Saudi renewables developer Acwa Power has signed an agreement with South Africa’s Central Energy Fund to co-invest in a 100MW concentrated solar power (CSP) project in the country’s North Cape province.

The Redstone project will move into construction phase later this year and will feature energy storage technology, allowing energy utilisation even after dark. The facility is expected to dispatch around 480,000 megawatt hours (MWh) per year, Acwa Power said in a statement on Friday.

“With capital and operating cost of CSP plants with molten salt storage solution reducing at the same time as demand for cost competitive renewable energy increases in South Africa, our Redstone CSP plant will be able to deliver stable cost competitive electricity supply to more than 210,000 South African homes during peak demand periods which are during the night,” said Acwa Power chief executive Paddy Padmanathan.

The investment will be the first in South Africa for Acwa Power, which has primarily invested in the Middle East and North Africa region, as well as renewables schemes in Jordan. The announcement follows a pledge by Saudi Arabia to invest around $10 billion in the African nation following the visit of President Cyril Ramaphosa to Jeddah on Thursday.

South Africa, which derives much of its power-generation requirements from burning coal is also dependent on oil to meet its energy needs. The biggest supplier of crude to the African nation is Saudi Arabia, which meets around 47 per cent of its requirement. It also relies on imports from Oman, Iraq and the UAE, which accounts for 4.5 per cent of the global crude production.

The UAE also announced plans for $10bn worth of investments into Africa's second biggest economy, official news agency Wam said, without giving further details. President Ramaphosa visited Abu Dhabi on Friday as part of his Middle East tour.

The African nation is looking to change its energy mix and its the fund, in which Acwa Power will become an investor, is a key to that strategy. The fund comprises a consortium of companies dedicated to finding solutions to meet energy requirements of South Africa as well as other countries in the sub-Saharan African region. It is pursuing development of hydrocarbons, biomass, wind as well as the other renewable resources in the region to achieve its objective. The fund also manages the development of oil and gas assets on behalf of the South African government.

__________

Read more

Saudi Arabia’s sovereign wealth fund increases stake in Acwa Power

Saudi Arabia pledges around $10bn investments in South Africa

__________

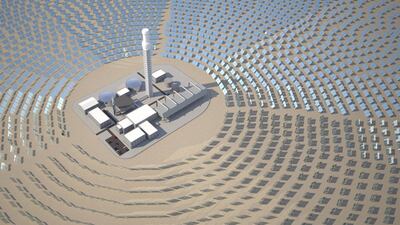

Acwa Power's joint investment in South Africa’s Redstone will see the CSP plant developed using a central salt receiver technology with 12 hours of thermal storage that will allow the facility to generate power during peak-demand periods. The central tower solution for the project, which has also been deployed in Acwa Power’s other CSP project in Shaikh Mohammed bin Rashid Solar Park in Dubai is expected to generate cost efficiencies by more than doubling MWh output of electrical energy per rated megawatt capacity.

Salt-based solutions have become a more popular and relatively inexpensive method to store energy in comparison with other solutions such as photovoltaic or wind-based schemes linked to utility-scale batteries.

Acwa Power chairman Mohammad Abunayyan said the Riyadh-based developer was looking to “explore more opportunities” in South Africa to increase production capacity and lower costs.

Saudi Arabia earlier this month increased its stake in Acwa Power through its sovereign wealth fund, Public Investment Fund, as the world’s largest crude exporter prioritises renewable energy development to free up more barrels to sell in the global oil markets.

Saudi Arabia is expected to tender over 4GW of solar and wind projects as it continues to diversify its economy away from oil. The kingdom last year established a renewables department within the energy ministry, which has largely overseen hydrocarbons, and is expected to tender around $7bn worth of solar and wind schemes this year. Acwa Power has taken a leading role in the alternative power generation sector in Saudi Arabia as well. A consortium led by the company was chosen to develop Saudi Arabia’s first-ever solar plant, a $302 million facility at Sakaka, being developed on independent power producer model.

The developer is also bidding for the kingdom’s first wind project, a 400MW scheme in the northern Dumat Al Jandal region.