Russia’s second-largest oil producer, Lukoil, has agreed to sell the bulk of its international assets to US private equity firm Carlyle Group, a potential deal that would accelerate Moscow’s retreat from key Middle Eastern energy projects, including some of the region’s largest oil and gas developments.

The agreement, if approved, would be a landmark transaction structured to meet the conditions set by the US Office of Foreign Assets Control (Ofac). The deal, announced on Thursday, depends on receiving regulatory approval, including Ofac clearance, and excludes Lukoil’s holdings in Kazakhstan.

Lukoil said the agreement with Carlyle was “not exclusive for the company” and that it was also continuing negotiations “with other potential purchasers”.

Analysts collectively value the assets for sale at around $22 billion. They represent the majority of the company’s international assets and include upstream oil and gasfields, refineries in Bulgaria and Romania, petrol station networks across the Americas and Europe, and stakes in major Middle Eastern oil and gas upstream development projects.

Rachel Ziemba, a senior adviser specialising in sanctions at New York-based consultancy Horizon Engage, said the Carlyle-Lukoil agreement was far from a done deal.

"It doesn't have the US government approval yet and of course no deal will go ahead if Russia gets paid," she said. "There are still other bids in play for parts of the assets."

The UAE's International Holding Company (IHC) previously expressed interest in buying Lukoil's foreign assets. IHC, the UAE's largest company by market capitalisation, told The National in November that it was in talks with Ofac over those international assets. Other bidders include US oil majors Exxon and Chevron, and Hungarian energy company MOL. Ofac previously rejected bids by trading house Gunvor and a consortium led by US bank Xtellus Partners.

Washington has a preference for US companies to be involved in the potential sale of Lukoil assets, Ms Ziemba said.

"But they haven't really signalled what a good deal would be. There are some in the administration who think that holding assets in limbo is leverage," she said.

Money from the asset sale is unlikely to go to Lukoil "any time soon" and any assets would probably be in an escrow account the company would not be able to access, she added.

Lukoil's Middle East assets

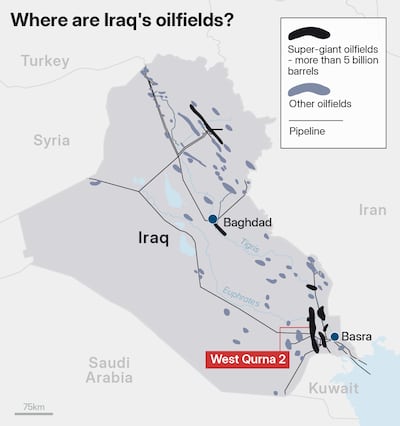

In the Middle East, Lukoil’s most prized holding is its 75 per cent stake in Iraq’s West Qurna-2 oilfield, one of the world’s largest, producing an estimated 460,000 to 480,000 barrels per day, which is about 0.5 per cent of global oil supply, and accounting for nearly 9 per cent of Iraq’s output. It is estimated to hold around 14 billion barrels of oil in reserves.

Iraq’s cabinet this month approved the nationalisation of petroleum operations at West Qurna 2 to prevent production disruption caused by sanctions on Lukoil. State-run Basrah Oil Company has since taken over operations so production can continue at the field in southern Iraq. Iraq's Oil Ministry and the BOC were not available for comment.

The move marked the "unwinding of Russian presence in upstream projects in the Middle East," Amena Bakr, head of Middle East and Opec+ Insights at energy consultancy Kpler, told The National. Adnoc confirmed to The National last month that Lukoil had sold its 10 per cent stake in Abu Dhabi’s Ghasha gas concession.

Francesco Sassi, assistant professor of energy geopolitics at the University of Oslo, said the move would give the US greater leverage in the region as Russia’s role is gradually scaled back.

"Russia’s hydrocarbon diplomacy will inevitably be affected by the sale of Lukoil’s assets in the region, providing the US under the Trump administration with a 'now' source of leverage for implementing its energy and foreign policy in the region," he said.

In November, Lukoil declared force majeure in West Qurna 2 after the company was hit with sanctions alongside Rosneft, as part of US President Donald Trump's push to end the war in Ukraine.

Force majeure refers to an unforeseen set of circumstances preventing a party from fulfilling a contract.

With the exit of Lukoil from Iraq, Exxon is said to be interested in a stake in West Qurna 2. Iraq, Opec's second-largest producer, has plans to raise its output capacity to 6 million bpd by 2029 after years of war, sanctions and underinvestment.

Lukoil firm also holds a 60 per cent interest in Iraq’s Block 10 (Eridu) and a 50 per cent stake in Egypt’s West Esh El Mallaha fields.