The consolidation among financial institutions across the GCC will continue amid the push to create lenders with greater scale as banks look to boost revenue, achieve cost synergies and support the diversification of Gulf economies away from oil.

Large GCC lenders are also seeking to increase their market dominance, hoping to drive mergers and acquisitions, Moody’s Investors Service said in its latest report on the GCC banking sector.

The large lenders that aim to capture large-scale transformation project finance business in the GCC are also keen to compete “more assertively outside their domestic markets” and these strategic objectives will continue to encourage them to increase their scale through consolidation.

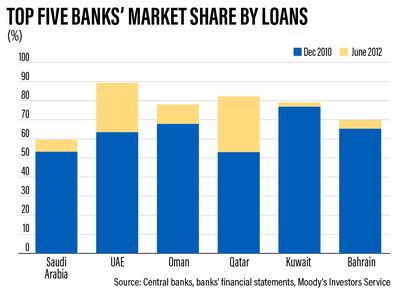

“The top five banks in each of the GCC countries commanded combined market shares of between 60 per cent and 90 per cent of sector loans (and financings for Islamic banks) as of June 2022, up from between 50 per cent and 80 per cent in 2010,” Moody’s analysts Francesca Paolino and Francois Planchard wrote in the report.

M&A activity among GCC banks rose significantly after the three-year oil price slump that began in the middle of 2014. Constrained growth opportunities dented their profitability and banks sought to merge balance sheets to steer difficult market conditions.

The ongoing wave of consolidations in the GCC banking sector has led to the creation of some of the strongest financial institutions in the market. First Abu Dhabi Bank, the UAE’s largest lender, was formed through the merger of National Bank of Abu Dhabi and First Gulf Bank in 2017.

Abu Dhabi Commercial Bank also completed a three-way merger with Union National and Al Hilal in 2019. Dubai Islamic Bank in 2020 completed its acquisition of competitor Noor.

Other big deals in the banking sector include the merger of Saudi Arabia’s biggest retail lender National Commercial Bank and smaller rival Samba Financial Group to create the kingdom’s biggest bank Saudi National Bank.

Kuwait Finance House also finalised the deal to acquire Bahrain’s Ahli United in June last year in a bid to create a stronger financial institution that was better equipped to grow its market share.

Financial fundamentals of the lenders are also very strong amid a rise in interest rate and robust economic growth, however, shareholders who held stakes in more than one lender — typically regional governments and their related entities will continue to drive consolidation.

“GCC banks' shareholder structure, characterised by a concentrated pool of state-linked entities and groups, facilitates tie-ups between lenders meaning that this M&A process is set to continue,” Moody’s analysts said.

Further consolidation will also create revenue synergies as greater market share translates into higher growth opportunities for banks as they bundle products and cross-sell to existing clients.

“Merged entities will likely also gain greater pricing power in competitive GCC environments, enhancing their deposit-gathering ability and contributing to higher net interest income,” Moody's said.

While GCC banks are already more cost-efficient than banking peers in other regions, cost optimisation is a key priority for their shareholders.

However banks must meet sizeable investments related to compliance, IT, digitalisation and cyber-risk mitigation, and the implementation of sustainability agendas and these costs, in addition to expenses of running branches and could lead to cost synergies in merged entities, the report said.

Moody’s said it expects the on-ongoing consolidation to be beneficial for the growth of Islamic banking in the region.

“We expect M&A in the region to continue to promote Islamic banking penetration. Most M&A activity concluded between banks since 2015 has involved Islamic banks,” it said.