Cyber fraud is the single biggest fraud risk facing governments and businesses in the UAE. The increasing use of digital platforms including cyptocurrencies raises the possibility of scams, the president of a global anti-fraud body said.

"With every new digital invention that comes about… the rise of Internet of Things, blockchain, virtual currencies and how they are traded and becoming more commonplace… when you have so many different avenues for someone to spin money, you have even more opportunities for corruption and fraud," Bruce Dorris, the US-based president and chief executive of the Association of Certified Fraud Examiners (ACFE) told The National on Sunday.

Public scepticism of cryptocurrencies has mounted this year, with the World Bank’s group president Jim Yong Kim comparing them to illegitimate “ponzi schemes”, and the UAE’s capital markets regulator warning investors of over the risks of investing in them, citing high volatility, lack of regulation and misleading offers.

The share price of one of the world’s biggest cryptocurrencies, Bitcoin, reached a three-month low of $6,000 earlier this month but has since recovered by at least 85 per cent, sparking fears of a bubble. The first licence to trade cryptocurrencies in the Middle East was issued in February to Regal RA DMCC, Dubai Multi Commodities Centre-registered gold investment and trading firm, however, the sector remains unregulated.

There is a need for the GCC governments to act quickly to regulate the cryptocurrency industry in order to minimise the risk of investors' exposure to fraud. It's "critical" to have the regulations in place and proper enforcement should follow, he said on the sidelines of the ACFE’s fraud conference in Abu Dhabi.

“When you’ve got swings in market value you’re going to allow for the build-up that enables many Ponzi schemes to start," he noted. “Does it mean that by having regulations, the ability for someone to commit fraud in any area goes away? No, but it does help us to be able to rein in [such activity]. Regulation is just the start.”

Mr Dorris, a lawyer and certified accountant, is a former assistant district attorney in Shreveport, Louisiana, where he founded and directed the local authority’s Financial Crimes Screening Section. He was previously a non-executive director of the US National White Collar Crime Center, and vice-chairman of its Audit Committee.

_______________

Read more:

World's first digital currency 'cold storage' vault launches in Dubai

Consumers wary of using cryptocurrencies to buy real estate – survey

_______________

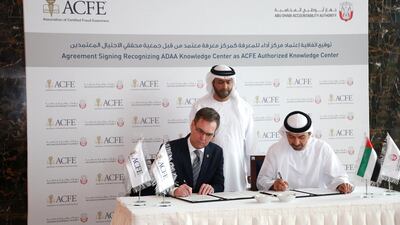

His comments came as the Abu Dhabi Accountability Authority (ADAA), an independent body set up in 2008 to oversee accountability across the government bodies in the emirate, announced ACFE certification of its educational arm, the ADAA Knowledge Center, on Sunday.

The centre will now be able to run CFE-accredited courses on fraud identification and ethical business practices for more than 300 Abu Dhabi public entities.

“This recognition underpins our decade-long effort to encourage the adoption of ethical business practices and transparency within the UAE’s public sector,” Hamad Al Suwaidi, chairman of ADAA, earlier told the ACFE conference.

“To address the window of opportunity to perpetuate fraud, we will strive to recommend to those charged with governance the design and implementation of preventive, directive, corrective and predictive controls,” he said of ADAA's efforts to help strengthen the UAE’s anti-fraud laws.

The UAE, the second-biggest Arabian Gulf economy, was ranked 21st out of 180 countries in Transparency International’s latest annual Corruption Perceptions Index, published last week. It is the highest rank among the Middle East and North African nations and up from 24th place in 2016.

It is not "good enough”, Mr Al Suwaidi said of the UAE's 21st position on the index. “We aim to progress our efforts to boost transparency and efficiency in government…and come up with lasting solutions to address fraud and corruption challenges.”

The UAE is also gearing up to undergo assessment by the Financial Action Task Force, a global inter-governmental body set up in 1989 to develop and uphold policies to combat money laundering and terrorist financing.

Saudi Arabia’s year-long review was scheduled to begin in October 2017, and the UAE’s in June 2019. Although both countries received satisfactory status in their last reviews in 2010 and 2008, the methodology was tightened up in 2013 with additional requirements to assess how regulations are enforced.