The wildfires ravaging Southern Europe and North Africa are set to adversely affect the local economies, particularly the tourism and agriculture sectors, and serve as a bellwether of what may come if climate change is not addressed.

Firefighters were tackling more than 100 blazes across Greece as of Wednesday, with hundreds of thousands evacuated as fires destroyed homes and businesses across islands as far apart as Rhodes in the Aegean and Corfu in the Ionian Sea.

Meanwhile, Algeria said on Wednesday it had contained deadly wildfires which have killed at least 34 people and displaced more than 1,000 others.

Other countries, including Italy, Spain and Tunisia are also battling blazes as temperatures continue to soar.

“The extreme weather – an increasingly frequent occurrence in our warming climate – is having a major impact on human health, ecosystems, economies, agriculture, energy and water supplies,” Petteri Taalas, secretary-general of the World Meteorological Organisation, said on Tuesday.

“This underlines the increasing urgency of cutting greenhouse gas emissions as quickly and as deeply as possible. In addition, we have to step up efforts to help society adapt to what is unfortunately becoming the new normal.”

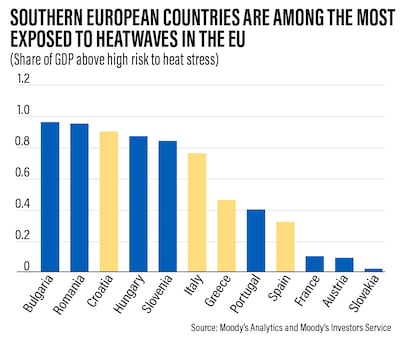

Southern Europe's heatwave will bring challenges and costs as the severity increases, Moody’s Ratings agency said in a report this week.

The heatwaves may reduce the region's attractiveness to tourists in the longer term or “at the very least reduce demand in summer”, which will have negative economic consequences, it said.

For Greece alone, the travel and tourism sector’s gross domestic product contribution last year grew by more than 38 per cent to reach nearly €38 billion ($42 billion), representing 18.5 per cent of its economy, according to the World Travel and Tourism Council.

The sector also created 5,000 more jobs, compared to the previous year, to reach almost 800,000 jobs nationally.

However, Greek Environment and Energy Minister Theodoros Skylakakis said only a “very small” number of tourists were affected by the fires.

“The tourist industry as a whole is handling this issue. It [has] not affected massively our tourism industry until now,” he told Bloomberg TV on Tuesday.

Agriculture plays a small role in most of the affected countries' economies and the current heatwave is likely to have relatively limited economic implications, although it could affect food prices, Moody’s said.

Greece has the largest agriculture sector, accounting for 4.5 per cent of gross value added and 10.9 per cent of employment in 2022.

“However, the countries are major suppliers of olives, grapes, grains and fruits, and production shortfalls will pressure food prices: in 2022, high temperatures reduced EU cereal harvest by 10.2 per cent relative to the last five years,” the report said.

From an energy perspective, gas prices on the Dutch Title Transfer Facility gas futures, the benchmark European contract, are up 20 per cent week-on-week to around $10.7 per million British thermal units (MMBtu) as of July 25 due to heatwaves in Italy, Greece, and Spain, Rystad Energy’s senior analyst Masanori Odaka said in a note on Wednesday.

Electricity generation, particularly hydropower, is also adversely affected by heat and drought at a time when air conditioning usage increases energy demand, Moody's said.

Among the European countries, Croatia and Italy are the most reliant on hydropower in their energy mix, with hydropower comprising 49 per cent of electricity production in Croatia and 17 per cent in Italy.

“However, because reservoir levels in both countries are much higher than this time last year following heavy rainfall in the spring, we expect energy supply will be sufficient,” Moody's said.

“While economic and fiscal costs remain manageable in the short term, the expected increase in the number, intensity and duration of extreme climate events in the coming years will have longer-term credit-negative effects,” the report added.

The EU estimates that wildfire damage in 2022 cost at least €2 billion and this year the bloc doubled the size of the standby firefighting fleet it finances.

“Adaptation measures to strengthen resilience to extreme weather-related events will require significant but manageable public expenditure,” Moody’s said.

According to the European Commission, in order to limit the global temperatures rise to 1.5°C above pre-industrial levels, adaptation investments will be around €40 billion per year, or about 0.3 per cent of the EU’s GDP.

If global average temperatures rise by around 1.5°C above pre-industrial levels, the EC estimates that debt ratios would be 4.5 percentage points higher in Spain by 2032, 2.6 percentage points higher in Greece and 2.2 percentage points higher in Italy, mainly as a result of the economic and fiscal costs of extreme climate events.

In a scenario where global average temperatures rise by 2°C, it estimates that debt ratios would increase by an additional 0.4 percentage points on average.

Climate change also poses a potential threat to the financial system through the physical risks, transition risks or liability risks, the European Central Bank said in a March report.

“These risks are distinct from each other, and they affect different financial institutions in different ways. Physical risk stems from the uncertain economic and financial costs due to the gradual rise in temperatures and more frequent and severe weather disasters, such as floods, droughts and wildfires.

“These events disrupt local economic activity and erode asset values, potentially resulting in economic and financial losses for businesses and households,” it said.

Wildfires cause more than just direct damage to life and property: smoke exposure can decrease labour income, employment and labour force participation, according to a report by Stanford’s Institute for Economic Policy Research.

Wildfire smoke reduced earnings in the US by an average of $125 billion a year between 2007 and 2019, the report published in December showed.