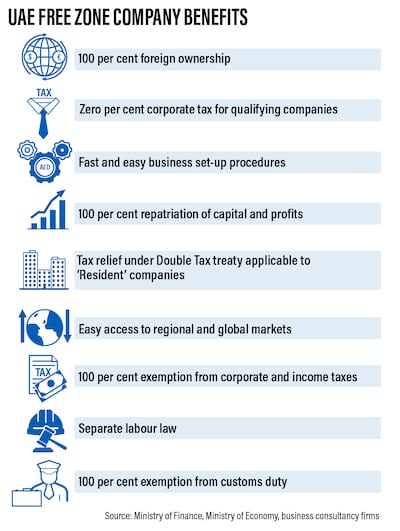

UAE free zone companies enjoy a host of benefits including easier access to regional and global markets, 100 per cent exemption from customs duty charges, and simplified procedures for setting up businesses, among other advantages.

These UAE businesses also reap the rewards of some of the world's lowest corporate tax rates - 9 per cent - if they have to pay them at all.

Companies doing businesses in more than 45 free zones in the Emirates have long enjoyed zero tax rates and full foreign ownership.

The National takes a closer look at the corporate tax law for free zone companies and what it means for those businesses.

Benefits and incentives

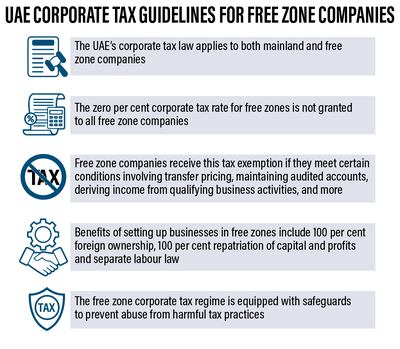

The UAE’s corporate tax regime continues to offer a zero per cent corporate tax rate for free zone (FZ) companies.

Qualifying FZ companies (also called Qualifying Free Zone Persons or QFZP) in the tax-free environment can benefit from a preferential zero per cent corporate tax rate on their income from qualifying activities and transactions, according to the Ministry of Finance.

They also enjoy a separate labour law and a 100 per cent repatriation of capital and profits, in addition to other measures that enable smoother business practice.

Designated zone businesses in the UAE, a type of freezone company, have a $1.4 million revenue allowance for non-distribution activity, zero per cent withholding tax on all domestic and cross-border payments, and also have access to an extensive double tax agreement network that extends to more than 100 countries.

A QFZP meets all the conditions of the corporate tax regime and hence benefits from that regime.

An FZP is a legal entity or juridical person that is incorporated or established under the rules and regulations of a free zone, or a branch of a mainland UAE or foreign legal entity registered in an FZ.

Thomas Vanhee, a partner at Aurifer, a Dubai-based tax consultancy firm, told The National that the preferential regime applies to FZ companies and branches that meet the following conditions:

• Maintain adequate substance in the FZ (in form of adequate assets, employees and operating expenditure);

• Derive qualifying income from relevant transactions that are not excluded or non-qualifying business activities;

• Do not elect to be a subject to corporate tax;

• Comply with the arm’s length transfer pricing rules;

• Satisfy the de minimis requirement; and

• Prepare and maintain audited financial statements.

An FZP that fails to meet any of the conditions above at any particular time during a tax period shall cease to be a QFZP from the beginning of that tax period and will be taxed at the standard corporate tax rate for five tax periods starting with the tax period in which the conditions have not been met, he added.

The Ministry of Finance has laid out a detailed list of qualifying activities and excluded activities.

In November, the UAE announced Cabinet Decision No 100 of 2023 and Ministerial Decision No 265 of 2023, which expanded the definition of qualifying income to cover revenue generated from owning or utilising qualifying intellectual property.

Not every intellectual property is eligible for zero per cent tax rate though, according to tax consultants.

“The concession given in the Cabinet Decision No 100 of 2023 is limited to ‘qualifying intellectual property’ comprising patents, copyrighted software, or any other property or right that is subject to similar approval and registration process as a patent,” Sadia Nazeer, UAE business tax partner, Deloitte Middle East, said.

This does not include marketing related intellectual property assets such as trademarks.

The ministerial decision of November also included trading of qualifying commodities as an eligible activity for corporate tax.

UAE free zone corporate tax regime, therefore, is "not akin to a general exemption for companies incorporated in free zones as appears to be the general perception", said Ms Nazeer.

There are qualified activities in specified sectors that FZ companies can conduct with onshore entities without exposing themselves to corporate tax.

If an FZ company meets all the conditions of a QFZP, “then any income derived from mainland or non-UAE companies will not taint the zero per cent relief, to the extent it is earned from specified qualifying activities or it is within the de minimis threshold (ie, lower of 5 per cent of annual turnover or Dh5 million)", Mr Vanhee said.

Under the de minimis requirements, a QFZP can continue to benefit from the FZ corporate tax regime where its revenue from non-qualifying transactions and activities in a tax period do not exceed five per cent of total revenue or Dh5 million, whichever is lower.

Are tax provisions different?

The provisions under the corporate tax law as applicable for mainland companies equally apply to FZ companies. However, there do exist "certain smaller nuances/differences in the corporate tax requirements for FZ companies that qualify for preferential rate of zero per cent vis-à-vis the mainland companies", Mr Vanhee added.

For instance, the FZ companies, to be eligible for preferential rate of zero per cent need to maintain audited financial statement, whereas the mainland companies are required to maintain audited financial statements only if their annual revenue exceed Dh50 million.

Further, unlike ordinary mainland companies, the QFZP is not entitled to a zero per cent rate on its first Dh375,000 of taxable income that is not qualifying income, he added.

How the UAE compares globally

A standard corporate tax rate of 9 per cent for companies in the UAE is much lower when compared with other financial centres and developed economies globally.

In Europe, for instance, Portugal had the highest combined corporate income tax rate in 2023, reaching 31.5 per cent, and was followed by Germany with a rate of 29.94 per cent. On the other hand, Hungary had the lowest combined corporate income tax rate, reaching just 9 per cent in 2023, according to Statista.

The UAE’s free zone corporate tax regime “has built-in safeguards to prevent its abuse from harmful tax practices, and that has been acknowledged recently by the Organisation for Economic Co-operation and Development", said Ms Nazeer.

Other jurisdictions usually have special economic zones (SEZ) to promote specific industries or to uplift a certain geographical area, and the concessions given to such zones vary on a case-to-case basis.

In other countries, "most SEZ are granted a fixed period of tax holidays (say 10 years) as a fiscal incentive generally during their initial set-up years", according to Priyanka Naik, senior counsel, Aurifer.

“Such incentives may not always be linked directly with the type of transactions undertaken by the SEZ companies, and could be covered broadly under the condition of conducting eligible business activities as per the SEZ regulations,” Ms Naik said.

In the UAE, on the other hand, given the broad presence of different FZ regulations and practices, the corporate tax relief is “uniquely conditionally linked with the type of revenue and business activities conducted by such free zone which could be complicated for business to comply and monitor”, she added.