MOSCOW // It was just a simple chess magazine, a slim periodical with annotated games and the latest news about grandmasters and child prodigies. But for Garry Kasparov, it changed everything. It was November 2007, and Mr Kasparov, the former world chess champion, being held in a police detention facility in central Moscow. He had been sentenced to five days in jail for participation in an unsanctioned protest against the Kremlin in the run-up to Russian parliamentary elections. As he was serving out the short sentence, an unexpected visitor showed up: Mr Kasparov's erstwhile, bitter chess rival, Anatoly Karpov.

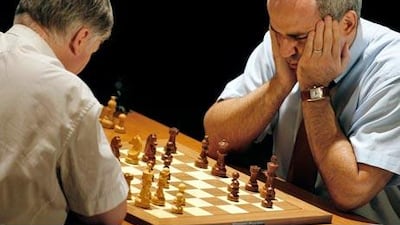

The acrimony between the two chess titans was legendary. Their battles over the board in the 1980s captivated the world, with Mr Kasparov, the brash newcomer, eventually defeating the loyal communist champion Mr Karpov, a favourite of the Soviet regime. But while police refused to allow Mr Karpov access to Mr Kasparov, he managed to get a copy of the famous Russian chess magazine 64 to his jailed ex-rival to help him to kill time behind bars.

The overture, Mr Kasparov said in the days following his release, "outweighs all of the problems in our relationship over the past 25 years". "That was the first step," Mr Kasparov said in an interview last week. "I learnt being behind bars that you would judge many events differently. And Karpov trying to meet me there, when many people didn't even want to try, that was a big sign for me." The relationship has blossomed into what could be called a friendship, said Mr Kasparov, who quit competitive chess in 2005 to take up opposition politics. Now it is Mr Kasparov offering his support to Mr Karpov, who has embarked on a campaign to become president of the World Chess Federation, the game's governing body known by its French acronym, FIDE.

With the backing of his old foe, Mr Karpov is locked in an unruly fight to unseat the current FIDE president, Kirsan Ilyumzhinov, who is also the eccentric leader of the southern Russian republic of Kalmykia. Mr Ilyumzhinov has held the FIDE presidency since 1995 but has faced repeated criticism in recent years for the lack of stable outside financing for major chess tournaments and the haphazard organisation of the world championship cycle.

"Everyone knows that I have a very complicated history with Karpov, but in this case I felt it was my duty to my colleague, a world champion, a person who is concerned about international chess and Russian chess," Mr Kasparov said of his support for the challenger's candidacy. Unlike Mr Kasparov, whose uncompromising condemnation of Russia's ruling elite has made him a political persona non grata in his homeland, Mr Karpov has always been much more conservative in his approach to politics. He rarely, if ever, publicly criticises the country's leadership, and even served on the Russian government's Public Chamber, a government oversight committee made up of prominent public figures. "We have different political views, and we don't discuss politics," Mr Karpov said. "But as former world champions, we understand chess, and I'm happy that we share the same views on many problems in chess."

Mr Karpov's bid for the FIDE presidency met unexpected resistance from influential Russian officials, however. Arkady Dvorkovich, a Kremlin aide who heads the Russian Chess Federation's supervisory council, has backed Mr Ilyumzhinov as Russia's official nominee for the post. The stand-off has sparked angry accusations of intrigue and subterfuge from both sides and even triggered a schism in the Russian federation.

A group of supervisory council members met on Friday and voted 17-0 to nominate Mr Karpov, giving him a majority. Mr Dvorkovich, however, said the vote was "illegitimate" and that Mr Ilyumzhinov would be Russia's candidate in the election, to be held this autumn in the western Siberian city of Khanty-Mansiisk. Being a world chess champion does not necessarily qualify a person to run a major international federation, Mr Dvorkovich said. "If Karpov believes he is a good candidate, he can ask any federation to nominate him," he said.

Mr Karpov has secured the support of the United States and several European countries and may indeed run as the candidate from one of these federations should he fail to earn the official Russian nomination. Mr Ilyumzhinov has accused Mr Karpov and his backers of conducting a campaign "based on misrepresentation and false accusations", while Mr Karpov has been repeatedly playing up the Kalmyk president's claim to have been abducted by space aliens in 1997.

Mr Karpov said the game of kings is at a crossroads and that his presidency can restore the international popularity chess enjoyed when he and Mr Kasparov waged war against each other on 64 squares. "Chess as a profession is in serious danger, and of course that hurts me," Mr Karpov said. "Chess is everything for me ? if chess dies, it will be a colossal tragedy." @Email:cschreck@thenational.ae