Iraqi President Barham Salih named Mustafa Al Kadhimi as prime minister-designate on Thursday, after weeks of political infighting.

Mr Al Kadhimi, the head of Iraq's intelligence service, has been rumoured to be among the prime ministerial contenders since December after the resignation of previous incumbent Adel Abdul Mahdi.

He now has 30 days to form a new cabinet and present it to Parliament for approval.

"I am honoured and privileged to be tasked with forming Iraq’s next government," Mr Al Kadhimi said on Twitter.

"I will work tirelessly to present Iraqis with a programme and cabinet that will work to serve them, protect their rights and take Iraq towards a prosperous future.

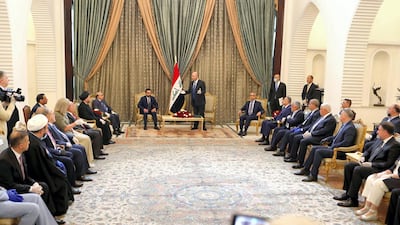

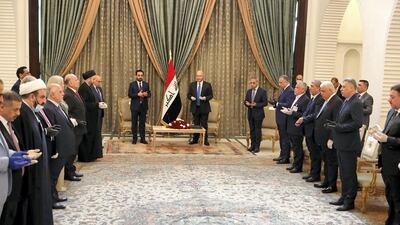

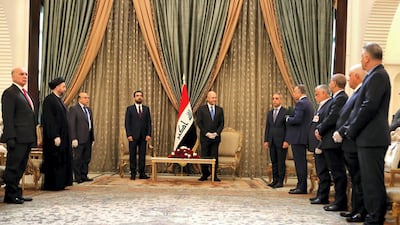

Mr Salih led a nomination ceremony for Mr Al Kadhimi that was attended by Iraq's top political figures, suggesting wide support.

"With sincere efforts the main political parties along with national and social forces have agreed to choose Mustafa Al Kadhimi," he said at the ceremony.

Thursday marked the 17th anniversary of the day that US-led troops occupied Baghdad.

The latest nomination comes as Iraq struggles to contain an outbreak of the coronavirus. The country has recorded more than 1,202 cases and 69 deaths.

Iraq, exhausted by decades of sanctions, war and political corruption also faces economic ruin and social unrest.

Mr Al Kadhimi has kept a low profile since taking office at the National Intelligence Service in June 2016 and is known to have good relations with the US and regional powers.

Born in Baghdad in 1967, he has a law degree and has published several books, including Humanitarian Concerns, which was selected in 2000 by the EU as the best book written by a political refugee.

He has worked as reporter and, until 2016, wrote widely on the reforms needed in Iraq.

Mr Al Kadhimi follows two other candidates nominated by Mr Salih to take over the prime minister's post from Adel Abdul Mahdi, who resigned in November.

The first candidate, former telecommunications minister Mohammed Allawi, withdrew his candidacy on March 1 after Parliament refused to approve his cabinet.

The second was Adnan Al Zurfi, who withdrew his candidacy on Thursday morning.

Mr Al Zurfi faced strong opposition from the main Shiite parliamentary blocs and lack of support from Kurdish and Sunni parties.

"This decision will not stop me from serving the public through my current parliamentary position," he said on Twitter.

"I will continue to work and prepare the country for the upcoming early elections and other challenges."

Mr Al Zurfi's decision to withdraw came a week before his 30-day period to assemble a cabinet acceptable to Parliament expired on April 16.

The UN mission in Iraq welcomed Mr Al Kadhimi's nomination to form a new government in a tweet posted soon after his designation as prime minister.

"We recognise and appreciate the hard work of Adnan Al Zurfi over the past weeks and welcome the designation of Mustafa Al Kadhimi to form a new government," the UN office said.

"The magnitude of challenges currently facing Iraq requires a united leadership that acts with urgent resolve."