Two artists with disabilities in Dubai have been awarded a golden visa that they say opens the door to greater independence.

Zambian painter Victor Sitali, Indian artist Sharan Budhrani and their art teacher Gulshan Kavarana received the 10-year residency for their cultural contribution.

The artistic community said the UAE visa was a tribute to their talent and spirit.

Zambian artist

“It gives me the opportunity to expand my ideas for my art. I can work harder and dream bigger,” Mr Sitali communicated in sign language.

“I am very happy. I now have independence. I can think only of working hard.”

Mr Sitali lost his hearing at the age of three and was introduced to art as a teenager by Ms Kavarana.

His distinctive oil and acrylic work on canvas earned him studio space in Tashkeel, an art gallery, in Dubai.

The 31-year-old holds domestic and overseas exhibitions, as well as workshops for students, adults and children with disabilities.

The Sitali family has lived in the UAE for more than a decade. His mother Dorothy said the family was proud of his latest achievement.

“This has brought us unbelievable joy,” she said. “We thought this visa was for senior executives. It came as a total surprise, a good surprise.”

Ms Kavarana, 57, met the family when she worked as a volunteer with the Dubai Centre for Special Needs.

“I worked with Victor when he was only 16 and he didn’t know anything about painting. I soon realised how talented he was,” she said.

Ms Kavarana said it was “wonderful” to be recognised.

“I dedicated my life to working with people of determination, doing art with them and taking them to the next level. I thank the UAE government for giving us this opportunity.”

Mr Sitali and Mr Budhrani were part of a vibrant artist community at Mawaheb, a studio in Dubai that nurtured the creative skills of young adults with disabilities.

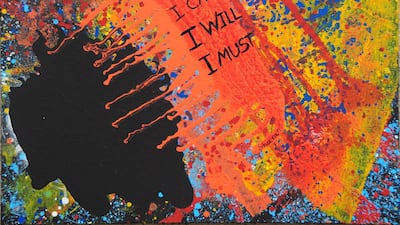

Mr Budhrani has muscular dystrophy that weakens his muscles and limits his mobility. Seated in a wheelchair, he uses remote-controlled cars, spoons and sticks to paint on large canvasses.

“This is very exciting news,” said the 30-year-old, who was born in the Emirates and has always known the country as home.

“I feel there is hope ahead in the future for me. I can still go on my creative journey to inspire and motivate more people with art.

Currently recovering from a severe bout of pneumonia, he requires a tracheostomy tube and a ventilator to breathe at night.

He has not stopped painting despite the discomfort of being fitted with the tube to open up his air passage.

“I feel I must always keep going and never give up,” he said.

Ms Kavarana said the golden visa acknowledged the resilience of the artists.

“Sharan has a never-give-up attitude. He is on the ventilator but there is nothing stopping him from his passion of art,” she said.

Nasser Juma bin Sulaiman, manager of the Al Fahidi historical neighbourhood, nominated Mr Budhrani and Ms Kavarana to the Dubai Culture and Arts Authority.

“These are very special cases. Dubai Culture gave these artists an opportunity so they can make their own business here and also make Dubai their home,” he said.

Lisa Ball-Lechgar, Tashkeel's deputy director, nominated Mr Sitali and described his contribution as vital to the community.

She said he recently ventured into abstract art demonstrating his appetite for experimentation.

“He works with passion and energy as a full-time creative professional in Dubai and deserves to be acknowledged for his unwavering commitment and dedication,” she said.

The golden visa was launched in May 2019, to give exceptional workers and foreign investors the opportunity to establish deeper roots in the country.

The 10-year residency scheme was expanded to attract people in the fields of health, engineering science and art.