New numbers on the coming US midterm elections have shown a slight shift in favour of Democrats, as party strategists voice cautious optimism that Republican momentum is slowing.

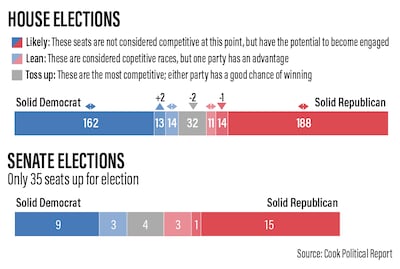

Analysis from leading election-tracker the Cook Political Report (CPR) moved five US House of Representatives race projections in favour of Democrats, while other Senate and state-level races have increased in competition.

The numbers are welcome news to Democrats, who have been bracing for a Republican "red wave" of wins in the critical elections.

The Republican Party has long been associated with the colour red, the Democrats with blue.

Democrats currently hold a razor-thin majority in the US House and Senate, and opposition parties historically see major gains in US midterms.

"Three months ago, it looked like a Category Five hurricane was heading for President [Joe] Biden and House Democrats clinging to a flimsy 221-214 seat edge," said David Wasserman in a new analysis for CPR.

"Today, not only has it weakened to a tropical depression, but Republican primaries have thrown Democrats enough sandbags to give them a plausible, if still unlikely, scenario to stave off a Republican majority."

Democrats have seen improved performances in special elections since the conservative-majority Supreme Court revoked the federal right to abortion by overturning 1973's Roe v Wade decision in June.

"I think that's the day when the 'red wave' turned in to the 'red riptide'," Brad Bannon, a Democratic pollster and chief executive of Bannon Communications Research, told The National.

"It's clear American voters by about a two-to-one margin think overturning Roe v Wade was a bad idea."

That decision unleashed a wave of women registering to vote, which led to abortion-rights victories in a Kansas special election.

Data from analytics group TargetSmart showed that 70 per cent of newly registered voters in Kansas are women. It also showed that among Kansans who registered to vote on or after June 24, Democrats have an eight-point advantage.

A reinvigorated Democratic electorate, polling shows, has not been matched by Republicans.

An NBC poll found that 68 per cent of Republicans express a high level of interest in the coming elections, versus 66 per cent for Democrats. That two-point Republican advantage is down from 17 points in March and eight points in May.

For Mr Bannon, the abortion issue is not the only reason for this shift; in some cases, it also reflects "bad candidates" that came out of former president Donald Trump-endorsed primaries.

He pointed to celebrity doctor Mehmet Oz in Pennsylvania and right-wing author JD Vance in Ohio, states where Republicans should be winning but are in close races or outright losing.

"Celebrity candidates turned out to be bad candidates. And those are all races where the Republicans thought they were going to win the Senate seats," said Mr Bannon. "But now Democrats have a definite shot."

Mr Trump has something of a mixed bag in his endorsements, with several picks losing in primary races.

And the former president is under intense pressure from several lawsuits and a criminal probe into his handling of classified documents after he left the White House.

"I think Trump's stamp of approval has becomes the Trump curse," Mr Bannon said.

But Republican pollsters and campaigners remain cautiously optimistic that between Mr Biden's low polling and persistent inflation, voters will repeat history and deliver losses for the Democrats in the midterm elections.

Conservative candidates have hit Democrats hard on the economy, as inflation hits a near 40-year high. The US Federal Reserve has increased interest rates in an effort to curb record prices.

The August jobs report released on Friday indicated US hiring had slowed, with 315,000 jobs added compared to 526,000 in July. The unemployment rate also rose slightly to 3.7 per cent from a half-century low in July.

Melissa Brown, a board member of Republican Women for Progress, said Democrats may be enjoying a streak of legislative wins, but any surge in support is likely to be short lived.

"Americans are facing sky-high inflation, rising crime in major cities and a humanitarian border crisis," Ms Brown told The National.

"These are kitchen table issues that are impacting every single American."

Mr Biden's approval rating hit a summer plunge, falling below 40 percent, though it has begun to tick upwards since July, as record-high petrol prices began to temper.

Republican pollster Bill McInturff, who works on the NBC midterm polling, said that more than 70 per cent of Americans believe the country is "on the wrong track".

"I anticipate that the Republicans will still take the House and consider the Senate to be a toss-up at this point in the cycle," Ms Brown said.

"As the summer winds down, I expect Republicans to double down on the significance of the Biden administration’s failures at home and abroad as we get closer to November."

The CPR's Amy Walter said in The New Yorker that "all the fundamentals are telling us not that much has changed".

“There is not a blue wave, no," she said. "The question is: how big is the red wave?”