The Central Bank of Turkey nearly doubled its benchmark interest on Thursday, the first increase in two years, with the move reversing the country's monetary policy in a bid to fight spiralling inflation.

The Monetary Policy Committee raised its policy rate, the one-week repo auction rate, by 650 basis points to 15 per cent, from 8.5 per cent, the central bank said.

“The committee decided to begin the monetary tightening process in order to establish the disinflation course as soon as possible, to anchor inflation expectations and to control the deterioration in pricing behaviour,” it said.

The committee includes Central Bank Governor Hafize Gaye Erkan, Taha Cakmak, Mustafa Duman, Elif Haykır Hobikoglu, Emrah Sener.

“While inflation in the world has been declining, it remains well above the long-term averages. As a result, central banks across the globe continue to take measures to reduce inflation.”

This is the first policy meeting under Ms Erkan, who was appointed as Governor by Turkish President Recep Tayyip Erdogan on June 9.

Turkey’s central bank rate increase was below the median 20 per cent estimate in a Bloomberg survey.

Craig Erlam, a senior market analyst at Oanda, said a rate increase was widely expected “but the range of forecasts was vast and, if anything, the 6.5 per cent hike was at the lower end of the range”.

“Turkey faces many problems going forward as a result of the misguided policies over the last couple of years and that will likely warrant more aggressive tightening in the future,” he said.

“For now, investors may be mildly relieved that rates are heading in the right direction, if not fast enough.”

Turkey’s lira dropped to a record low after the rate increase, which was smaller than expected, according to Bloomberg data. The currency slipped 2.6 per cent to 24.20 against the US dollar at 2.35pm in Istanbul.

In his victory speech in May, Mr Erdogan acknowledged that inflation was the most urgent issue for the country.

The Turkish currency has been under severe pressure since Mr Erdogan began to enforce unorthodox economic monetary policies in 2018.

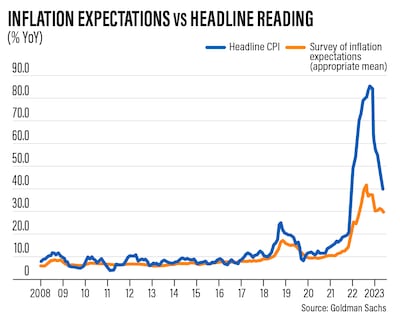

While inflation has been decelerating from a 24-year high of 85.5 per cent in October, it still remains elevated.

The annual headline reading was 39.6 per cent in May, after hitting 43.7 per cent in April. Goldman Sachs forecasts average annual inflation of 40.1 per cent for 2023, below consensus expectations of 45.9 per cent.

The interest rate increase by the central bank "represents the start of the return to economic policy orthodoxy" said Hasnain Malik, a strategist at Tellimer in Dubai.

"The change in policy direction is, of course, positive and, better than expected prior to the election, but not only is the shift more gradual than some short-term investors might have hoped for but those longer-termists considering a revisit of Turkish assets should have eyes wide open to the risks to the durability of this change in direction."

Turkey has faced intensifying external, monetary, fiscal and banking system pressures, with its currency plunging about 20 per cent this year and eating away at its foreign currency reserves.

A devastating earthquake in February piled on the pressure, with the damage estimated at more than $100 billion. Reconstruction and recovery costs may exceed $68 billion as a result of the disaster, according to the World Bank.

“In our country, recent indicators point to an increase in the underlying trend of inflation,” Turkey's Central Bank said on Thursday.

“The strong course of domestic demand, cost pressures and the stickiness of services inflation have been the main drivers. In addition to these factors, the committee anticipates that the deterioration in pricing behaviour will put further pressure on inflation.”

The regulator said the committee would determine the policy rate “in a way that will create monetary and financial conditions necessary to ensure a decline in the underlying trend of inflation and to reach the 5 per cent inflation target in the medium term”.

It said monetary tightening would be “further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved”.

The central bank said it would closely monitor inflation indicators and underlying trends, as well as “continue to decisively use all the tools at its disposal” to restore price stability.

It intends to continue supporting strategic investments that will improve the current account balance.

In March, Saudi Arabia deposited $5 billion with the Central Bank of Turkey through the Saudi Fund for Development and in 2021, the UAE formed a $10 billion fund to support investments in the country.

Last month, the UAE and Turkey ratified a comprehensive economic partnership agreement signed earlier this year, which will help to push their non-oil trade beyond $40 billion in the next five years.

“The Turkish Central Bank will have to regain its credibility that has been shattered [and] repeat a similar operation in the next few meetings to bring the Turkish rates to where they should be in accordance with the economic fundamentals, and not where the government wants them to be,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

And “if all goes well, get rid of the expensive and ineffective side measures – like FX [foreign currency] interventions and FX protected savings – that served to keep the lira afloat while the monetary policy was no longer” she said.