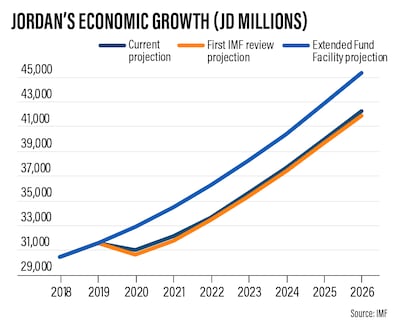

Jordan's economy is forecast to grow 2 per cent this year as the gradual return of tourists, Covid-19 vaccination efforts and rising global demand support a rebound in the second half of 2021, the International Monetary Fund said.

The forecast is little changed from 2020 and slightly lower than earlier projections of 2.5 per cent after a slow start to vaccination campaigns, weaker balance sheets and tourism sector challenges weighed on domestic demand in the first half, the fund said.

Growth is expected to reach about 3 per cent in the medium term, supported by structural reforms.

Jordanian authorities have taken "timely and well targeted" measures to soften the pandemic's blow, save lives and protect jobs and the livelihood of vulnerable groups, said Mitsuhiro Furusawa, the fund's deputy managing director and acting chairman.

However, successive Covid-19 waves and a "sharp decline" in tourism had a "significant" human and economic toll, with unemployment hitting a record high while the recovery was delayed, he said.

"Notwithstanding these challenges, the authorities have successfully maintained macroeconomic stability, notably by meeting all key fiscal and reserve targets, and made very strong progress on a large number of critical structural reforms," Mr Furusawa said.

"Moreover, Jordan’s vaccination programme, one of the first in the world to cover refugees, has recently accelerated.”

The comments came after the Washington-based lender concluded its second review of Jordan's economic reform programme under its Extended Fund Facility, or EFF.

After the review, the IMF released about $206 million under the EFF arrangement, bringing its total disbursements to Jordan since the start of 2020 to about $900m.

The fund's executive board also approved Jordan’s request to increase the amount of EFF funds available to it by about $200m.

It approved a four-year, $1.3 billion loan programme for Jordan, equal to 270 per cent of the country’s quota within the fund, on March 25, 2020.

The kingdom, which relies on foreign aid and grants to finance its fiscal and current account needs, is trying to overhaul its economy and cut state subsidies as public debt and unemployment rise.

It is also looking to boost oil production and expand its non-oil economy. However, a large number of Syrian refugees and the Covid-19 outbreak have deepened its economic and fiscal woes.

Jordan had 792,278 cases, 10,338 deaths and 769,192 recoveries as of Thursday, according to Worldometer, which tracks the pandemic.

“In the near term, the priority remains to manage the fallout from the pandemic," said Mr Furusawa.

"Thus, the revised fiscal targets for 2021 appropriately aim to accommodate higher spending on critical health, social protection and job-supporting schemes."

Jordanian authorities are committed to bringing about a gradual, growth-friendly and equitable fiscal consolidation as the recovery becomes entrenched, as part of efforts to bolster public debt sustainability and ensure inclusive growth, he said.

To this end, they have advanced key reforms to close tax loopholes, broaden the tax base and strengthen tax administration capacity, the IMF official said.

"Continued high-quality reforms to enhance the efficiency and transparency of public finances will also be important."

Looking ahead, Jordan's monetary policy needs to remain flexible and data driven, balancing the need to solidify the recovery and maintain financial stability, the fund said.

While Jordan's financial sector remains sound, "continued vigilance is warranted", given that it will probably take time for the full effects of the pandemic to be reflected in the asset quality of banks, Mr Furusawa said.

The country's public debt, which stood at 88 per cent of gross domestic product at the end of 2020, is projected to peak at 91 per cent of GDP in 2021, before declining to below 80 per cent of GDP by 2025, the IMF said.

A full recovery of the country’s tourism sector is not expected before 2023, the fund said.

Jordan’s current account deficit is projected to widen further to 8.3 per cent of GDP this year as the weak trends in tourism reported in late 2020 persist.

The country must continue to make progress on structural reforms to ensure a "durable and inclusive" recovery, the fund said.

Reforms in the power sector, where the authorities are working to address the high electricity costs for businesses, are also crucial for job creation and improved growth and competitiveness.

Other reforms should also focus on improving the business environment, enhancing governance and reducing unemployment, especially among women and young people, the fund said.

“The pandemic has significantly increased Jordan’s external financing needs, underscoring the criticality of continued donor support ... to help shoulder the disproportionate burden Jordan has borne in hosting refugees," said Mr Furusawa.

Jordan is currently hosting 1.3 million Syrian refugees. The pandemic raised the country's external financing needs by about $1.1bn in the 2021-2022 fiscal year, mainly due to weaker tourism and services receipts, the IMF said.

The authorities have demonstrated strong reform momentum and a commitment to fiscal transparency, said Mr Furusawa.

"These, together with continued implementation of reforms, as well as stepped up financial assistance from development partners, will help Jordan achieve the objectives of its programme and build a stronger, more resilient and inclusive economy,” he said.