A technology company using advertisements to divert people from viewing online extremism is trialling the same technique to combat anti-vaccination conspiracy theories.

London-based social enterprise Moonshot CVE invented the “Redirect Method”, which targets Google and social media users searching for certain extremism-linked keywords by showing them a range of advertisements countering the narrative. The advertisements are provided by trusted figures, citizen journalists and defectors from the searched group on YouTube playlists and other sites.

Moonshot’s latest initiative is part of a global fightback against anti-vaccination activists using social media to spread harmful untruths.

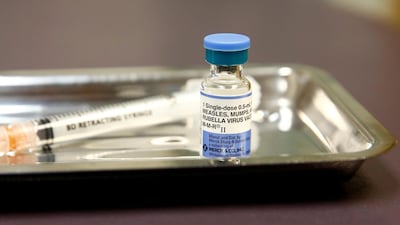

So-called “anti-vaxxers” have drawn false links to vaccines, which prevent diseases such as measles, and autism.

In the United States and the European Union, access to vaccines is widespread, however, the number of measles cases reported has surged in the past year.

The measles virus in the US was declared eliminated in 2000 but since the beginning of 2018, more than 1,120 cases were reported in the worst outbreak since 1992, according to the US Centres for Disease Control and Prevention. Health experts have blamed the rise of the highly-infectious disease on parents of school-age children, who declined to give them the measles mumps rubella vaccine.

While in Europe, measles is also on the rise. The number of people infected with the virus in 2018 was the highest this decade, with three times the total reported in 2017, according to data from the World Health Organisation.

The WHO has described the anti-vaccination movement as one of the biggest global health threats of 2019.

The UAE is bucking the trend, however, with a significant reduction in measles cases reported in the first three months in 2019 in comparison with the same period last year.

At the moment Moonshot is still at the information-gathering stage, which is internally funded, but the firm is feeling confident. Once it has finished its development phase, the social enterprise will sell its service to governments, charities and social media companies globally, as it did with its counter-extremism software.

"We've been using the Redirect Method since 2016 to deliver alternative, positive content to individuals searching for violent extremist material online. Now we're adapting the methodology to focus on other potentially destructive online communities," Clark Hogan-Taylor, manager at Moonshot CVE, told The National.

“Anti-vax is an entirely different social problem - we're not conflating it with violent extremism in any way - but that doesn't mean our underlying methodology can't be re-purposed to help those at-risk of, in this case, believing in a conspiracy theory that poses a serious threat to life.”