green or ethical fields, ESG is now mainstream," Masdar chief executive Mohamed Al Ramahi said in the report.

"And, fed by investor pressure and the popularity of purpose-led business strategies, ESG has reached enough of a critical mass that it seems very unlikely that we will be able to retreat to the old profits-above-all models of the past, even if we wanted to."

ESG investments have gained traction after asset manages such as BlackRock began to push for greater adherence to climate action from the companies it invests in.

Meanwhile, a record fall in emissions following the lockdowns to stem the Covid-19 pandemic also proved to be a turning point for investors and consumers to demand greater sustainability from companies.

Nearly 65 per cent of executives hope to see financial benefits from their ESG investments over the next two years, according to the survey.

Thirty-five per cent of those are optimistic their returns will be realised within 12 months.

Geographically, over three-quarters of executives polled in the Asia Pacific are in favour of companies' commitment to targets such as reaching net-zero emission. However, only 33 per cent of those surveyed in the Middle East saw such targets favourably.

"The opportunities presented by the green recovery will further fuel investor appetite for backing smart, sustainable companies. Those companies that ignore ESG will lose their relevance in the post-Covid era," said Yousef Baselaib, executive director, strategy & corporate development at Masdar.