The artists who will present works at NYU Abu Dhabi Art Gallery's landmark autumn exhibition have been announced.

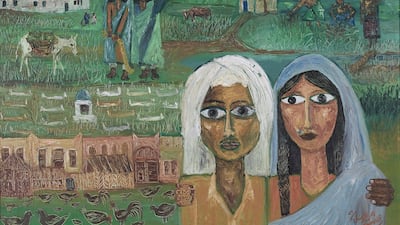

Titled Khaleej Modern: Pioneers and Collectives in the Arabian Peninsula, 1941-2008, the show, which will open on September 6, seeks to document 20th-century modern art movements in the Gulf.

It's being curated by Aisha Stoby, who this year also curated the inaugural Oman Pavilion at the Venice Biennale, as it’s based on Stoby’s doctorate research tracing the region's “pre-boom era”.

The historical survey examines the evolution of visual art movements across the region as it transformed after the discovery of oil.

“An exhibition like this is quite rare, a kind of opening salvo and call to action, offering new vistas on art history and art practice in this region," Maya Allison, executive director of the NYU Abu Dhabi Art Gallery and university chief curator, said.

Allison also describes it as a "crucial, path-breaking project".

"Rather than a definitive survey, this project sets us on a journey to explore the understudied — and, for some people, unknown — emergence of modern art in the Arabian Peninsula over the last century. It is a profound honour that Dr Stoby will present her original research with us, in this exhibition that was many years in the making."

Local art histories will be contextualised by tradition, modernisation and evolving national identities. Artistic pioneers and collectives from the 20th and 21st centuries will be studied, beginning with the first exhibition of Kuwait's Al Mubarakiya School in 1941.

Saudi Arabia’s modern art scene dates back as early as 1938, and to explore this, works will be included by artists such as Mounirah Mosly, Safeya Binzagr, Abdulhalim Radwi and Abdullah Al Shaikh. Pieces by Mohammed Al Saleem and Abdulrahman AlSoliman are also being provided by the Saudi House of Fine Arts in Riyadh.

For Bahrain, Stoby takes us back to the 1950s, when the Manama Group formed, with Abdul Karim Al-Orrayed, Nasser Al Yousif and Ahmed Qassim Al Sunni.

Over the following 20 years, The Three Friends collective was active in Qatar, comprising Yousef Ahmed, Hassan Al Mulla and Mohammed Ali Abdullah.

In the UAE, early art practitioners whose work will be touched on in the survey include Abdul Qader Al Rais and The Group of Five, comprising Hassan Sharif, Abdullah Al Saadi, Mohammed Kazem, Mohamed Ahmed Ibrahim and Ebtisam Abdulaziz.

Scroll through the below to see images from Mohamed Ahmed Ibrahim's latest Dubai exhibition Embryonic Coat

Important figures from Oman will also be included, such as Anwar Sonya, Rabha Mahmoud and the The Circle group, led by Hassan Meer.

It is the first time work by these trailblazing artists will be brought together, and many of the pieces will be on view for the first time in decades, said Stoby.

"Enhanced by the presence of rare and archival material, Khaleej Modern creates a space and offers resources for learning and re-understanding our own histories,” she said. "More broadly, we hope the exhibition will contribute to wider regional and global understandings of modern visual art.

"This project responds to emerging debates around recentring art narratives, toward a more nuanced and inclusive appreciation of global art histories.”

Khaleej Modern: Pioneers and Collectives in the Arabian Peninsula, 1941-2008 will run at NYUAD Art Gallery from September 6 to December 11