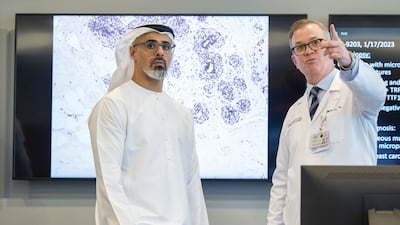

Sheikh Khaled bin Mohamed, Member of Abu Dhabi Executive Council and chairman of Abu Dhabi Executive Office, has inaugurated the Fatima bint Mubarak Centre at Cleveland Clinic Abu Dhabi.

The new centre provides patients with personalised care, including screening and diagnostic testing, advanced radiation treatments and precision cellular therapies.

Modelled on Cleveland Clinic’s highly rated Taussig Cancer Centre in Cleveland, the 19,000-square-metre centre has a team of 150 nurses, physicians and radiologists.

It has 32 exam rooms for multidisciplinary cancer consultation, 24 private infusion rooms for administering medications intravenously, two procedure rooms and an area devoted exclusively to women's oncology services.

The naming of the oncology centre honours the leadership role played by Sheikha Fatima, Mother of the Nation, in the development of the UAE's healthcare sector.

“The Fatima bint Mubarak Centre provides patients access to world-class screening, cutting-edge diagnostics, and personalised treatment plans to improve their outcomes and quality of life,” said Waleed Al Muhairi, chairman of Cleveland Clinic Abu Dhabi and deputy group chief executive of Mubadala Investment Company.

“The opening of the centre represents a major milestone in the development of the region’s healthcare industry and enhances Abu Dhabi’s status as a global leader in the life sciences industry.”

Dr Jorge Guzman, chief executive of Cleveland Clinic Abu Dhabi, said the new centre “will transform the level of care available to cancer patients in the region and eliminate the need for them to travel overseas”.

“The facility will participate in worldwide clinical trial programmes benefiting from collaboration and expert knowledge sharing with partners across Cleveland Clinic’s global healthcare network.

“Cancer is currently the third most common cause of death in the UAE. The Fatima bint Mubarak Center will bring pioneering technologies and life-saving treatments to set a benchmark in the efficacy of cancer care in the region.”

The inauguration was attended by officials of the Abu Dhabi Government, members of Mubadala Investment Company’s leadership team and senior guests from local and international partners and organisations.