Shaukat Ali Rana is sitting in his family villa in Mirdif, surrounded by his three sons, Ayub, Taimur and Asad. Somewhere else in the house, a grandson is playing.

Four generations of one family have made the UAE their home, all because Shaukat's father, Rafi, moved to Dubai in 1966.

As the UAE celebrates its 50th anniversary since unification, the Rana family's tale is part of the story of the country itself, one of millions woven to create the fabric of the nation.

It begins in Lahore, where, Shaukat explains, his father received a job offer of clerical work with the British Bank of the Middle East in Dubai, now HSBC, which had been operating in the city since 1946.

What is now the UAE was in those days the Trucial States, bound to Britain by a series of century-old treaties. Mohammed Rafi Rana, who was born in 1929 in British India, left behind a wife in Pakistan, and eight-year-old Shaukat.

“The family followed in 1968,” he says. “By then my father had got a new job with Pakistan International Airways.” He was the airline’s dispatcher at Dubai International Airport, then just a single terminal, that opened in 1960. The airline operated one flight a week.

Initially, the family, which included his brother Liaquat, lived in a three-bedroom flat in Karama. “He rented it from Sheikh Rashid for 2,000 rial a year (Dubai used the Qatari rial before the Dirham) and it was in what they called the ‘Cola Colony’ because it was in the same area as the Coca-Cola factory.”

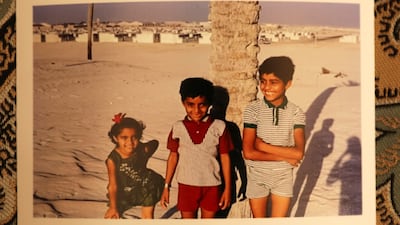

The family settled into their new home and soon added a baby daughter. Shaukat was sent to the Pakistani Academy in Karama in Oud Metha, a 40-minute walk through what was then mostly desert.

For entertainment, there was a cinema in Deira showing Bollywood films twice a night. Shaukat’s father was friends with the manager, a former roommate from his first days in the country. As a favour he allowed the children in for free. But only one at a time, says Shaukat. His father did not want to abuse his friend’s generosity.

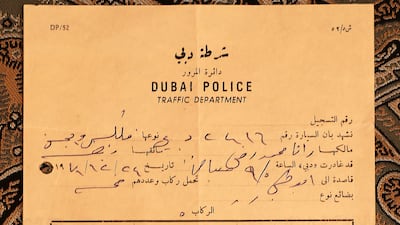

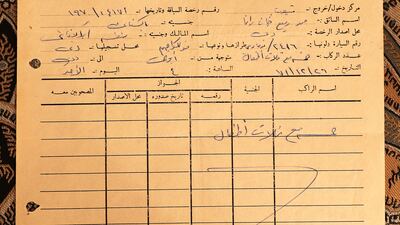

In 1970, Rafi obtained his driving licence and bought his first car, a treasured Volkswagen hatchback. It was just in time for the family’s first adventure, a trip to Abu Dhabi to witness the formation of the UAE and celebrations that would also have included the fifth anniversary of the accession of Sheikh Zayed as ruler.

This was no 90-minute drive to the capital. To reach Abu Dhabi was a four to five-hour trip guided by nothing more than tracks in the sand.

After receiving their border pass at the Seih Shuaib crossing, Rafi was baffled. “My dad was worried about which way to go,” Shaukat says. “It could be the way to Abu Dhabi but it could also be Al Ain.

“We waited an hour until a taxi came along, and the driver said “you can follow me”.

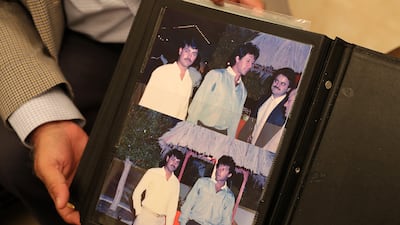

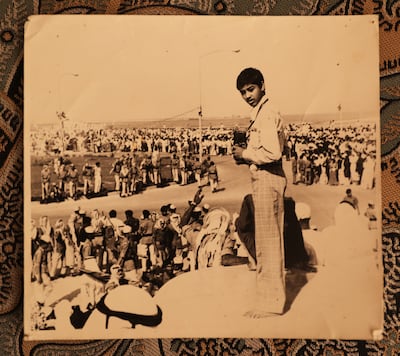

Shaukat had been given his first camera for the trip, something that would become a lifelong passion, to record the celebrations. He was now 11, and a family photograph from the trip shows him watching the parade, barefoot, with the camera proudly hanging around his neck.

Five years later, Shaukat was ready to leave school. A confident young man – a photo shows him wearing a pair of fashionable flares – he had an idea for a business based on his love of cameras and photography.

The result was Shaukat Photo Studio, a tiny shop in Deira with big ideas from its teenage proprietor. The business sold camera equipment, but also handled film development, which for the more advanced colour slide films meant dispatching them for processing to Europe or the US.

There were other complications. “There was no email, no fax,” Shaukat recalls. “Business was conducted by letter. It might take two months just to get a reply and buy stock.”

Still, the business did well, even after being given notice to close. It later moved to larger premises in Al Quoz.

Telex arrived in the 1980s, an international communication system that used teleprinters. The Telex office in Dubai was based near the Sheraton Hotel on the Creek. Not long after, the fax machine made its debut.

As did married life.

In 1985, Shaukat married Fouziya, a match arranged by his parents with a Kuwaiti family to whom he was distantly related.

As a Gulf citizen, she was eligible to buy land in Dubai, so a plot was secured on the outskirts of the city at Mirdif. An aerial photograph belonging to the family shows it almost alone in the desert scrub.

“It took two years to get a telephone line,” Shaukat recalls. Today the area is entirely built up, home to an international Chinese school, and with the main runway of a much expanded Dubai International Airport just a few kilometres away.

The business grew, expanding to art materials and supplying hotels with artwork. His family also grew, with a daughter and three sons who also work in the business, the RAFI Group.

Now there are grandchildren. Two of the four generations have known nothing but the UAE, three if you include his sister, who was born in Dubai. His father passed away in the city in 2006. There are no relatives left to visit in Lahore, he says, but they all still have Pakistani citizenship.

Now in his 60s, the pandemic has left Shaukat with time to sort through the many boxes of photographs, negatives and family ephemera kept over the decades, including his collection of vintage cameras.

The lives of the Rana family are far from the glamorous international image of Dubai, with its five-star hotels and Instagram celebrities, but they are much closer to the real story of the city, one more chapter in the making of the UAE.