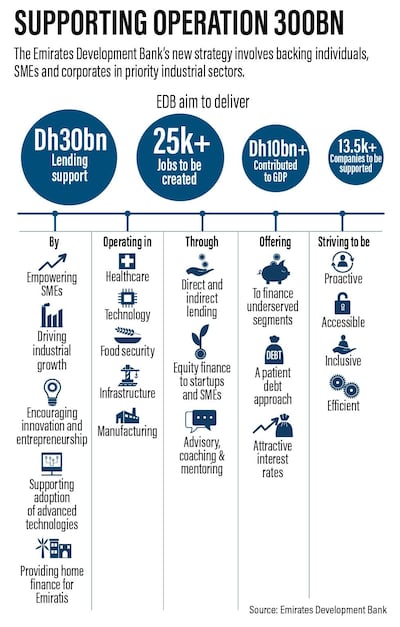

The Emirates Development Bank will provide Dh30 billion ($8.17bn) in financing over the coming five years to support the UAE's efforts to more than double the size of the industrial sector in the coming decade.

The announcement was made on Monday by Sheikh Mohammed bin Rashid, Vice President and Ruler of Dubai.

The funds will help create and back 13,500 new companies in various sectors and generate 25,000 jobs, Sheikh Mohammed said on Twitter as he unveiled the initiative.

In attendance were Deputy Prime Minister and Minister of Interior Sheikh Saif bin Zayed, Deputy Prime Minister and Minister of Presidential Affairs Sheikh Mansour bin Zayed and Minister of Foreign Affairs and International Co-operation Sheikh Abdullah bin Zayed.

The EDB strategy, which is aligned with the Ministry of Industry and Advanced Technology, will fund industries such as health care, infrastructure, food security and technology.

"Advancing the national economy is a top priority that requires a joint effort of all our economic entities in the coming phase,” said Sheikh Mohammed.

“We must adopt a distinctive vision that meets global trends and sustains development to maximise the industrial sector’s revenue and boost the broader economy.”

The EDB is a key driver of the national economy. Through its financial backing, it will support the role played by small and medium enterprises in shaping the UAE's national economy, said Sheikh Mohammed.

Sheikh Mohamed bin Zayed, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the Armed Forces, said on Twitter that the EDB strategy was "an additional ambitious engine for the development of the national economy" and a major supporter of companies and SMEs.

"We are keen to support exceptional initiatives and creative ideas that adopt industry and advanced technology that meets our future development priorities," he said.

Last month, the UAE's leadership announced a new industrial strategy named Operation 300bn that aims to more than double the industrial sector's contribution to the country’s economy.

Overall, Operation 300bn will boost the industrial sector's contribution to Dh300 billion by 2031, from Dh133bn currently.

The initiative is being led by the Ministry of Industry and Advanced Technology.

Dr Sultan Al Jaber, Minister of Industry and Advanced Technology and chairman of EDB, presented the bank’s strategy pillars and objectives on Monday, which are in line with the goals of Industrial Strategy 2021-2031.

"Through close collaboration, the Ministry of Industry and Advanced Technology and the Emirates Development Bank will extend support to large corporations, SMEs and entrepreneurs across various industries including health care, infrastructure, food security and technology,” he said.

The EDB will act as "a critical financial engine" in tandem with its continued mandate to provide Emiratis with housing finance, said Dr Al Jaber.

The Ministry of Industry and Advanced Technology has conducted workshops, met and held discussions with 200 stakeholders in the federal, local and private sectors to help to create its new strategy to boost manufacturing, he added.

The EDB strategy will help to hasten industrial development and the adoption of advanced technology while its funds will support entrepreneurs, start-ups and SMEs, he said.

The lender will seek to spur “innovation, with a focus on the industries our leadership have identified as critical to the nation’s long-term sustainable growth,” he said.

It will also provide supply chain support, project finance, long-term finance, business accelerators, equity capital finance and a business growth support fund.

The EDB will establish partnerships with UAE lenders to extend financial services to small and medium industrial companies and increase its direct financing by 73 per cent in 2021.

It will support priority sectors while also offering extensive financial solutions to underserved sectors.

Entrepreneurs of all nationalities in the UAE and SMEs owned by both citizens and residents can apply for finance, which will take the form of direct and indirect lending, as well as equity finance for start-ups.

The bank will launch a Dh1bn investment fund for start-ups and SMEs in 2022 and focus on industrial companies in critical sectors that need funds and investment.

The EDB has supported 550 companies and provided Dh1.8bn in business loans to SMEs since its inception. It has also provided housing loans worth Dh2.4bn.

As part of the overarching industrial strategy, a Make it in the Emirates campaign will showcase the benefits of being a manufacturer in the country, as well as build a reputation for quality.

Operation 300bn and Make it in the Emirates will boost job creation, stimulate research and development, boost competitiveness and increase self-sufficiency, which will enhance the resilience of the UAE's economy.

The industrial sector's R&D spending will increase to Dh57bn by 2031, more than doubling from Dh21bn. That will increase its contribution to gross domestic product to 2 per cent from 1.3 per cent.

“This announcement is a continuation of the UAE's vision to increase manufacturing’s economic contribution," said Saud Abu Al-Shawareb, Managing Director of Dubai Industrial City.

"As a global industrial hub, we are proud to have contributed to this growth and look forward to seeing this new strategy turbocharge an advanced manufacturing sector that leverages solar power, artificial intelligence, robotics and 3D printing to enhance the UAE’s knowledge and innovation-based economy.”