Holiday listings website Airbnb has joined hands with Dubai’s Department of Economy and Tourism to unveil the Dubai remote working hub as the UAE seeks to attract more talent to the region with its one-year residency permit for remote working professionals.

The remote working hub will serve as a one-stop-shop for aspiring remote workers, the DET said.

Anyone looking to live and work in Dubai can use the hub to find local long-term listings, as well as information on entry requirements and visa policies, it said.

“Dubai is a global leader in facilitating remote working,” Velma Corcoran, regional lead for Middle East and Africa at Airbnb, said.

“As this trend continues to accelerate, we want to work together to make it easier for people to enjoy the newfound flexibility to work and travel, and help the city harness the economic benefits of this new type of tourism.”

The UAE introduced a one-year digital nomad visa in March 2021 that allows people to live in the Emirates while continuing to work for employers in their home countries.

Sheikh Mohammed bin Rashid, Prime Minister and Ruler of Dubai, said the residency permit meant that “any employee anywhere in the world can reside in the UAE to practise work remotely, even if the company is not present in the country”.

The decision came as people increasingly worked from home following the Covid-19 pandemic.

The one-year visa allows people to enter the UAE from overseas under self-sponsorship and work in line with the terms and conditions issued with the visa.

Earlier this year, Airbnb included Dubai in its list of the top 20 most remote worker-friendly destinations in the world, alongside Canary Islands, Thailand and the Caribbean.

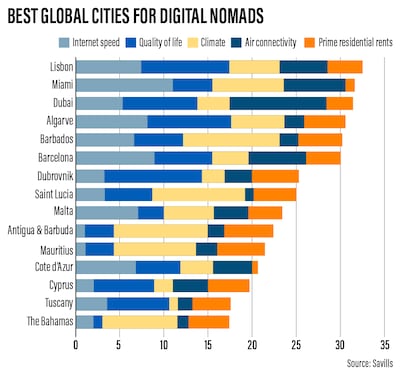

In April, Dubai was ranked as the third-best city in the world for digital nomads to live in, research by real estate consultancy Savills found.

“Dubai’s global connectivity and pro-business ecosystem combined with visa-friendly reform has underlined the city’s status as a leading hub for remote workers, building on Dubai’s commitment to nurture business growth and meeting the demands of today’s talent,” Issam Kazim, chief executive of Dubai Corporation for Tourism and Commerce Marketing, said.

“The city is already home to over 200 nationalities that enjoy unrivalled career opportunities and lifestyle offerings.”

Under the remote working hub programme, Airbnb and the DET will promote Dubai to remote workers seeking accommodation and guidance for their long-term stays, according to the statement.

Long-term stays, defined as more than 28 days, were at an all-time high in the first quarter of 2022, more than doubling in size from the same period in 2019, according to Airbnb.

In the first three months of 2022, searches for international solo travel in the UAE for long-term stays grew by more than 280 per cent compared with the same period in 2019, the platform said.

The rise of remote work is an opportunity for countries to develop policies and programmes to attract these workers, who can further support local economic growth and innovation, Airbnb said in a September report.

Many jurisdictions are seeking to capitalise on the economic potential of remote work by streamlining rules and regulations to enable remote workers to live and work in their communities, the report said.

“These efforts run the gamut from one-time relocation incentives and targeted tax breaks to the creation of remote worker-specific visa processes and community amenities that promote local small businesses and cultural institutions,” it added.