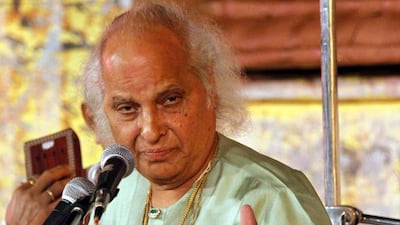

A conversation about Indian classical music is incomplete without the mention of Pandit Jasraj, one of India’s top classical musicians who represents the Mewati style of Hindustani classical music.

The 83-year-old, who will perform in Dubai on Saturday as part of the Emirates NBD’s classical concert series, says his musical journey began with his father teaching him music when he was 3 years old. Jasraj gave his first public performance at the age of 22, after being trained by his brother Maniram. Jasraj’s vocal range extends three-and-a-half octaves. The musician notably contributed vocals to the 2012 film Life of Pi.

How did you get inducted into the Mewati gharana (musical house or family)?

This is a tradition that has been passed on from generation to generation. It isn’t just taught to family members but to students who continue the tradition. The teaching creates a sacred bond between the pupil and teacher. I am from the fifth generation continuing in this musical house.

You are credited for presenting rare ragas in performances. How do you come up with them?

I am often commended for being a creator, which is not right. There are only a set number of ragas to work with such as Gyankali, Jaiwanti Todi and Nanak Malhar. With them I have developed bandishes [compositions] that are an inspiration from God.

Can you tell us how you came up with the Jasrangi Jugalbandi?

Everything in this world is a collaboration of two things. Like husband and wife, Shiva and Parvati [Hindu male and female deities], the land and sky, sun and moon; they have to be together to make perfect sense. Jasrangi is a jugalbandi between a male and female singer, where each of them sing in their respective swar [note], but together. It is from the ancient method Moorchana Paddhati, creating different ragas from same sequence of notes. My heart told to me follow that route and create this jugalbandi where two diverse ragas come together beautifully.

When did you first perform this and how did the name come about?

It was first performed on stage in Pune in the 1990s by Sanjeev Abhyankar and Shweta Jay, and I picked up quite quickly as people began appreciating it. But I had not named it. When my friend Meena Phalnikar heard it, she said: “Mujhe toh Jasraj ke rang mein rangi hui lagti hai” [It is mixed with the colours of Jasraj] and started calling it Jasrangi. The name stuck. It is now sung at various shows in Canada and America by my students.

Do you think today’s generation is attuned to classical music and understands the significance of gharanas?

All music originates from classical music. Only the most fortunate understand it.

Who will be accompanying you on stage in Dubai?

I do not believe in rehearsal and neither do I think [about] who will be accompanying me on the tabla or the harmonium. Whoever is available at that time, we will get together and make music. That is the beauty of Indian music – an extempore performance creates the most powerful music.

What compositions can the audience expect at the show?

The audience will have to wait and see what we create there. My music is atmospheric and depends on the setting and mood. The aim will be to create music that will touch their hearts.

Mewati music

The Mewati gharana (musical house or family) was founded by Ghagge Nazir Khan and his brother Wahid Khan from the Mewat region in Rajasthan. Over the years, they passed on the nuances of the vocal and instrumental style to their family members and disciples. The music comes from the Khayal genre, which emphasises improvisation. It is distinct from other variants of the genre in its bhajan (devotional songs) and Sufi feel.

•Jasraj performs at Ductac on Saturday at 8pm. Tickets are from Dh100. For more information, call 04 341 4777