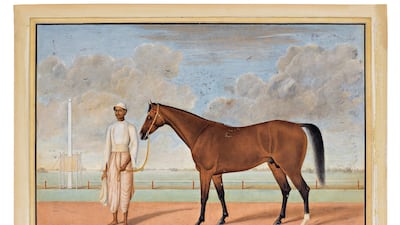

In the 18th and 19th centuries, a new genre of painting emerged in India as British imperialists expanded their scope in the subcontinent.

The country’s flora, fauna, people and places became the subjects of what is called Company School, or Patna paintings, made by Indian masters and commissioned by the East India Company.

A collection of these paintings, owned by a single collector for decades, will go on auction at Sotheby’s on October 27 for its In an Indian Garden: The Carlton Rochell Collection of Company School Paintings sale.

It is the first time Sotheby’s has dedicated an auction to paintings from the Company School.

The works are offered by American collector and art dealer Carlton C Rochell, Jr, who worked at Sotheby’s for 18 years, founding its Indian and South-East Asian Art Department in 1988.

“I first began to collect these lesser-known masterpieces over two decades ago simply for my personal enjoyment, my imagination having been captured by their ‘East meets West’ aesthetic. When they were painted, these works were the principal way in which India could be revealed to those in Great Britain, who otherwise could only hear stories about this sumptuous land,” he said.

As employees of the colonial East India Company travelled around India, they wanted to capture scenes of the country and commissioned Indian painters to produce works for the European eye. They were intended for viewers in Britain, hence the adoption of European palettes and styles, and they presented an exoticised view of India, its nature and its inhabitants.

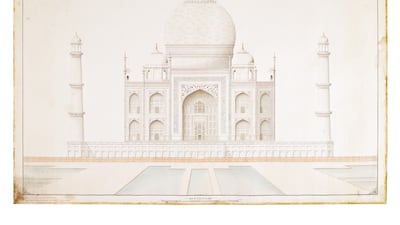

Cities in India began to develop their own style, with artists drawing from their local traditions, including techniques from miniature painting. However, the Company School paintings fused the fine detailing of miniatures with the realism preferred by the West, producing a unique style of its own and in a larger format. The works are often characterised by their linear perspective and the use of watercolour.

There was also a shift in the subject matter. Miniature painting flourished during the Mughal period, with rajas and nawabs commissioning artists to create royal portraits and depict courtly scenes, as well as historical and divine subjects. British patrons, on the other hand, wanted to focus on animals, nature and architecture.

“The meticulous miniature style was scaled up to depict birds, animals and botanical studies with remarkable lifelike detail, with the results rivalling any western artists who recorded natural history and travel," said Rochell Jr.

"Many years on, as they are beginning to take their rightful place in world art, these pieces can now inspire a new generation of collectors who I hope will cherish them as I have.”

The auction will also includes works that were presented in Forgotten Masters: Indian Painting for the East India Company exhibition at the Wallace Collection in London. Seven of the works in the auction were loaned for the show in 2019 and 2020.

Curated by writer and historian William Dalrymple, the show was recognised for highlighting Indian painters who produced works on paper during the late Mughal period, including Shaykh Zayn al-Din, Ram Das, Bhawani Das and Ghulam Ali Khan, whose works are also included in the auction.

Albums commissioned by famous patrons in Calcutta – Sir Elijah Impey, who served as chief justice of the High Court from 1777 to 1783, and Lady Impey – will also be up for sale. The Impey family had a menagerie in their garden and hired local artists to paint the surroundings. Their collection includes 300 paintings, more than half of which are of birds.

In 1810, the Impey Collection was sold at auction in London, some of which was acquired by institutions such as the Metropolitan Museum of Art and the V&A.

Other works from the Impey Collection were owned by figures such as Jacqueline Kennedy Onassis, who had in her collection A Painted Stork Eating a Snail, a 1781 work signed by al-Din in Calcutta. The piece has an estimate of £200,000-£300,000.

Another work, A Great Indian Fruit Bat or Flying Box, which shows the animal with its dark wings outstretched, is estimated at £300,000-£500,000. Created around 1778-1782 by Das, it was once owned by scholar Stuart Cary Welch and later Qatari prince Sheikh Saud bin Mohammed Al Thani.

The two works are the top lots of the auction.

Apart from paintings of animals, the auction also includes botanical studies of fruits and plants, such as A Botanical Study of a Silk Cotton Tree, dated circa 1800-1820 and created by a Company School in Calcutta. Previously in the collection of Joseph Verner Reed, Jr, the US ambassador to Morocco from 1981-1985, the work carries an estimate of £20,000-£30,000.

There are also architectural drawings and portraits of individuals, giving glimpses of life in India, particularly from the perspective of the British colonisers who commissioned the pieces. Influenced by the fine detailing of miniature works, the paintings of the Company School are noted for the precision and characterisation of the subjects, brought to life by the artists.

A number of pieces from the In An Indian Garden auction will go on view at Sotheby’s galleries in New York, Hong Kong and London in the coming weeks, before the auction on Wednesday, October 27.