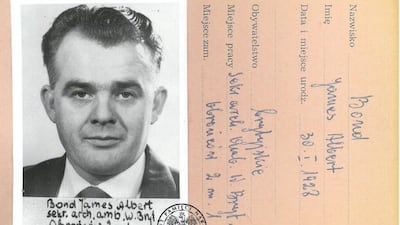

“The name’s Bond, James Bond” is a salutation synonymous with Ian Fleming’s world-renowned fictional spy. Yet, in a bizarre blend of fact and fiction, it has emerged that a real-life British agent could well have used the same greeting.

The discovery of the namesake was revealed by Poland’s Institute of National Remembrance which chronicles the country’s communist past.

It prompted the institute to speculate on Twitter as to whether any Polish spies could be compared to 007.

Unlike Mr Fleming’s Scottish-born Bond, the real-life Bond heralded from Bideford, Devon, in 1928.

He was “talkative, but cautious” according to the Poles, not attributes readily associated with the fictional Bond. They did share at least one trait in common, however: a keen interest in women.

Keeping a low profile is an integral responsibility for any spy so Britain’s decision to send James Bond to Poland was somewhat misjudged.

He arrived in Warsaw on February 18 1964, INR archives reveal, where he took up a low ranking position in the British embassy as a military attaché. The institute said that this was a ruse to “penetrate military facilities”.

By this stage the fictional Bond was already a global phenomenon. Mr Fleming had published 11 novels and Dr No had been released in cinemas two years prior.

“The arrival of such a famous agent did not go unnoticed by the officers of Department II (counterintelligence) of the Ministry of the Interior,” the INR said. “An operational surveillance case code-named “Samek” was established and he was placed under strict surveillance.”

Under such scrutiny, Mr Bond’s spell in Poland was not a success. He left the Eastern Bloc territory on January 21 1965, leaving Polish authorities neither shaken nor stirred.

The IPN archivist who discovered the Bond files, Wlodzimierz Lechnio, said the agent was sent back home by the British secret service.

“This case mainly shows that after one year in communist-era Poland, Bond was effectively discouraged from staying on,” he said. “It was common practice for diplomats to cover up their real profession and purpose.”

Mr Bond’s background didn’t mark him out as a likely intelligence officer. He was the son of a farm labourer and rabbit trapper, and married Janette Tacchi in Taunton in June 1954. They had a one son together, born the following year.

Ms Tacchi confirmed to The Telegraph that Mr Bond was a spy and that she and their son had gone with him to Poland.

The true nature of his work was a mystery to her at the time she told The Telegraph although she "knew it was dodgy and he was doing things he shouldn't have been doing."

Ms Tacchi is now widowed following her husband’s death in 2005, after he spent most of his life in the British military.

Next time the UK wishes to recruit a secret agent named after a fictional character, it would be well advised to steer clear of any creation from Mr Fleming’s tales of seduction and espionage.

This gallery depicts some more noteworthy real-life spies: