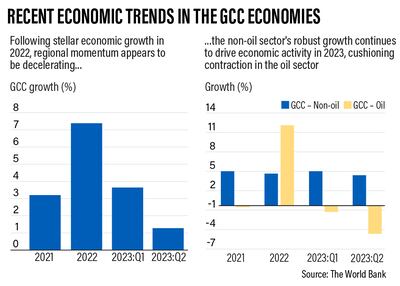

The economic growth momentum in the GCC is set to pick up pace in the next two years as the countries continue with their diversification efforts.

The region is forecast to grow by 1 per cent in 2023 before rebounding to 3.6 per cent and 3.7 per cent in 2024 and 2025, respectively, the World Bank said in a report on Wednesday.

The non-oil sector in the region is projected to grow by 3.9 per cent in 2023 and 3.4 per cent in the medium term “supported by sustained private consumption, strategic fixed investments, and accommodative fiscal policy”, the Washington-based lender said in its economic update for the region.

However, the oil economy is expected to contract by 3.9 per cent amid output cuts by Opec+ member countries and the global economic slowdown caused by tightening monetary policy and geopolitical concerns.

“To maintain this positive trajectory, GCC countries must continue to exercise prudent macroeconomic management, stay committed to structural reforms, and focus on increasing non-oil exports,” said Safaa El-Kogali, the World Bank's country director for the GCC.

“However, it is important to acknowledge the downside risks that persist. The current conflict in the Middle East poses significant risks to the region and the GCC outlook, especially if it extends or involves other regional players. As a result, global oil markets are already witnessing higher volatility.”

The Israel-Gaza conflict, in its seventh week, continues to raise concerns about global economic growth if it is not contained.

More than 14,000 people have been killed in Gaza since the war started on October 7, while diplomatic efforts continue to end the hostilities in the region.

Oil prices rose following the start of the conflict, but fell in the subsequent weeks on rising demand concerns amid the tightening of the monetary policy by the central banks.

The latest World Bank report said the diversification efforts in the GCC region are paying off but more reforms are needed.

“The region has shown notable improvements in the performance of the non-oil sectors despite the downturn in oil production during most of 2023,” said Khaled Alhmoud, senior economist at the World Bank.

“Diversification, and the development of non-oil sectors, has a positive impact on the creation of employment opportunities across sectors and geographic regions within the GCC.”

GCC countries, especially Saudi Arabia and the UAE – the region’s two largest economies – are continuing to focus on diversification of their economies with new projects and initiatives.

The UAE economy is expected to grow 3.4 per cent in 2023 with oil GDP growth projected at 0.7 per cent and non-oil GDP at 4.5 per cent, backed by a strong performance in tourism, real estate, construction, transportation, manufacturing and a surge in capital expenditure, according to the World Bank.

The Emirates' non-oil economy continues to grow amid its diversification push. Business activity in the UAE's non-oil private sector economy hit its highest level in more than four years in October, driven by a sharp rise in new orders and output, latest data shows.

The UAE economy expanded by 3.7 per cent annually in the first half of the year, Minister of Economy Abdulla bin Touq said last month.

Saudi Arabia is building the $500 billion Neom project along the Red Sea coast that is expected to boost the kingdom's tourism and real estate sector. It is also developing new entertainment projects including Qiddiya in Riyadh as it pushes to reduce its reliance on oil and create more jobs as part of the Vision 2030 programme.

The kingdom's non-oil economy grew at its fastest pace in four months in October due to higher client orders and improving economic conditions.

The headline Riyad Bank purchasing managers' index reading climbed to 58.4 in October, up from 57.2 in September, the highest level since June.

Saudi Arabia’s gross domestic product is expected to contract by 0.5 per cent this year before rebounding to 4.1 per cent in 2024, according to the World Bank. The oil sector is expected to contract by 8.4 per cent this year amid production cuts by Opec+, while the non-oil sector is expected to grow at 4.3 per cent.

The World Bank said the Saudi private sector workforce has grown steadily, reaching 2.6 million in early 2023, with women’s participation in the labour market more than doubling in six years, from 17.4 per cent in early 2017 to 36 per cent in the first quarter of 2023.

“This positive development was a result of an effective reform drive, started by the kingdom’s Vision 2030, that made it significantly easier for more women to join the workforce,” the lender said.

Bahrain’s economy, meanwhile, is estimated to grow 2.8 per cent in 2023, while Kuwait, Qatar and Oman are projected to grow 0.8 per cent, 2.8 per cent and 1.4 per cent, respectively, according to the World Bank.