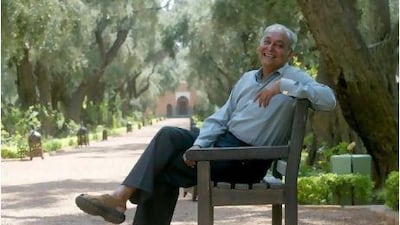

The Bengali actor Soumitra Chatterjee, who starred in some of the most famous films of Satyajit Ray, including The Apu Trilogy, has been chosen for the prestigious Dadasaheb Phalke award, the highest film award in India.

Amitabh Bachchan congratulated Chatterjee, who was Ray's preferred actor for complex roles, the way Mario Mastrioanni was for Federico Fellini or Toshiro Mifune was for Akira Kurosawa.

Chatterjee made his debut in the 1959 film Apur Sansar. He went on to play key roles in Ray's classics such as Charulata, Ghaire Baire and the Feluda series, which remains hugely popular with children.

"Congratulations Soumitra ... such a magnificent journey in cinema," tweeted Bachchan, who also pointed out the significance of the award as the Hindi film industry celebrates its centennial next year.

* Anjali A

Egyptian teenager wins Arab Idol

The 17-year-old Egyptian singer Carmen Suleiman was crowned Arab Idol at the close of the MBC1 show's first season on Saturday night, winning against her opponent, Dunia Batma from Morocco.

Platinum Records will produce Suleiman's first album. She will also sign a contract with Pepsi International and join their growing roster of celebrity endorsers. Her third prize, a surprise to all watching, was a 2012 Chevrolet Corvette.

The evening featured performances from two of the judges - the Emirati singer Ahlam and the Lebanese musician Ragheb Alameh - as well as performances by the Tunisian singer Latifa, who was the guest of honour during the finale.

* Hala Khalaf

PETA slams Kim Kardashian

After Kim Kardashian announced she will press charges against the woman who threw flour on her at a hosting event on Thursday, the People for the Ethical Treatment of Animals (PETA) have called out the reality television star for her selfishness.

"If she presses charges, at least people will be constantly reminded of her selfish, callous disregard for the cruel deaths that she causes by wearing fur," PETA told TMZ in a statement.

"If anything, Kim should get a life, the very thing that she denies animals."

The animal rights group also said they are willing to help the accused woman with her defence costs.

Acclaimed Irish films come to the UAE

St Patrick's Day may have already passed, but the Irish Embassy is keeping things going with a series of film screenings across the UAE. At the NYU City Campus at 6pm tonight, it's Ken Loach's award-winning The Wind that Shakes the Barley, followed by The Field from Jim Sheridan, tomorrow.

The Wind that Shakes the Barley will be screening again in Dubai at the Bonnington Hotel on April 3, and The Field on April 4 at the Rotana Hotel in Al Ain. Each screening will be accompanied by a selection of Irish short films. For more information, visit www.irelandonscreenuae.weebly.com.

* Alex Ritman

Bollywood couple to go on film spree

The best friends Ritesh Sidhwani and Farhan Akhtar, the producer-director pair behind Bollywood's two biggest hits last year, Don 2 and Zindagi Na Milegi Dobara, have laughed off rumours that they are parting ways and instead announced their most ambitious expansion so far.

The duo said their production company Excel Entertainment will make six films in the next 10 months: a film by Akhtar, two films directed by Akhtar's sibling Zoya, one film by Abhishek Kapoor, another by Abhinay Deo and a project by a new director.

The Aamir Khan-starrer Talaash will be the next big release from the studio.

* Anjali A

Hello! magazine comes to Pakistan

Pakistan is better known for bombs than bombshells, but a few enterprising Pakistanis hope to alter that perception with the launch of a local version of the well-known celebrity magazine Hello!.

"The side of Pakistan that is projected time and time again is negative," said CEO Zahraa Saifullah. "There is a glamorous side of Pakistan, and we want to tap into that."

"We are trying to be happy in a war zone," said consulting editor Wajahat Khan. "We are trying to celebrate what is still alive in a difficult country."

Khan said they would do everything they could to protect the security of the people they profile, but he wasn't overly concerned.

"I don't think terrorist networks are going to be reading Hello! anytime soon," he said.

* AP

Follow

Arts & Life on Twitter

to keep up with all the latest news and events