Between the Burj Al Arab, Burj Khalifa and The Opus by Omniyat, Dubai is a city noted for its architectural feats.

But while conversation surrounding the emirate's structures typically focuses on the sky-high buildings of downtown Dubai and Dubai Marina, there is a wealth of modernist and Arabian heritage buildings to explore in Bur Dubai and Deira too.

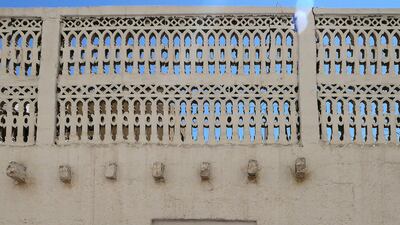

Click though the gallery above to see a selection of notable architectural feats

During a walk down Baniyas Road in Deira, with the thriving and busy Dubai Creek waterway to one side, you will pass by modern mirrored towers, geometric facades and traditional souks. In many ways, it's a blend of architectural styles that represents the city's varied history.

There are structures that seemingly hark back to the 1960s, with curved stylings and distinctive windows, while regional wind grills and towers make the mark you'd expect to see on many of the buildings.

Preserving the city's history through architecture

In March this year, a new project was announced aiming to document and preserve the modernist structures that were built during Dubai's economic boom of the 1970s and 1980s.

“Preserving our urban heritage and culture that we have inherited through generations, and the intellectual and creative legacy it has presented to us, is an historic responsibility that we will carry today and our children and grandchildren in future,” said Dawoud Al Hajri, director general of the municipality.

“Modernity is only complete by absorbing history, learning from its lessons, and celebrating what it has given us as evidence that conveys to us a picture of the past that our forefathers and grandfathers lived and how they made the first beginnings of our modern renaissance.”