India's economy is turning a corner and looks set for a strong rebound this year, helped by a pick-up in the pace of Covid-19 vaccinations and a progressive drop in new infections.

However, Asia's third-largest economy is not yet on the home straight and risks including inflation can hamper the recovery, analysts say.

“Given a faster ramp-up in vaccinations and opening of the economy, a rebound in economic momentum is quite visible,” Binod Modi, head of strategy at Mumbai-based Reliance Securities, says.

“In our view, India is set to witness healthy economic growth [this year].”

The economy took a massive battering last year as the country of 1.3 billion people imposed one of the strictest Covid-19 lockdowns in the world.

Many restrictions were reimposed this year, as India went through a deadly second wave of the pandemic. At its peak in May, the country recorded more than 400,000 cases a day, health ministry figures show.

The country's gross domestic product shrank 7.3 per cent in the financial year to the end of March, a major setback for the developing economy.

India needs to achieve annual GDP growth of 8 per cent or more to lift people out of poverty and create enough jobs for its large, young population.

In recent months, the government has removed most Covid-related restrictions.

New coronavirus cases have been averaging about 10,000 a day in the past week.

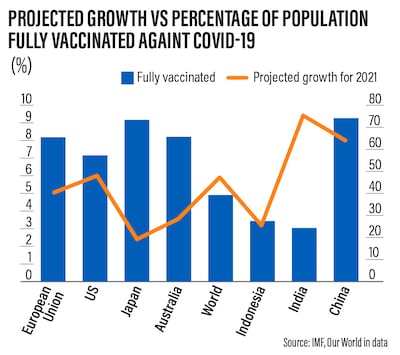

The majority of the eligible population has received at least a first dose of a Covid-19 vaccine, which is driving optimism for a steep economic rebound.

“There is light at the end of the tunnel,” Luis Breuer, the International Monetary Fund's senior resident representative to India, said in a podcast earlier in November.

The IMF forecasts that India's GDP will grow 9.5 per cent in the current financial year and 8.5 per cent the following year.

“Granted it is from a low base, but the economy is recovering,” Mr Breuer says.

In its November 15 report, the Reserve Bank of India said that the country's job market is rebounding and “overall economic activity is on the cusp of a strengthening revival”.

However, “the global economic outlook remains shrouded in uncertainty with headwinds from multiple fronts”, it warned.

“In India, the recovery gained strength though the speed and pace of improvement remains uneven across different sectors of the economy,” the RBI said. “Indicators of aggregate demand posit a brighter near-term outlook than before”.

Business owners are optimistic about the economic rebound and expect the momentum to continue as spending improves.

“The economy is getting back to normal quite fast, primarily because of consumer spending,” says Rohit Gawli, chief executive and co-founder of The Lokal Kitchen, a Mumbai-based food technology company.

The pandemic was “tumultuous” for most businesses in India, Rasesh Seth, founder and managing partner at Nextyn, a management consulting firm, says.

Several of the company's projects were put on hold but are back on track.

“Business activity for us came back to pre-Covid levels in the middle of 2021, and now we're seeing consistent double-digit growth of about 12 to 15 per cent, as most of the business community is vaccinated and eligible to resume office as well as business travel,” says Mr Seth.

The recent economic data also points to accelerating growth momentum as the pace of vaccination improves.

India's exports increased 43 per cent annually to $35.65 billion in October, the latest statistics released on Monday showed.

The country's manufacturing sector has expanded for four consecutive months, according to IHS Markit Purchasing Managers' Index.

Foreign direct investment is also growing, up 62 per cent to $27bn in the April to July period. Indian tech start-ups, including food delivery app Zomato and digital payments company PayTM that listed on the stock exchanges this year, were among beneficiaries of FDI.

“Coincidentally, the time Indian start-ups started getting listed on Indian exchanges is when Chinese start-ups came under their regulatory overhaul and [global] investors started fleeing from China", says Tanushree Banerjee, co-head of research at Equitymaster. “So a lot of that money has come to India.”

Mr Seth said the pick-up in investment is among the factors that are making him “very bullish on the Indian economy”.

“We are seeing more and more foreign investment come into the start-up economy, which shows that the world is bullish about India's growth too.”

But analysts and business leaders are also sounding caution over looming risks including a third wave of Covid infections and headwinds from the wider global economy. The biggest and most immediate concern for business in India is inflation.

head of strategy, Reliance Securities

Higher crude oil prices globally have pushed fuel prices to record highs in India in recent weeks. The country imports most of its oil and, as well as weighing on its trade deficit, it has fed into inflation. Data released last week showed that wholesale price inflation has hit a five-month high of 12.54 per cent in October.

There has been some relief with tax cuts on petrol and diesel from the government this month, although fuel prices still remain "uncomfortably high".

Rising prices “are posing a challenge to the small businesses to operate as they impact their costs of production and ... margins”, says Pradeep Multani, president of the Delhi-based PHD Chamber of Commerce and Industry. Small businesses were among those most affected by the pandemic.

“Prices are significantly increasing the input costs of the industry and reducing its competitiveness in the domestic and international markets. The shortages of raw materials are [also] impacting the production and anticipated sales volumes.”

However, despite challenges, Mr Multani is upbeat about the state of the country's economy.

“The uptrend in the main economic and business indicators in the recent months shows that the economic recovery is strengthening," he says, adding that a rapid progress in vaccinations, festive season and resultant increase in "consumer and industry sentiments" has also underpinned the rebound.

Economic reforms instituted by the government have also contributed to the country's economic recovery.

“Reform measures by the government in various industries like manufacturing – in the form of production linked incentive schemes – infrastructure, telecom among others, have started yielding results and supporting economic activities,” says Reliance Securities' Mr Modi.

However, one of the biggest reforms under the Narendra Modi government, involving three agriculture laws passed last year, was scrapped on Friday following a year of protests by farmers.

The government had insisted that the laws – aimed at deregulating the sector and allowing farmers to sell directly to corporates beyond the state-run wholesale markets – would iron out the inefficiencies and wastage rampant in agriculture and improve profitability for growers.

However, farmers were concerned that corporates would offer them lower rates than the guaranteed prices they currently secure from the wholesale markets.

Experts had widely expected the now repealed laws to bring in much-needed private investment into the country's agriculture sector, which accounts for about 15 per cent of its GDP.

Despite such setbacks, for now, optimism abounds in India as its economic recovery gathers pace.