Firefighters from several stations around Rushmoor in Hampshire county in England rushed to Farnborough Airport on Monday after Elton John's private jet reportedly suffered a hydraulic failure and was attempting to make an emergency landing amid Storm Franklin.

Yet a day later the six-time Grammy Award-winner could be seen performing live at Madison Square Garden in New York City, as part of his Farewell Yellow Brick Road world tour, which is meant to be the final tour of his career. It began in Pennsylvania in 2018, but has been beset by delays, including postponements owing to the coronavirus pandemic.

John was leaving the UK for the US when the incident occurred at an altitude of 10,000 feet, The Sun reports. According to the newspaper, the ordeal began shortly after John's £66 million ($90m) jet left the airport at 10.20am. About an hour into the trip, the aircraft suffered hydraulic failure and the pilot had to make a U-turn while approaching the coast of southern Ireland.

The pilot headed back to Farnborough and radioed air traffic control to declare an emergency landing. Ambulance crews and police were alerted at 11.19am, as firefighters raced to the scene and the runway was cleared.

But as Storm Franklin's fierce winds continued to batter parts of the UK, the pilot soon struggled to land the twin-jet Bombardier Global Express.

On Monday, Rushmoor Fire Station tweeted images of firefighter trucks as they headed to the airport.

"Multiple resources from Rushmoor and surrounding stations sent to Farnborough airfield earlier for a plane suffering hydraulic troubles. The plane ended up landing safely and all fire appliances, police and ambulance crews were stood down," it posted.

UK flights disrupted amid Storm Franklin

Millions of travellers across the UK have faced disruption to their plans after Storm Franklin hit the country. Flights have been cancelled and delayed and one train operator has issued a “do not travel” warning over the risk of flooding to tracks, while hundreds of homes have been evacuated.

The Met Office issued an amber warning for winds, which could cause a “risk to life”, in Northern Ireland until 7am on Monday, while a milder yellow wind warning covers England, Wales and south-western Scotland from noon until 1pm.

Following the on-air drama, John tweeted: "Hello New York! See you @TheGarden tonight."

On January 19, the tour's rescheduled North American leg finally began in New Orleans, Louisiana, after a two-year delay. But John was again forced to postpone two concerts in Dallas, Texas after he contracted Covid-19 on January 22.

John had also previously said he was postponing European dates on his world tour until 2023 so that he can have an operation on an injured hip. The US tour is scheduled to make stops in Houston, Chicago, Detroit, Toronto, New York and Miami.

On Tuesday night, John made it to the Madison Square Garden and performed for thousands of fans. He is set to play the famed venue again on Wednesday.

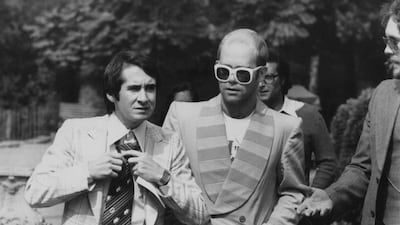

Scroll through the photo gallery below to see Elton John's style evolution over the years: