Of all the initial public offerings, many of energy sector companies, conducted in the UAE in recent years, the listing of Adnoc Gas is the biggest and most strategic.

The state company’s gas processing unit will be valued at up to Dh186.5 billion ($50.8 billion) when it lists about 4 per cent of its shares, with trading intended to start on March 13. More than the money, the company is crucial for the country’s energy ambitions.

The four previous Adnoc IPOs have covered fuel retail (Adnoc Distribution), drilling, petrochemicals (Borouge) and fertilisers (Fertiglobe). Their total market capitalisation today stands at about Dh215 billion, so Adnoc Gas will almost double the value of its parent’s listed entities.

It will be comparable in value to large international companies such as Occidental, Eni and Woodside, and worth almost four times EQT, the largest gas-producing company in the US.

At the top of its valuation range, it will offer an attractive 6.4 per cent dividend yield.

Direct access for investors outside specialist oil and gas companies to the region’s hydrocarbon reserves is almost unheard of.

Saudi Aramco, which carried out its own IPO in December 2019, is the exception but public shareholders own part of the parent company, which includes refining, petrochemical and other assets.

Adnoc Gas does not offer upstream exposure, but it comes close. It processes gas from Adnoc’s fields to remove valuable by-products such as liquefied petroleum gas (LPG, used for cooking), natural gas liquids employed in petrochemicals, condensate (a type of light oil) and sulphur.

The processed gas is reinjected into oilfields to improve recovery, sold to the domestic market, or liquefied for export by Adnoc LNG.

So Adnoc Gas offers exposure to local as well as international commodity prices, after tax and a profit-sharing arrangement with its parent.

It enjoys low processing costs, just $0.5 per million British thermal units, when international liquefied natural gas sells for about $15 per MMBtu even after recent price drops.

The raw figures are imposing: drawing on nearly all the UAE’s 290 trillion cubic feet of gas reserves, the world’s seventh largest, demand will be at about 8.7 billion cubic feet per day by the late 2020s, which would equate to the world’s ninth-largest production currently, with the UAE hot on the heels of Algeria in eighth.

The UAE intends to be capable of self-sufficiency in gas by 2030, which should be eminently achievable given Adnoc’s planned production increases.

These include major new offshore projects, unconventional gas onshore, production from the Bab field, and higher associated gas derived from expanding oil production as the parent company moves towards its target of 5 million barrels per day capacity.

And that will allow more exports, crucial in a world market suddenly short of gas because of the obliteration of Russia’s supplies to Europe.

With countries such as Pakistan turning to coal because of unaffordable LNG, more gas will help limit carbon dioxide emissions in Asia.

The planned LNG export plant at Fujairah is not part of Adnoc Gas’s asset base currently, but it expects to acquire it from the parent when it is complete in about 2027, in addition to the existing facility on Das Island which will be expanded.

Building scale is essential for Adnoc’s LNG business to be internationally competitive.

Gas requirements for domestic power generation will drop as nuclear and solar capacity come online, so increased consumption at home will depend on rising industrial use.

Although the IPO prospectus refers only in passing to hydrogen, the production of “blue” hydrogen or its derivatives ammonia and methanol from gas with carbon capture is likely to be another key strategic area of growth.

Gas is still a carbon-containing fuel, so for compatibility with the UAE’s 2050 net-zero goal, Adnoc Gas needs to install carbon capture, limit methane leakage, improve energy efficiency and electrify its facilities with renewable and nuclear power.

That will be ever more important as its current gas purchase agreement with Adnoc moves towards 2047 and the expiry of its primary term, and investors grow ever more attentive to climate risks.

So Adnoc Gas appears a solid and relatively low-risk company, with good growth prospects, and a realistic lower-carbon proposition.

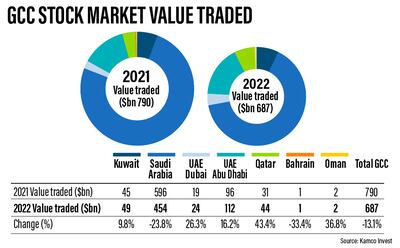

After decades of absence of the region’s main industry, the GCC stock exchanges now offer a range of different petroleum-related companies.

The continuing wave of GCC IPOs gives citizens, residents and international investors more of a stake in Gulf economies.

Could any of its regional peers follow the Adnoc Gas template?

Aramco could, but it would be duplicative with its parent company listing. QatarEnergy is overwhelmingly a gas exporter, and neither it nor Bahrain’s state oil company have shown any interest in listing. Kuwait Petroleum produces gas only for domestic use and is not set up commercially to be a public company.

There has been talk of an IPO of the gas network of Oman’s OQ, but production and processing are complicated by several partnerships with international oil companies.

For now, Adnoc Gas probably stands alone.

Within Adnoc itself, there are some other specialist units that could see offerings and that have sparked media speculation.

Alternatively, it might pursue more partnerships or securitisations, as it has done for its refining and oil and gas pipeline units.

But unless and until the company decides to give access to its upstream operations, Adnoc Gas will be the closest approach investors have to the nation’s subsurface wealth.

Robin M. Mills is chief executive of Qamar Energy, and author of The Myth of the Oil Crisis