Latest: Abu Dhabi tears down skyscrapers in seconds ahead of port regeneration

Abu Dhabi transport chiefs announced major road closures for the demolition of Mina Plaza on Friday.

The Sheikh Zayed Tunnel, Mina Street, Corniche Street and other roads in the port area will be affected from Thursday.

Closures will take place in two phases.

From 10pm on Thursday, Mina Street (from the intersection with Al Zahia Street); Corniche Street (from the intersection with Al Zahia Street); and all roads and entrances on Sheikh Khalifa bin Zayed Road that lead to the Mina Zayed area will close until after the demolition.

From 6am on Friday, the Sheikh Zayed Tunnel in both directions; Sheikh Khalifa bin Zayed Street leading to Sheikh Khalifa Bridge; and Hamdan bin Mohammed Street for those coming from Al Maryah Island towards the port will close. On Corniche Street, all vehicles will be diverted to the upper intersections of Sheikh Zayed Road.

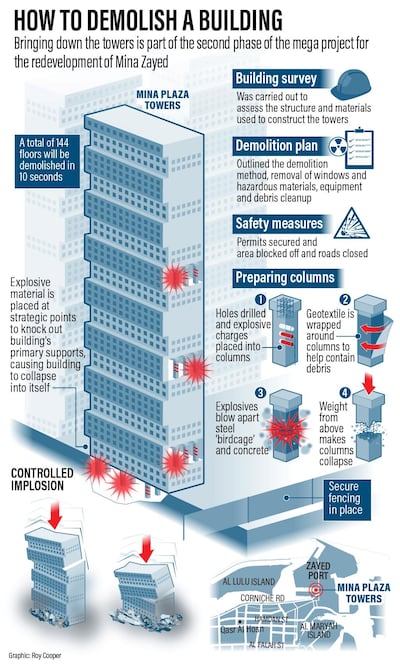

The closures are in place until the demolition ends. Authorities previously said it would start at 8am and take just 10 seconds.

On Wednesday, police went to Mina Zayed to speak to shop owners about the plans in place for the demolition.

They urged traders to co-operate with inspection teams, who will be ensuring all shops are closed from 7pm on Thursday until 4pm on Friday.

The temporary closure will affect all the markets (fish, plant, carpet, livestock, fruit and vegetables) as well as the Abu Dhabi Co-operative Supermarket and the slaughterhouse.

Major rejuvenation works will begin in the area when the abandoned tower block is demolished. The work includes overhauling the souqs and building separate facilities for fish, fruit and vegetable markets.

Construction on the three-tower Mina Plaza block began in 2007 but was halted several times.

Bus services in the area will also be affected. Abu Dhabi Police urged everyone to follow the rules.