The UAE was ranked as the third-largest foreign direct investment market globally in terms of project activity in 2023, moving up from fourth position the previous year, as the country continues to boost business with its investor-friendly policies.

The UAE, the Arab world’s second-largest economy, attracted $23 billion of foreign direct investment (FDI) last year in 1,277 projects spanning sectors including business and professional services, software and IT services and financial services, according to the latest report by data and analytics company GlobalData.

The US and Germany were the two biggest FDI markets globally last year.

“The UAE is just one of those places where it's almost a real safe haven for investors, and investors continue to come,” Glenn Barklie, principal economist and head of FDI services at GlobalData, told The National on the sidelines of the AIM Congress in Abu Dhabi on Wednesday.

“In FDI, there's a big domino effect, a couple of companies come in, they're seen as successful, other companies think 'I'm going to come in and get a piece of the pie as well'. He cited increased project activity in Abu Dhabi, adding “and then you have Dubai which is the leading destination city globally and has been since 2021”.

Global companies are boosting their investments in the UAE and setting up offices amid new initiatives from the government including opening up 100 per cent foreign ownership of companies, reduced visa restrictions and incentives for small and medium enterprises.

The country posted record FDI of about $23 billion in 2022. Official figures for last year have yet to be released. It aims to attract Dh550 billion ($149.7 billion) in FDI by 2030, and eventually reach Dh1 trillion by 2051.

The UAE also moved up on Kearney’s 2024 Foreign Direct Investment Confidence Index, jumping from 18th to eighth place as the country focuses on diversifying the economy away from oil.

“You can look at the UAE strategy with innovation at its core for a long time, attracting the right companies and building clusters,” Eleanor Slinger, regional director of Middle East and Africa at GlobaData Marketing Solutions, said.

“The UAE government is signing and setting up G2G (government to government) relationships, through Cepas (comprehensive economic partnership agreements), MoUs (memorandums of understanding), free trade agreements – that’s something they’ve done aggressively in the last few years and that’s paying dividends now.”

The UAE aims to boost non-oil foreign trade to more than Dh4 trillion by 2031. It has signed Cepas with India, Indonesia, Turkey and Israel, among others.

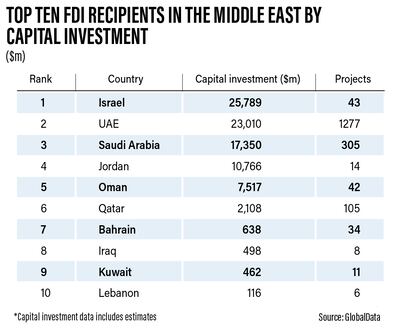

In the Middle East region, the Emirates continued to maintain a leading position with the number of FDI projects, and was ranked second in capital investment flows after Israel, which attracted $25 billion worth of investment from Intel for a chip plant in the country last year.

Excluding Intel's investment, Israel received about $789 million in inbound investment, ranking it as the fifth-largest regional destination.

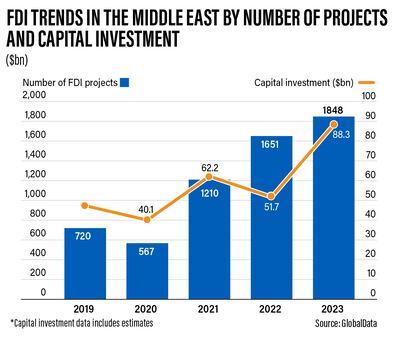

The total FDI in the Middle East grew in 2023, according to the latest GlobalData report. Project numbers rose 11.9 per cent annually to 1,848, while inbound capital investment surged 70.8 per cent to $88.3 billion.

Saudi Arabia was the region's second-largest destination country based on project activity, attracting inward investment of $17.3 billion from 305 FDI projects.

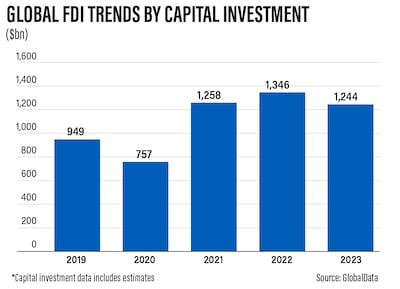

Globally, however, both capital investment and the number of projects declined amid continued geopolitical tensions and high interest rates.

Capital investment fell to $1.24 trillion in 2023 from $1.34 trillion during the previous year, while the number of projects declined to 17,714 from 20,675 in 2022.

“We’ve seen a downward trend and FDI in 2023,” Mr Barklie said. “Geopolitical [events], shaky macro economic environment, all those types of things – although they happened in 2022, we started to see the real impact of them in 2023 on a global scale.

“The Middle East was one of pretty much the only regions to buck that downward trend,” he said, adding that investors turn towards locations where they feel safer “whenever there are a lot of risks associated”.

“They want an environment that's business-friendly. They want to see a country or domestic market that's growing, and the UAE and Saudi Arabia are the two key growth countries that are really driving the overall trend into the Middle East.”

Saudi Arabia, Opec's largest producer, is radically transforming its economy to cut its dependence on hydrocarbon revenues. It has announced new projects in tourism and other sectors to attract more foreign investment.

The kingdom is also vying for regional leadership in advanced technology, with hopes of creating data centres, AI companies and semiconductor manufacturing.

It is looking to bolster partnerships with the US and would divest from China if asked to do so by America in technology sectors, Amit Midha, the chief executive of investment firm Alat, told Bloomberg on Wednesday. Alat is backed by $100 billion in capital from the Public Investment Fund.

“So far the requests have been to keep manufacturing and supply chains completely separate, but if the partnerships with China would become a problem for the US, we will divest,” said Mr Midha.

The US is investing heavily in the Middle East and was the leading source market for FDI in the region by both capital investment and the number of projects, according to GlobalData.

US companies announced 362 projects in the region worth $36 billion in 2023. The US was followed by Ireland with investments of $9.9 billion and Denmark with $7.6 billion.

Business and professional services, software and IT services, financial services, tourism, logistics, construction and real estate were among sectors that attracted foreign investment in the Middle East.